Бесплатный фрагмент - The only reason why you don`t own Bitcoin is that you don`t know enough about it…

© Copyright by Oleh Bozhenko 2023 — All rights reserved.

The content contained within this book may not be reproduced, duplicated or transmitted without direct written permission from the author or the publisher.

Under no circumstances will any blame or legal responsibility be held against the publisher, or author, for any damages, reparation, or monetary loss due to the information contained within this book. Either directly or indirectly. You are responsible for your own choices, actions, and results.

Legal Notice:

This book is copyright protected. This book is only for personal use. You cannot amend, distribute, sell, use, quote or paraphrase any part, or the content within this book, without the consent of the author or publisher.

Disclaimer Notice:

Please note the information contained within this document is for educational and entertainment purposes only. All effort has been executed to present accurate, up to date, and reliable, complete information. No warranties of any kind are declared or implied. Readers acknowledge that the author is not engaging in the rendering of legal, financial, medical or professional advice. The content within this book has been derived from various sources. Please consult a licensed professional before attempting any techniques outlined in this book.

By reading this document, the reader agrees that under no circumstances is the author responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this document, including, but not limited to, — errors, omissions, or inaccuracies.

Leave a review about our book:

As an independent author with a small marketing budget, reviews are my livelihood on this platform. If you enjoyed this book, I’d really appreciate it, if you left your honest feedback. You can do so by clicking review button.

I love hearing my readers and I personally read every single review!

TABLE OF CONTENTS

INTRODUCTION

The person who would want to appropriate the name of the creator of Bitcoin in a court of law has nothing to do with it. Otherwise, he would have just written this book. The best thing you can do for an asset you believe in is to widen the circle of people who can appreciate it.

I don’t claim to be a writer of the year. For a very long time, I have been a «knowledge gleaner» like you. Gathering information, data, and experience, I had a lot of «bumps» — all this formed a complete picture of the world called «All about Bitcoin in simple words.» And now, without exaggeration, I can be called a lucky man reaping the fruits of my hard work. I am ready to share this information and experience with you generously. And, perhaps, you may be surprised, but in this field, generosity returns a hundredfold. It is not enough to find gold and fill your coffers with it. It is essential for as many people around you as possible to also realize the genuine value of that gold.

This book is at the same time:

— a history textbook;

— a guide for beginners and experts;

— a book of predictions;

— a key to understanding Bitcoin as a tool that can lead you and the world to its best versions.

What you will get after reading this:

— The most valuable, reliable, and relevant knowledge about bitcoin, blockchain, and cryptocurrencies that I could gather over 8+ years of study, self-development, and constant practice. The publication you hold now will become your Bitcoin board book and your ticket to another prosperous future. Moreover, I would have gladly paid all that I have now for this book eight years ago. And I wouldn’t have missed out. If I had this knowledge eight years ago, my capital would be even greater today. All these years, I have been collecting bits of knowledge, like gold, sifting them from the sand, washing them, and melting them into a shining ingot. Here it is;

— The most significant theses, secrets, and data from gurus in the cryptocurrency and bitcoin market, confirmed by personal experience. I will not «put you on the needle» of courses worth thousands of dollars and keep you dependent on how much information I sold you today or, for marketing purposes, will gift you tomorrow;

— All the things that seem to lie openly available on the web but are of no real value to the inexperienced user. The abundance of information confuses people. You can find ten different answers to one question. I will give one and the right one at every stage.

As a financial visionary, I see tremendous value in showing you the genuine value of the «gold in my coffers» with this book and explaining why you need the same.

N я ow that the Bitcoin network is more powerful than ever and the eponymous unit (Bitcoin or BTC or XBT) is being bought end masse by large companies, the price has become more stable and predictable. And this is the best moment to leave you with my advice.

Bitcoin is entering the phase where some of it is being taken over by corporations. At the same time, it’s money for the average citizen and their protection. Bitcoin’s true purpose is to become a full-fledged international currency.

Having observed the development of the community, in this book, I want to draw a clear line between Bitcoin and all other «coins» right away. Don’t even try to compare, for example, Ethereum and Bitcoin. These are all technologies, but each of them has its task. In the future, though, they may closely interact and complement each other.

I will immediately dispel the popular stereotype that Bitcoin is already too expensive and too late to buy it. It is never too late to buy Bitcoin! Of course, provided you understand the reasoning behind its pricing and make a purchase when it reaches the lower end of its cost.

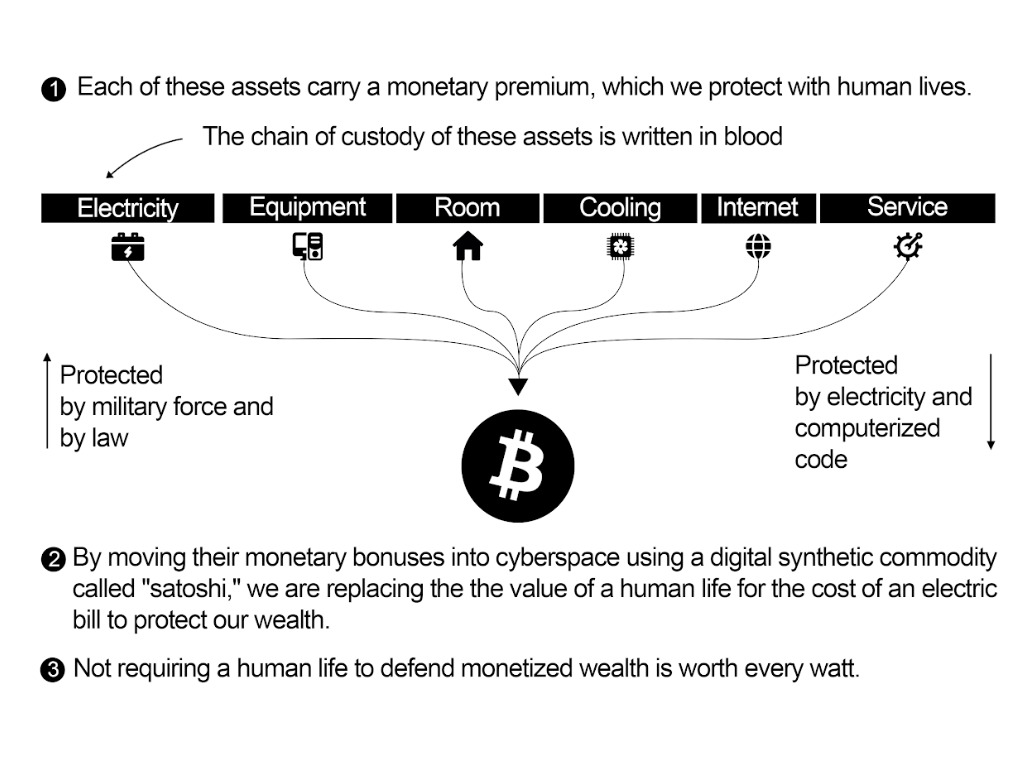

What does the cost of Bitcoin consist of:

— Cost of electricity. The more expensive oil, gas, and other energy resources are, the higher the bitcoin cost.

— Cost of equipment. The more expensive the hardware, the higher the expenses. Video cards are the most valuable component of modern machines and related technologies.

— Cost of premises. The price of real estate and its arrangement directly affects the increased costs.

