Бесплатный фрагмент - Financial planning

A WORD TO THE READER

This book comprises a guide on how to manage finances in business, not only encompassing hands-on management but rather providing a foundation for creating an effective, secure management system ensuring that your managers will never have any issues in finance again. There are a great many textbooks in available on finance. However, they are quite hard to understand, and most aren’t designed for use in practical, real live situations.

This book takes a particularly simple, practical approach to financial management for any manager to be able to understand it and then go on to successfully integrate it, even a small company manager. Standing behind this claim are our consultants, who have given guidance to over 500 companies of all types and sizes. From the smallest firms to large corporations with over 1,000 employees — the principles described in this book have been repeatedly implemented with success. By applying these principles, managers have succeeded in achieving a whole new level of organization and magnified their incomes dramatically.

The main concepts outlined in this book with regard to a company’s financial management system have already been described long ago by classic management authors. However, as you may have experienced, it is not that easy to take a theory and put it into practice. In overcoming this difficulty, the practical financial management know-how described in the works of L. Ron Hubbard are particularly valuable. It is this know-how that enabled us to create an effective yet simple system for companies to manage their money which can be employed by a great variety of different businesses.

As you read through this book, mark the particular terms and words you don’t understand. Understanding the definitions of words will provide you a stable foundation upon which to build a greater level of competence. The field of finance contains a multitude of technical terms, and at times it is quite difficult to discern simple and clear definitions. For this reason, this book contains footnotes with explanations of words that may potentially be misunderstood. If you find yourself exhausted from reading and losing interest, what likely happened is you went past a word you didn’t understand. Clear it up. Finance is actually a simple subject. The only reason it appears so complicated is due to the technical terms used in it.

As you read this book, chapter by chapter, you gain more and more of a full, clear picture of the financial activities your company is engaged in. You will find the answers to some of the most complex and frustrating questions associated with financial management.

Business owners will be able to use this book as a means of escaping operational management and beginning to expand, all the while retaining total control. Managers of different levels will find answers to questions on how to allocate funds and ensure that their own departments are functioning the way they should. Financial professionals will attain a complete understanding of how to organize financial activities while achieving the full cooperation of managers, creating a company budget, and making on funds allocation decisions.

I sincerely believe that no manager can do without having a complete understanding of how to manage a company’s finances — without this, success is simply unattainable.

CHAPTER 1

FINANCIAL MANAGEMENT

Surely you’ve already heard of «financial management» or «managing finances». In all likelihood, someone has probably tried to convince you that it’s complicated before. Truthfully, it’s quite simple, and anyone, from the diligent homemaker to the skilled mechanic, should able to explain the basics of it. If a homemaker can manage the funds to cover all the family’s needs without creating any debt, they can manage finances. How do they do it? They simply plan all their expenses around the current household income. By planning them out, they ensure that payments for all important items are covered. They maintain «robust discipline» regarding expenses and don’t allow anyone to spend the money allocated for those purposes on other items.

In this chapter, we will take a look at financial management and what exactly its purpose is. Different theories, ideas, and concepts exist on this subject. One theory holds that financial management serves to economically allocate money into savings. Another maintains that money should be primarily used to expand and increase the company’s income as fast as possible. This chapter will escape the bounds of financial management theory, and help you achieve a clear understanding of the subject as a whole so you can use it yourself.

I will begin by talking about my mother and a number of other people. At first, you may think that the following examples have nothing to do with managing finances in business. However, that is incorrect. Those to whom I will draw attention intuitively apply the basics of financial management in their own lives. It was only when I grew up that I realized my mother was a financial management guru. She has never had any debt, nor did she ever buy anything on credit. Moreover, she has always had money set aside for a rainy day, so even when an unexpected expense arose, she didn’t need to take out a loan. And she managed that on a fixed income! She simply knows how to create reserves and gradually accumulate enough funds for larger purchases. She set aside separate amounts for unexpected expenses.

When it comes to money, people could be divided into two categories: those who manage their money thoughtfully and don’t create debt regardless of their income, and those who fall into debt even if they make an above average income. Some people always live within their means while others are constantly getting themselves into trouble with money. This has nothing to do with the size of their income. The people in the first category simple use financial management, while the second group doesn’t employ any kind of system at all. Their finance-related operations are chaotic and the results of their actions are unpredictable.