— Cooling costs. Video cards need cooling. Maybe in the future, this will change, but right now, it is also included in the Bitcoin cost of production.

— Cost of the internet. The more expensive it is, the higher the costs.

— Maintenance costs. It is the cost of repairs, employee salaries, and owner income.

— Difficulty Ratio. It is an internal unit of measurement whose task is to constantly produce «equipment inflation» when faster equipment is encouraged, and weaker equipment is devalued, helping miners to increase their productivity promptly and always be relevant in the network (Fig.1).

Bitcoin is the sum of all the most valuable resources in one place, expressed in numbers. The worse the current state of the economy, the more expensive the resources and bitcoin. It will always protect you from inflation.

Fig 1. What the cost of Bitcoin consists of

Bitcoin was conceived as a defense against inflation and the devaluation of fiat and revolves around the «energy currency» paradigm. The concept, initially proposed by American industrial titan Henry Ford in 1921, involves backing currency with «units of energy» and creating a new monetary standard known as the «energy standard.» This principle was proposed by the great inventor Nikola Tesla in the early 20th century.

In Ford and Nikola’s vision, the monetary standard was to be immune to control by any international banking group. His aspiration aligns with Bitcoin’s philosophy and finds support from today’s market players. As Kathy Wood once said, «Bitcoin is the insurance everyone will want at the end of the day.»

Bitcoin protects wealth from outright confiscation, inflation, and the risk of loss to third parties (counterparties) in storage or transfer. As cryptocurrencies are adopted and a regulatory framework emerges, interest in Bitcoin will grow arithmetically.

Against this background, I am not without annoyance to see how people react to various manipulative news and make decisions based on the opinions of authors who are unable to prove their competence.

My opinion on this matter is as follows: every article about bitcoin should start with the words «today the minimum international price of bitcoin value according to the graph is equal to…» and only then the text of the author’s material. If you do not see this in the article, the material should be ignored. It is written for hype, search engines, SEO promotion, discrediting Bitcoin, or anything else, but not for transferring information of a really expert level to the user.

The link where you can track the cost of bitcoin mining comfortably can simply follow the link. tradingview.com/chart/yNzt0Ymn

Recently, many significant stockholders and fund owners have been scared about the fall of Bitcoin, but I want to reassure you. They fear the moment when a considerable portion of people realize the value of Bitcoin and begin to exit the stocks of the companies and funds of which they are primary holders.

The stock market will collapse as finance transitions into better money, as will their corporations, and these people, as leaders of their fields, will take two hits at once — they will lose money and cease to be needed. You cannot capitalize on a company indefinitely and also profit from it. There always comes a time when the next «bubble» bursts and the ignoramuses pay the most for it because they lose the last thing, unlike the same corporate owners. They lose everything.

We are not so rich that we can afford to be ignorant. It costs us too much.

Ignorance is a lack of knowledge or low level of education in a specific area, a lack of the required information or understanding of a topic.

It is essential to note that ignorance is not a sign of low intelligence but merely indicates a lack of knowledge on a particular subject. Combating ignorance requires an openness to learning and a desire for self-improvement.

Ignorance has several negative consequences that can be detrimental to the individual and society as a whole. It also creates fertile ground for manipulation of you, your decisions, and, as a result, your money. Subsequently, your capital insures anyone but you.

Ignorance and unawareness also often cause stereotypes, prejudiced views, and new reasons for discrimination. Collective ignorance leads to the backwardness of society, slowing down its development and progress. It can also cause social problems such as unemployment, poverty, and crime. Some issues can go unaddressed for decades because of the failure of society to recognize the extent of their harmfulness, making it challenging to solve them.

This book will give honest and reasoned answers to all your questions about Bitcoin. It will save you from ignorance and protect your capital from manipulative information and actions of authorities, big investors, and funds. The best thing you can do for your future and your children’s well-being is to educate yourself to understand Bitcoin and apply it to better the world through this system.

The author is not paid for extra words. This publication attempts to inform the reader precisely on the stated topic. I have endeavored to maintain factual accuracy but make no guarantee thereof. This book is published for popular enlightenment and entertainment only. It should be clear to the purchaser that the publisher does not provide legal, accounting, financial, or other professional services. Please consult competent professionals if legal or other advice or other expert services are required. Cryptocurrencies and bitcoin are a complex and treacherous area. The author is neither a lawyer nor an expert in any field. The book contains no financial legal advice, including cryptocurrencies and bitcoin. The reader acts at his own discretion. Neither the author nor the publisher accepts any responsibility for any decisions or actions you take supposedly influenced by what you hear or read in this book, especially if you kill someone.

MEANINGS AND VALUES

«Bitcoin is fundamentally a mathematical concept, but its relationship to the physical world is very different from its relationship to the world of other mathematical concepts because most can be visualized, like Pythagoras’ theorem!

Fig.2 Pythagoras’ Theorem

It is enough to draw a square from each face of a triangle to understand it to see that the hypotenuse length square is equal to the sum of the catheter’s length squares (Fig.2). In turn, all the concepts embedded in Bitcoin can be represented quite easily in the form of graphs and sketches. I think you’ve seen them dozens of times. However, bitcoin has another layer that is much harder to realize — its connection to reality and value.

«Value» is a pretty odd concept because while it is actual, it is also completely subjective. For some collectors, a worn-out banknote will be extremely valuable, but at the same time, it is just a piece of paper, a relic of the past for an ordinary person. That is why there is no ruler or scale to measure value. Most sites trying to express the value of Bitcoin use the US dollar as the unit of value, and this is wrong. The US dollar is a poor tool for measuring value because no one knows how much there really is or how much there will be in the future, which is even more critical. Our current viral global crisis, with its 99.9 percent survival rate, has caused the world’s money printers to run at an unprecedented ratio, and the dollar’s value relative to commodities is slowly fading. So, what is a fair way to measure Bitcoin’s value?

Measuring value

Imagine two people stranded on a desert island. Let’s call them Robin and Tom. They have one Bitcoin each and no way to acquire more. In other words, these two bitcoins are metaphors for the entire economy. Tom and Robin know that only two coins are circulating on the island. Robin knows how to fish with his bare hands, and Tom knows how to chase and catch rabbits. They exchange fish and rabbits with each other, which are consumer goods.

Sometimes, they use their bitcoins as a medium of exchange if there is a shortage of fish or rabbits. One day, Robin crafted a net. He now catches many more fish per hour, giving him an advantage over Tom, who has to invent a spear to capture rabbits as efficiently as Robin catches fish.

The net and the spear are capital goods, and they benefit the island’s entire economy, as fish and rabbits are now cheaper to produce and buy. There are still only two bitcoins in the economy. While before the net and spear, these bitcoins could be used as a means of accumulation and exchange, now the value of the capital assets (the net and spear) are also part of the economy. In other words, one bitcoin can now buy many more fish or rabbits than before. To put it even more simply, every time Tom and Robin invent new ways of extracting sustenance, bitcoin increases in value, and that’s because bitcoin is finite, as there can’t be more than two coins on an island.

So far, people are doing just that. Volatility (price fluctuations) is proof of that. In the future, there will come a point when no one will sell bitcoins at a loss because everyone will realize that it is pointless to do so. That’s when things will change dramatically.

In reality, there are only 21 million coins, and imagine how small that is compared to the same dollars printed in trillions of banknotes. Imagine the entire world economy soon switching to Bitcoin. Absolutely any commodity, any currency, all divided into twenty-one million coins. One bitcoin by itself will have enormous value, and every time people invent and introduce new capital goods into this economy, each bitcoin will have even more worth.

It is much easier for a new capital good to enter the Bitcoin economy than to join the conventional economy because the power of a completely unrestricted free market is the best gas pedal of human ingenuity.

But let’s take a step back and consider a different concept, one in which information itself is literally valuable.

Value of information

I think it’s no secret that having a lot of information about an event has always been considered valuable. Information is inherently the resolution of uncertainty. I believe everyone would be willing to pay if we came across a newspaper from the future in 2009 that said Bitcoin would be worth tens of thousands of dollars. It is valuable information that would make you a millionaire.

The smallest unit of information is called a bit. It is a simple «Yes» or «No» answer. A single bit can be valuable, representing the answer to a specific question, such as whether a game is rigged in a player’s favor. If you know the answer to this binary question, a successful bet can bring you a generous reward.

This kind of information has an indirect value, but with the advent of Bitcoin, information has literally become valuable. Let me say right away that this is a very abstract concept, and it is rather complicated to realize its meaning.

You may have heard the saying, «Not your keys, not your bitcoins,» meaning that possessing the private keys to a particular Bitcoin address means owning those bitcoins. In Bitcoin, there is no difference between knowledge and possession.

Indirectly valuable information can be converted into something valued in various ways, such as betting on player «A» if you know he will win. When information becomes an asset — money becomes a language. Information and money are the two core tools driving communication and interaction in the modern economic system. It will test every free speech law in the world because you can now claim ownership through communication in a way that has never been possible before. The boundaries between knowledge and possession are now forever blurred. The world will never be the same again.

Communication has always been the key to progress. But now, it has become the key to the opportunities opened up by an innovation called Bitcoin, and the potential wealth lurking in this territory is simply incomprehensible.

Combining concepts

Now, let’s combine these two concepts into one — a finite set of tokens representing a potentially infinite future economy where tokens are nothing more than simple information transferred between people anywhere in the world.

The invention of Bitcoin is more significant than anything imaginable because it can move humanity in a matter of years to a Type 2 civilization on the Kardashev scale, where the most tradable and most valuable commodity exists, not subject to confiscation. Where will this lead to? When you can’t know who has what amount of a resource, you can’t take it away. End Violence and war, and there is no way to enrich yourself except by offering something of value in return! It is impossible to realize the significance of this.

At this point, humanity can be compared to cave trolls trying to imagine Boston Dynamics.

Central banks are and always have been a heinous crime against all of humanity, a war crime, if I may say so.

Thanks to Bitcoin, everyone can free themselves from oppression and bypass unjust economic systems by destroying their weapons. After all, in a world with a finite and infinitely valuable resource, uncontrolled printing of currencies becomes useless because no one needs those currencies anymore.

Bitcoin balances our understanding of the world between the material and the imaginary even more than we realize. That makes it rewarding. As Niels Bohr said, «If quantum mechanics doesn’t seem weird and lousy to you from the start, then you haven’t understood it yet.» The same can be said for bitcoin. The main thing you need to realize right now is that Bitcoin already exists and is gaining more and more momentum. There is no way out of the rabbit hole, and it seems bottomless, but daring to go down is the best thing you can do with your time.

Bitcoin is a tool for maximizing personal sovereignty and freedom, and bitcoiners are your brothers and sisters in arms who want the best for themselves and encourage you, in turn, to want the best for yourself. Bitcoin is not controlled by central banks or governments, and that’s fine.

THE BEST MONEY ALWAYS WINS

There is no outcome in which Bitcoin would lose because the best money always wins due to natural selection and survival. Gold and silver won the millennia-long monetary war. Bills of exchange backed by gold, then crushed silver. Gold was then defeated by its leviathan, the currencies of nation-states. Now, Bitcoin is emerging as the alpha omega of money. It will strip all assets of their monetary premium. It has been happening for 15 years in a row.

Measure any physical resource in the world against Bitcoin and you will find that it has fallen in price against Bitcoin by 90—99% in that time.

And this is just the beginning! Bitcoin hasn’t started sucking the air out of higher assets yet.