A few years ago, at the beginning of the Summer, I ran into an old acquaintance at a gas station. He seemed to be quite successful. It was a warm, beautiful day, but the Summer heat was still a ways away. My acquaintance drove an amazing new Porsche Cayenne. I was surprised as I didn’t think he was all that rich. The car’s wheels caught my attention — my friend was oddly still using winter tires. After talking to the guy for a few minutes, I realized he simply didn’t have enough money to buy a set of Summer tires suitable for his car.

That is undeniably amazing: when he was buying the car, this guy didn’t consider the future maintenance expenses it would have. His financial management was horrible, as he couldn’t even enjoy driving this expensive new car he bought. Driving a powerful car on the sun-heated asphalt with winter tires is hardly enjoyable. Winter tires are heavy and loud, and they slide over puddles since the tire tread isn’t designed for that kind of weather. In any sports car, a driver will experience the full consequences of using the wrong tires. His investment in the joy of driving came up short, as he didn’t properly plan his expenses and coordinate them with his income. As a result, instead of enjoying driving a powerful, luxury car, he now has extra problems to deal with. He can’t afford to service the car and the monthly installments are more than he can handle, the basic reason being: he wasn’t familiar with the most basic aspects of financial management.

You could say exactly the same of a business where the managers are forced to manually handle a lack of money and unexpected expenses. Here is what usually happens in a business: at the end of the month, an manager has to look for money to pay the employees’ wages and account for office rent by postponing payment of all of his other bills. Sometimes he has to borrow money to smooth out unexpected problems that arise. On the other hand, if a company has enough money to comprehensively pay for the company’s operations and expansion, and all its contractual partners’ invoices are paid on time, you can confidently say that its finances are being skillfully managed.

Financial management is an effective and efficient method of handling money to help an organization achieve its goals.

If a company is wisely spending its money, avoiding taking on debt that it cannot pay back and expanding at the same time, then its financial management is completely fine. While it does sound simple, there is a catch. This result has to be achieved by an manager personally handling this area. Will his hands-on financial management turn out to be effective?

When founding a company, it’s the owners and managers that deal with the allocation of funds and decide which expenses to approve. In this moment, a particular hands-on financial management model is created, which will then last for many years. As with any habit, it does have certain benefits, seeing as upon a business’ conception, even the smallest mistake may entail disastrous ramifications. A person at the head of the company usually takes complete responsibility for making financial decisions to avoid financial matters getting out of hand. Quite often, such a person is either risking their own money or the money his investors have entrusted to him. During that time, every cent counts and money is the most important resource, so the success and speed of expansion both depend on how well money is managed.

When I founded my first manufacturing company, I knew that to begin manufacturing would require a large investment and a great deal of time. I knew we would have had to invest not only in equipment, materials, and the premises, but also in «non-material» objects — marketing and employee competence. I wasn’t under any illusion that the money I invested would yield quick returns. We needed time to achieve popularity, a reputation, and train specialists to become competent on the job. Additionally, we had very little money to work with, and by the time we properly equipped manufacturing and hired our first employees, our funds were completely depleted. All further financing came from the income we were earning through our operation. We were sorely lacking in funds and I had to solve financial puzzles practically on a daily basis. Not only did we count every cent — all of the income we were expecting in the near future had already been promised to an investor to repay the debt. Every day I had to «juggle» the money and obligations I had just to make it to tomorrow. I had unpaid rent invoices, debts to suppliers, and even unpaid wages to employees. I spent almost a year of my life paying all my debts and working to stay above the red line.

At the time, I didn’t comprehend the basics of financial management and, to be honest, had more pressing matters to deal with than studying how to properly manage money. Even if someone were to have walked up and told me, «Man, you are spending too much of your valuable time and attention on dealing with financial issues. There’s another way!» I would simply not have listened to them. Now, having created a number of successful businesses, I can see very clearly that my incompetence in money management and my manually handling all expenses were simply robbing me of my time and creative energy. If I had had an idea of how to properly organize things, I would have been able to direct my efforts to marketing development, sales, and manufacturing, and the company would have nowhere to go but up.