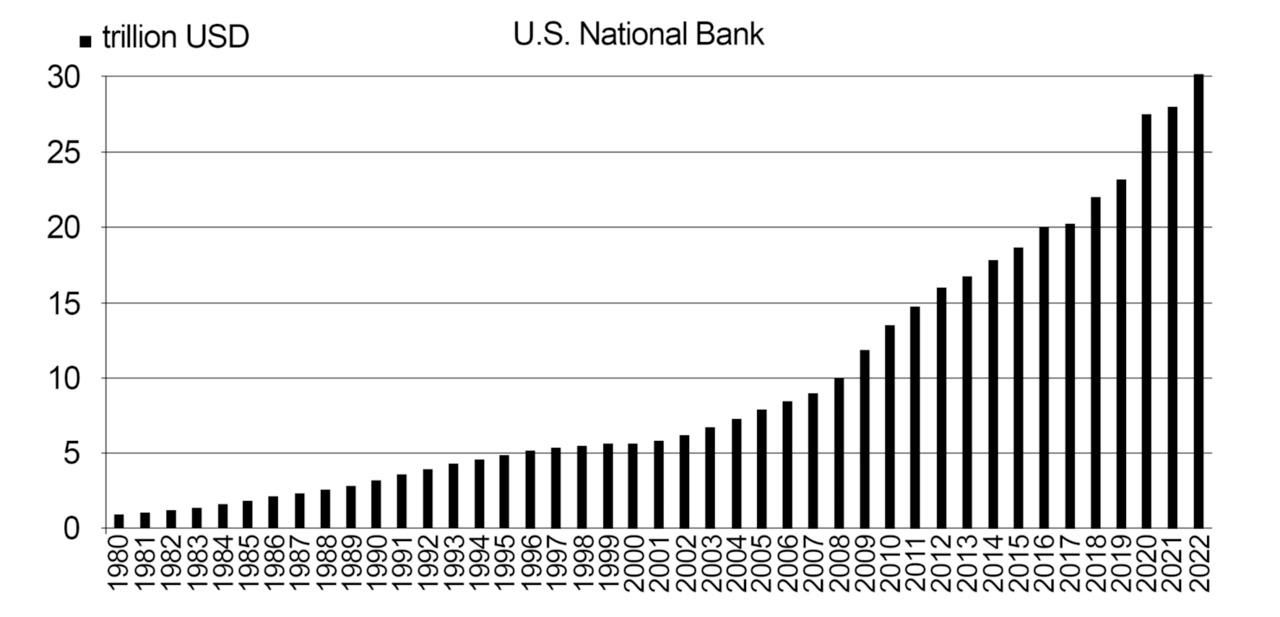

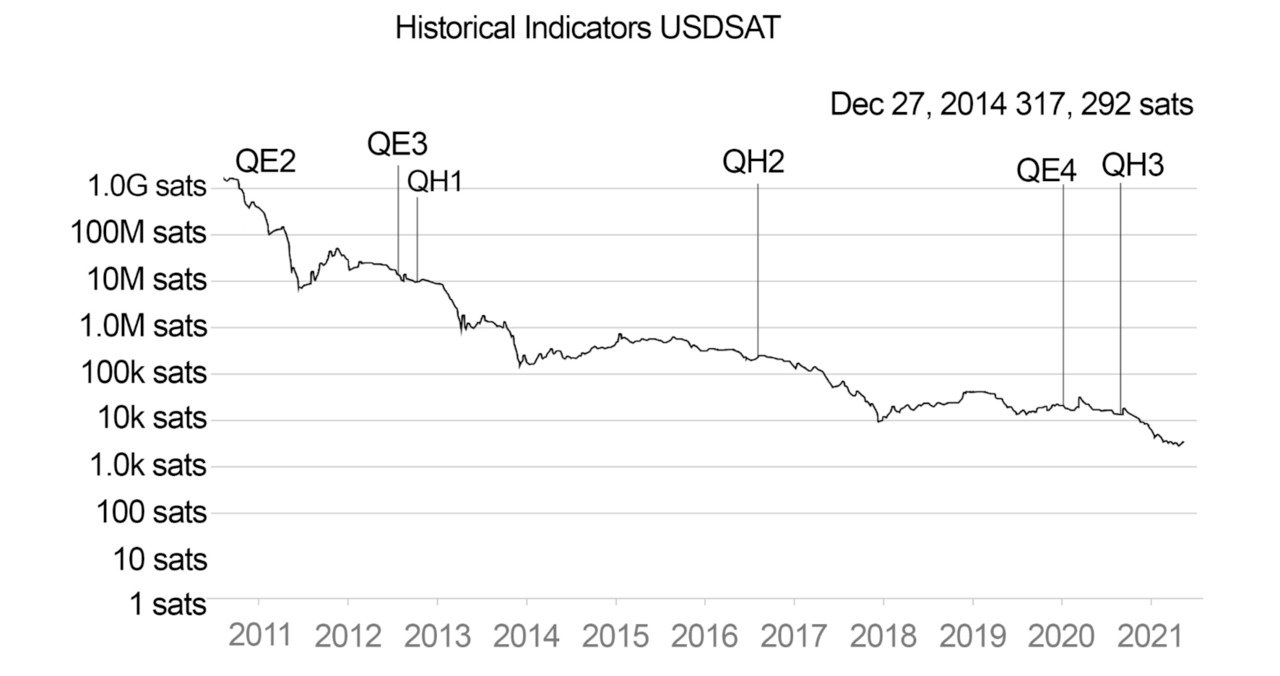

Fig.3 Correlation of the dollar and bitcoin exchange rate

The longer the chart, the worse it looks for the US dollar.

usdebtclock.org. This link shows the US debt online.

Fig.4 U.S. National Debt

It is a logarithmic graph, so the fall seems not so sharp. But we can see that the dollar has depreciated by an order of magnitude against bitcoin.

Fig.5 Historical USD/SAT indicators

Consider the chart in Fig. 6. It shows the cycles of every main reserve currency worldwide. And it looks to be around 100–110 years. Given that after two world wars, the dollar replaced the pound sterling as the world’s primary currency, we can conclude that we can prepare for a change in primary reserve currency.

Fig.6 Graph of the transition from one reserve currency to another

If we look closely at this graph and remember what happened when one reserve currency changed to another, we find that it did not happen by itself. It was always accompanied by the extinction of the issuing state* of the currency, by war, or by its ruin. In all cases, the next reserve currency in the world was chosen to be the one whose country benefited from the war, as it became more powerful, and its money began to be in high demand.

«Bitcoin is about property rights. It is the technology to provide property rights to eight billion people for the first time in human history. And that’s life, liberty and property» — Michael Saylor.

Saylor explains that half of the world has no hope of accumulating property while the other half takes risks with their property. Bitcoin is a technology that gives everyone the right to personal sovereignty and their own property.

Trust is more expensive than gold

The complete abandonment of the gold standard occurred between 1976 and 1980, when all countries, including the United States, gradually abandoned the gold standard, allowing their currencies to float freely in international currency markets.

If we had still used the gold standard, the economy and financial system could have had some differences. For example, a limited supply of gold could limit the expansion of money supply and economic growth.

A more predictable and stable monetary system based on a limited supply of gold could provide more confidence and trust in the system. However, the limitations of the gold standard would create problems in situations requiring rapid mobilization of resources or response to economic crises.

These concerns led to the final abandonment of the gold standard and the transition to a system of fiat currencies, where the value of money is determined by supply and demand in the market. The gold standard had its pros and cons. One of the pluses was the restriction of the state in the flexible management of the country and the prohibition of the possibility of getting money from nowhere.

Occasionally, there were situations where a shortage of gold or an excess of gold led to economic problems. For instance, if the country needed a major construction project and the treasury was short of funds, with the gold standard, the government could not simply print money. Instead, it had to suspend construction until the required amount was accumulated. Also, if the government started a war and the citizens were against it, they could cut back on consumption, and the money would stay with the people. It caused difficulties for the insolent government in financing the war effort.

The gold standard also limited the ability of governments to control the economy and manipulate money. It could also prevent the destructive influence of politicians and government. At the same time, the gold standard gave the population greater financial independence and incentivized the preservation of valuable ideas and innovations without the risk of government impairment. However, history has shown that the gold standard had limitations and led to a shift to more flexible monetary systems.

Today, we are seeing the development of new technologies, such as cryptocurrencies, that offer alternative approaches to monetary policy and financial stability. These innovations open up new economic and societal opportunities but also come with certain risks and challenges.

In this way, the history of the gold standard reminds us of the complex interrelationships between government intervention and economic development. The world is constantly changing, and we are learning from the past as we strive to create more flexible and sustainable systems that meet the needs of today’s economy. BITCOIN itself is a tremendous combination of sections of academic sciences and disciplines such as economics and finance, programming, and financial law. Therefore, even with a 2, 3, or 4 educations, a person will not understand the essence of Bitcoin at once.

One of the most important features of Bitcoin is that it is a currency that has not been known in the world before. It is an entirely new part of the economy, and currently, no single focused education process delivered professionally can explain what Bitcoin is.

Acceptance of BITCOIN

Psychology identifies 3 to 7 stages of accepting the inevitable. Here are the three main ones:

Denial. People in this stage may refuse to accept information about the inevitable event and stubbornly deny its reality. They may look for excuses or seek to find reasons why the event should not happen.

Anger. People in this stage may display anger and irritation toward those associated with the inevitable event. They may be aggressive and express anger and resentment.

Humility. People who have reached this stage accept the inevitable event and may begin to find ways to come to terms with it. They may start to find ways to adapt to the new situation or look for new opportunities.

Given the current trend of acceptance, the price of BTC will grow strongly over the next ten years and then follow a more linear trend. Bitcoin has yet to reach even half of its adoption potential, which means that the highest growth is yet to come. Bitcoin will perform outstandingly in the coming decades when only 4% of the world’s population will use it, and then that number will only increase. In the long term, BTC is expected to grow significantly, and despite short-term declines, we should pay attention to the overall development trend.

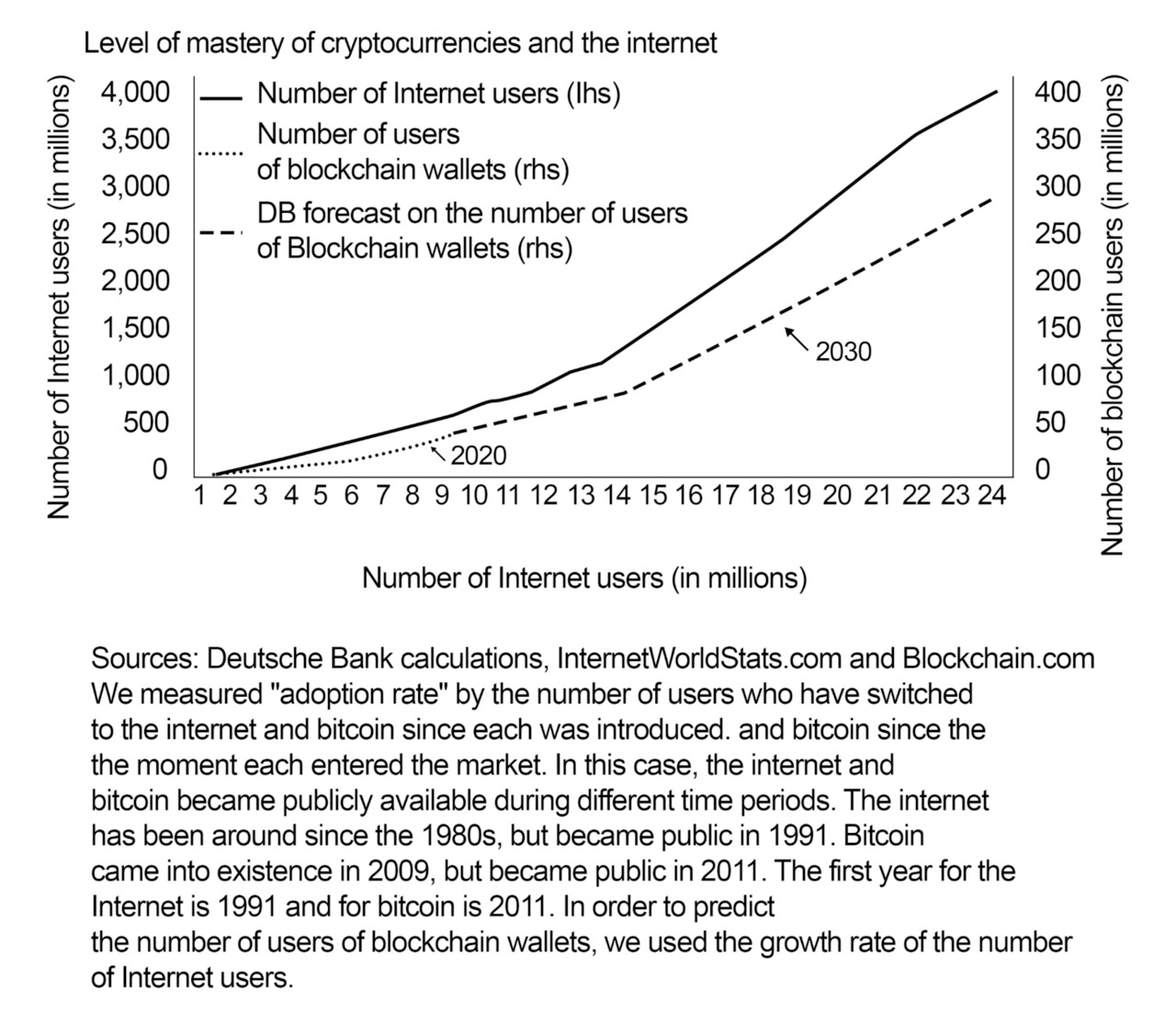

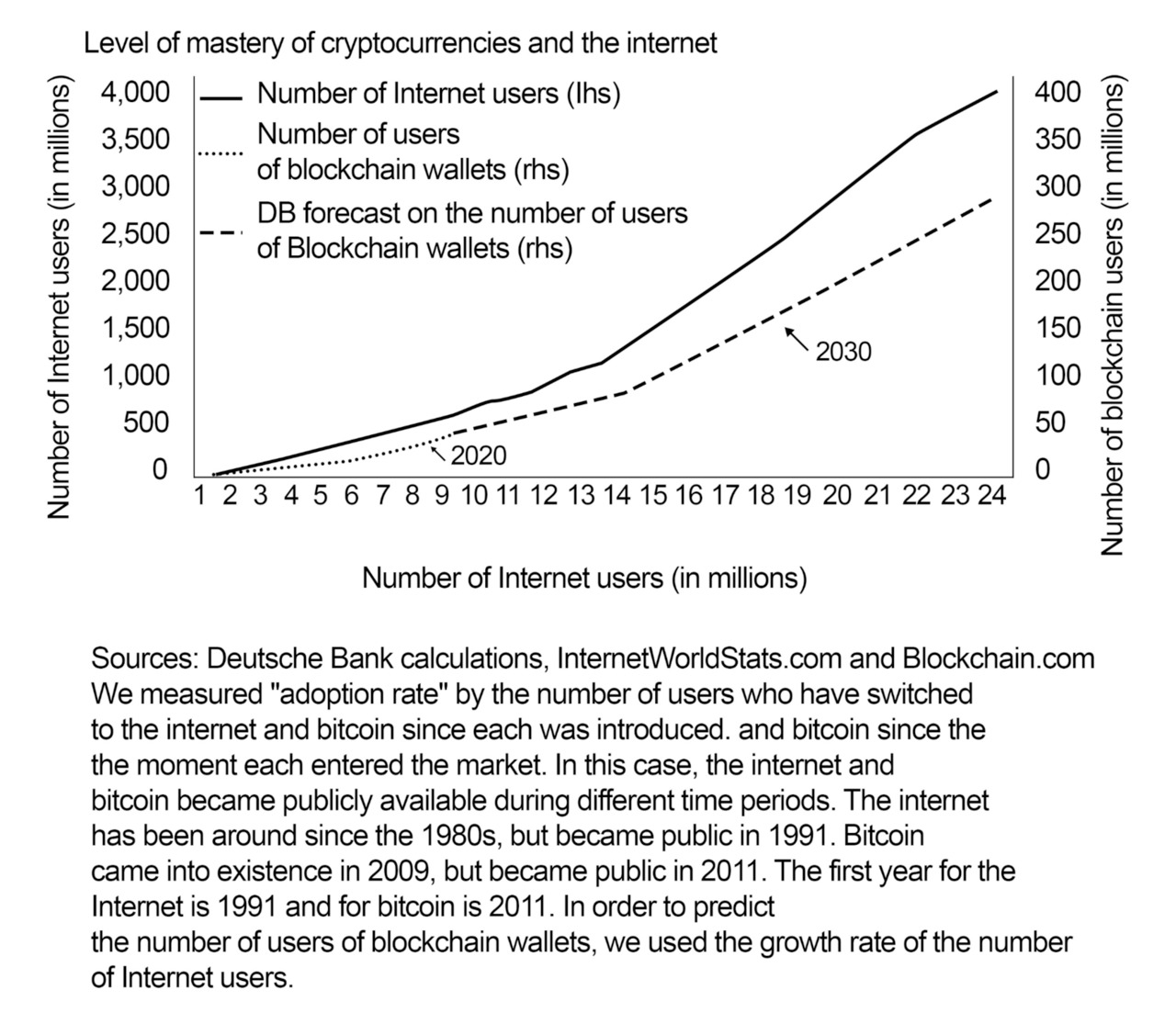

Let’s consider how users came to the World Wide Web and blockchain.

Figure 7 shows the curves of Internet users and active cryptocurrency wallets over the 24 years of the World Wide Web’s existence. The dotted line indicates the expected growth rate of the number of blockchain wallets based on the Internet adoption dynamics in the past.

Fig.7 The level of take-up of cryptocurrencies and the Internet

As we can see, both technologies had a slow start in the first few years. In eight years, the number of Internet users worldwide grew to 500 million, while only 50 million people started using blockchain in the same period of time. It took the Internet a quarter of a century to reach more than 4 billion people. The blockchain user base is projected to grow to 350 million people in the same timeframe (Figure 7).

The study only covers the period of time when the Web has already become a user-driven phenomenon. The network began to be created in the United States in the sixties, but at that time, it was used only by government organizations. It wasn’t until the nineties that the Internet began to gain noticeable popularity among ordinary people, both in America and the rest of the world.

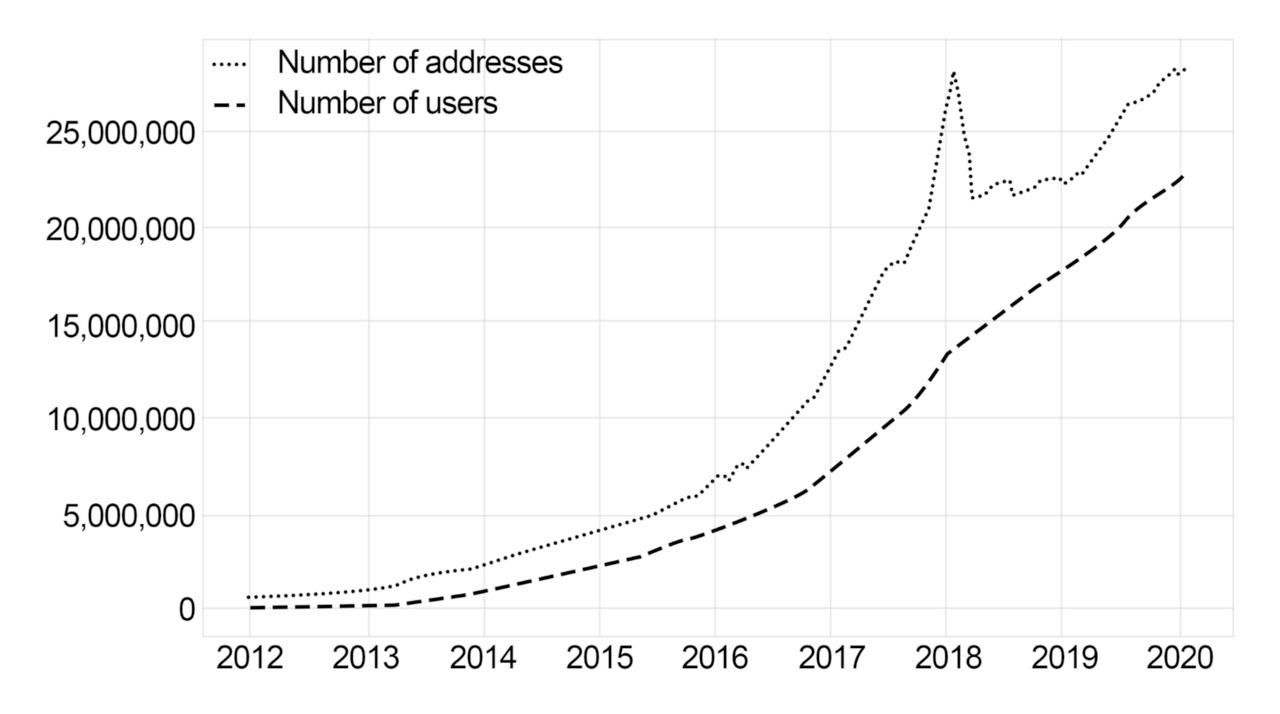

The approximate number of Bitcoin wallet owners with a balance of more than zero exceeded 23 million people as of 2020. As of 2023, according to the latest tweet published by crypto analyst Ali, the current number of BTC holders exceeded the entire population of Spain (47.5 million), reaching 48.5 million people. An interesting comparison between the number of addresses and Bitcoin users is shown in the following graph.

Fig.8 Comparison of the number of BTC addresses and users

The bottom line of the graph shows that the number of Bitcoin users grew linearly from 2018 to 2020. Therefore, we did not have a sudden upsurge, as people entered the market gradually. Nevertheless, despite the lack of frantic price growth, the number of Bitcoin users has been growing steadily, and more and more people are starting to use the first cryptocurrency (Fig.8).

If we remember market cycles and look at the same graph and the bottom line from 2016 to 2017, we see a parabola when the influx of new people into the market was many times greater. It is quite logical, given the sharp rise in prices at the time, but now the excitement has subsided, and the industry lives off those who have made a conscious choice to use cryptocurrencies.

What BITCOIN is like

Bitcoin is like a bank, only better because you can put money into Bitcoin and earn income from the growth of a currency that relies on inflation as long as you buy it at the lower end of cost. Think of the interest rates banks offer. Usually, it is 2% per annum in dollars and euros. Thus, over three years, you will get 6% at best. In turn, BTC has risen in price by 150% over the past three years, and this does not include the moments when its rate increased by 400%.

Bitcoin is a cross-border transfer system. It can be used to make payments and transfers for goods and services in the same way as using a bank card.

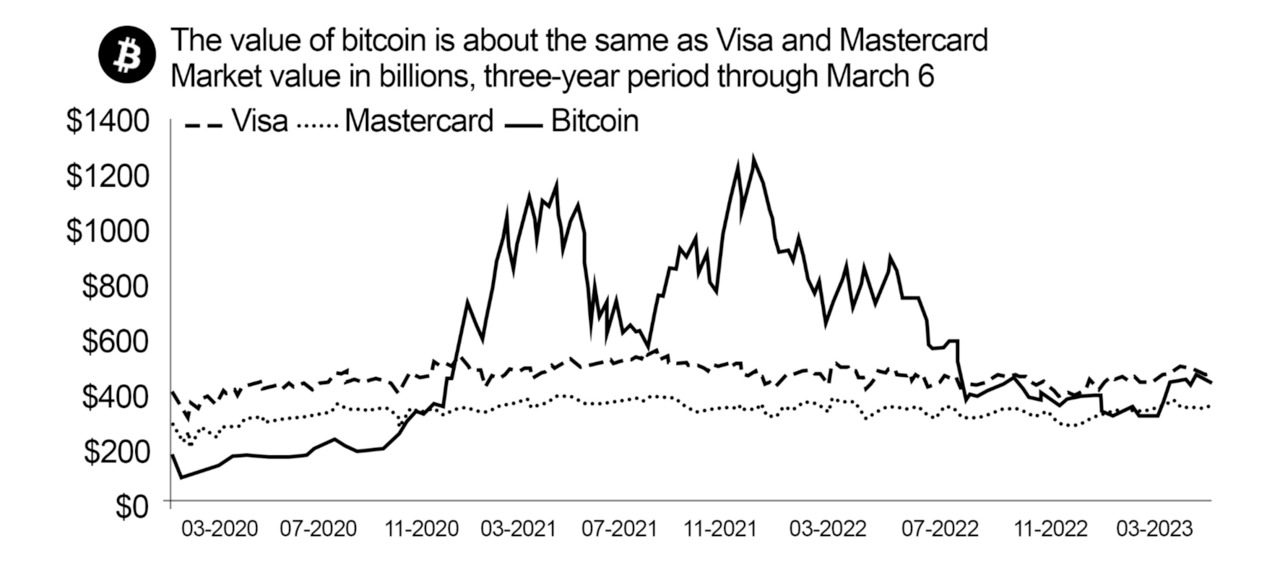

Bitcoin is a company’s share because when investing in BTC, it is as if you buy shares in the form of tokens and, owning them, receive dividends in the form of growth in the company’s capitalization. Bitcoin’s market capitalization now rivals that of Visa (NYSE: V) and Mastercard (NYSE: MA), which have had millions of users and name recognition for decades (Figure 9).

Fig.9 Market value of bitcoin

Bitcoin is decentralized, meaning it has no CEO, board of directors, and marketing budget. Yet its total value is roughly the same as the two largest credit card companies. Securities, such as stocks or bonds, give investors rights to a share of ownership, profits, or the right to receive interest payments. They usually have a legal status and are governed by relevant laws and regulations. Bitcoin has no legal status and is not regulated by central or state authorities. Bitcoin is not a security because it is not a financial instrument that entitles you to a share of ownership or profits from any company or asset. Unlike stocks, bonds, or other securities, bitcoin is a cryptocurrency, a digital asset operated on blockchain technology*.

Bitcoin is a business — you can buy equipment, rent it out to a network, and get paid for it, or buy part of a mining company as an investor. You can even directly buy hash rate in the form of tokens, open an exchange platform, or put your Bitcoin ATM. Everything is as it should be — business purchases goods cheaper and sells them more expensive.

The definition that bitcoin is MLM (multi-level marketing) is very superficial. There is no business plan or tiers, but there are product consumers who recommend the product to others and attract new members to the network. The more participants or users, the more valuable the currency is.

Bitcoin is the new perfect money. You can exchange them for any goods you have in the world. Although, it is not yet as easy to do as exchanging US dollars or euros. You have to search for who accepts Bitcoin, but it is possible. And BTC is, by all definitions, money, or maybe even something more. Bitcoin can be considered the digital equivalent of cash without the physical embodiment. It serves as a medium of exchange, a store of value, and an investment asset, but it does not have the attributes of a security. Bitcoin has no relation to any companies or project’s financial health or profits. Yes, bitcoin is not very suitable for transferring small amounts of money, and yes, while you will pay for the product, its price may fall or rise. But we will come back to this issue later.

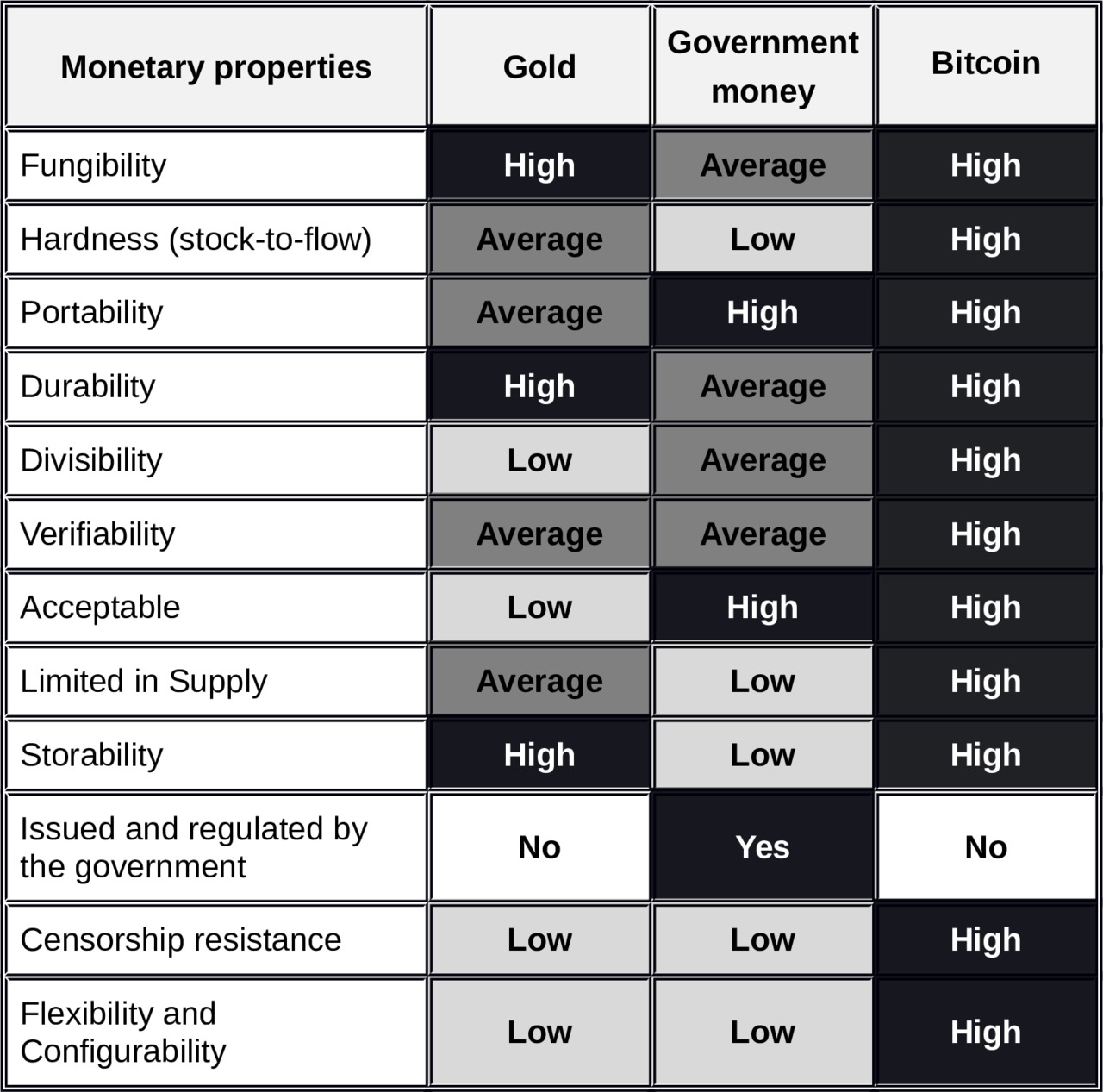

Bitcoin is gold, but it has one key difference: gold, like Bitcoin, resists inflation on its own, but it is harder to store, move, and sell.

Besides, one day, gold will be mined so much that there will be no point in new mining, and the price will stop rising. And if there is a crisis, all production companies will start reducing their purchases to save themselves. In the end, gold, like the states, will lose, and its price will fall.

As we can see, gold is significantly inferior to bitcoin, and in addition, unlike BTC, it does not participate in the role of raw materials for the company like gold. In contrast, it has a different role. It is more of an arbitrage and not a commodity role. But as great as Bitcoin is, it still doesn’t come close to the market value of gold and silver, the other two decentralized assets.

The total global value of gold is just over $12 trillion, and silver is worth about $1 trillion. I believe this is favorable for bitcoin, which currently has a market capitalization of about $433 billion. For a digital asset to have the same value as silver, each bitcoin must be valued at $60k, which it has reached before and will likely reach again.

For BTC to become as valuable as gold, it would have to trade for a staggering 630 thousand dollars, which is not the best option if we want to have time to stockpile this valuable resource (Fig.10).

Fig 10 Advantages of Bitcoin compared to Gold and government money

Bitcoin is the most secure database, and for many years since its inception in 2009, no one has been able to trick, hack, or alter it in any way. Anything can be written into this database, up to 4 MB in size, and this information will be stored in the network’s memory until our planet ceases to exist.

Bitcoin is a commodity expressed at its best. According to the U.S. Commodity Futures Trading Commission (CFTC), bitcoin is the only crypto-asset officially considered a commodity. All other coins and tokens can be classified as securities. Now, think about why I am talking about Bitcoin and not its alternatives.

Bitcoin is a religion or sect that believes jealously in technology and the possibility of a decent life given to everyone. Bitcoin has its own symbol, similar to the cross for Christianity or the crescent moon for Islam. Its «B» symbol is known by literally every person on the planet who has accessed the Internet at least once. In such a religion, there is a specific «God of Bitcoin,» symbolizing the incomprehensible idea of a decentralized financial system.

There are also sacred texts containing information about blockchain and cryptocurrency. There are rituals associated with using or investing in Bitcoin to help believers feel connected to its ideas and community. There are holidays like Bitcoin’s birthday or the famous Bitcoin Pizza Day dedicated to the first purchase made with the coin. There is also a mythical creator — Satoshi Nakamoto, and other personalities who have made a particular contribution to the development of Bitcoin and have been honored, brought gifts, or invested in charity or development projects supporting Bitcoin. There is even merch — symbols, items, and clothing that help users identify with this religion. You don’t have to go far — you’re holding this book that is also part of the Bitcoin culture and religion.

Now for a more complex concept. Bitcoin is a cryptocurrency based on the Bitcoin Protocol, which uses a distributed network of nodes (nodes) to provide security and transaction support. If you don’t know what it is, don’t feel bad. The main thing to remember is that the BTC network is resilient to censorship and single points of failure. Plus, bitcoin uses cryptographic methods to ensure security.

Over the years, bitcoin has demonstrated the reliability and resilience of its system, and it has never been hacked in its 14 years of existence.

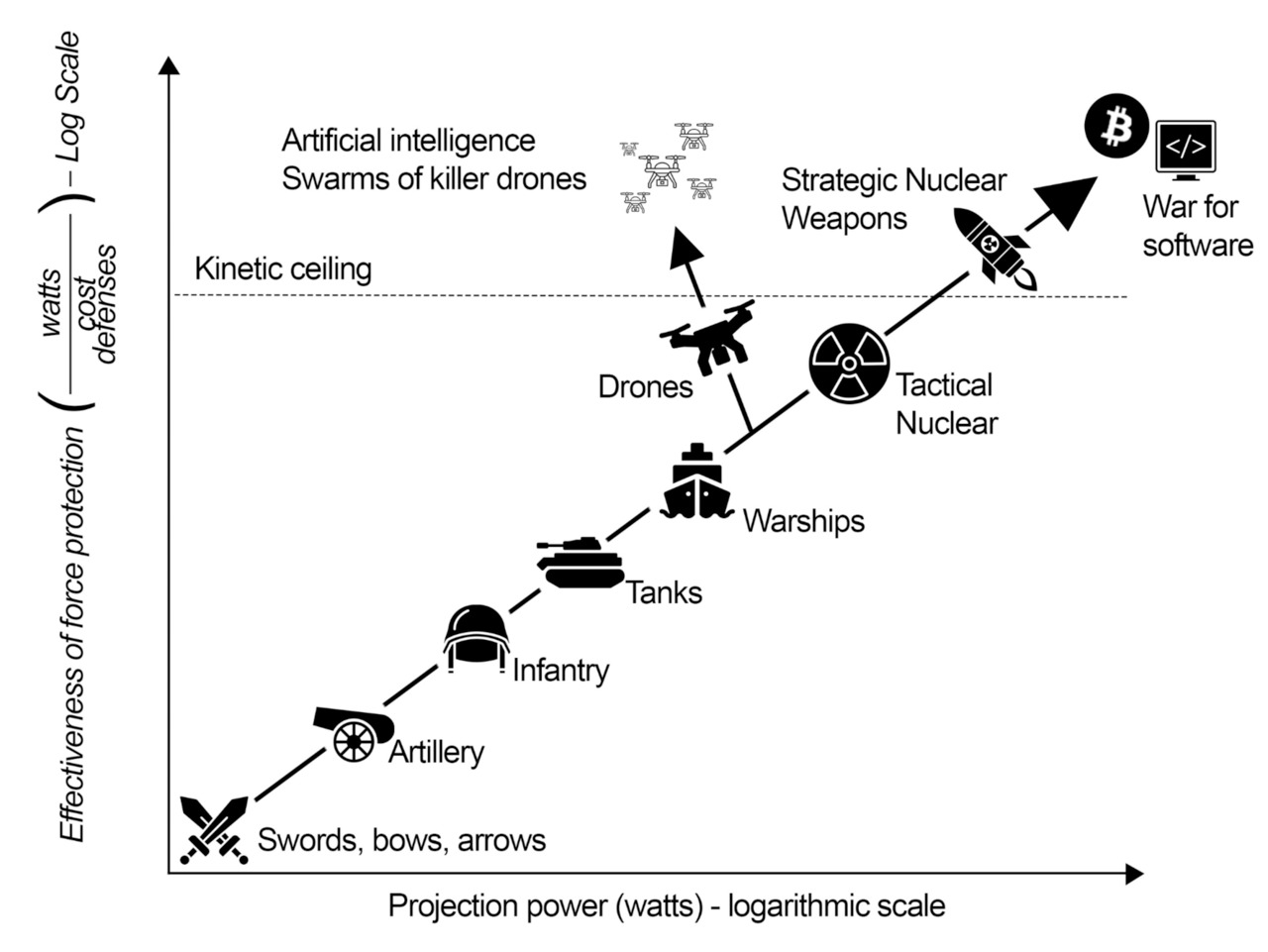

Bitcoin is a means of waging soft warfare. Soft warfare (non-linear or hybrid warfare) is a conflict strategy that uses unconventional methods and tactics rather than armed aggression to achieve its goals. Soft warfare includes information operations, economic pressure, diplomatic tactics, cyberattacks, and other unarmed measures. Soft warfare has become more common in the modern world, especially with the development of information technology and social media, which allow for the rapid spread of misinformation and manipulation of public opinion. The main objective of soft warfare is to achieve political, economic, and cultural advantages without overt use of armed force. It can include interfering in the internal affairs of other states, disinformation, and manipulation of public opinion, weakening foreign economies, supporting non-governmental organizations, terrorist groups, etc. If all of this can be done with fiat money and gold, it is possible with Bitcoin (Figure 11).

Бесплатный фрагмент закончился.

Купите книгу, чтобы продолжить чтение.