For most business owners, especially those who own small businesses, financial management starts with hands-on management and remains that way forever. It all starts with the business’ founder, who is full of enthusiasm and is happy to handle these matters. But if the hands-on management phase continues, all these actions will become routine. From the viewpoint of company expansion, these routine activities are dangerous. They don’t allow the owner a chance to escape beyond daily operational management. The ability to correctly prioritize expenses comes from a comprehensive understanding of those expenses and comparing their relative importance. Should we pay the advertising bill or would it better to buy more materials? To answer this question, one must understand the nature of advertising, how it is supposed to work, and how the manufacturing materials will be used. In attempting to understand such matters, an manager is forced to examine every detail. His attention is scattered between thousands of little problems. As a result, he doesn’t have the chance to see the overall state of the company’s operations.

Compare this situation to a hamster wheel, where the poor animal is running as fast as it can but still cannot make it ahead even one bit. And the faster the hamster runs, the faster the wheel turns, and the faster he has to move his feet. As the company expands, the amount of issues an manager has to deal with grows even bigger, and this will go on forever until he collapses in exhaustion. There is only one way off this hamster wheel, and it is not by running faster. You need to take a step to the side. To escape beyond operational management, a company owner first must understand how financial management is done at his company and then he must reorganize the company’s operations to be able to jump off the wheel. To equip you with the tools to do that, this book will first describe the ideal state of affairs in the area of financial management, who should be doing what, how it all should be organized, and then we will explain how to put it into practice.

You may be wondering: «Why don’t I simply shift all of that onto the shoulders of a responsible and honest financial manager?» This is a natural question for a proficient manager to ponder. A skilled manager, unlike a newbie, knows that if you’ve encountered a problem, your first thoughts should be not about how to solve it, but who can do it. However, the field of finance is too «hot» to put in the hands of just anyone. It is obvious that even if you have a competent, reliable specialist, he needs to have exact guidelines for this area, and you need a way to monitor his actions. People say that there are two things in life that can drive people crazy –money and in sex. I can definitely say I agree with the first thing.

When you’ve been working in people management for a few years, you’ve gotten a very good idea of how it can drive people crazy. I will never forget the amount of confusion I experienced when my business partners and I discovered that a small amount of money was missing from the company safe. Money disappeared from the company safe during working hours. The safe wasn’t locked since it was in a room that only partners and a few employees had access to. Before this happened, none of us could even imagine that someone was capable of stealing money. I will never forget how we felt when we discovered that money went missing — a combination of shock and confusion. What would you have done in a situation where only good people that you respected were working for you, but the fact remains that money was missing?! During this odd and stupid situation, I realized for the first time that money requires proper control and organization. The amount that was stolen wasn’t a lot, but it became obvious that we needed security guidelines, otherwise sooner or later we would continue to have major problems.

I established my first business at the age of 23, a year after graduating from college. Since then, I’ve founded a number of companies, and during that time I have seen so many different things! From a partner who was entrusted with the company’s finances blowing company money at a casino to a company that was stupidly purchasing items for inflated prices. I can say with complete confidence that a lack of sound financial management opens the door to crazy dealings with money.

From the business management side, you could say that a good financial management system must be designed to: 1. Ensure the sane handling of finances, which helps increase product manufacturing, income, company profits, and help fulfill its strategic plans. 2. Render financial abuse impossible. 3. Allow one to delegate financial management to company managers so the executive can work on growing the company. 4. Provide full control over the company’s finances.

In the following chapters, we will look at all basic elements of the system I’m proposing, as well as examples of its application. Once you fully understand this material, you will have a clear idea of how financial operations can be organized in your business. Naturally, to be able to apply these ideas in your company, you will need to exert a certain amount of effort, but it’s worth it.

CHAPTER 2

MONEY AND MANAGER RESPONSIBILITY

Most company managers ask the following question, «Who should manage the company’s money and be responsible for ensuring that it’s used effectively?» The obvious answer may be that the CEO should be the one responsible, because he is overall in charge of the entire company. But common sense says otherwise. A company has many managers, and their divisions make large contributions to operational results with overall success depending on their coordinated activities. They also need to take part in financial management. To understand this, we first need a clear idea of what money is — what kind of object it is. Some people think that money is the purpose and goal of a business; others say that money is correlated to results, and if the results are good, then there won’t be any money problems.

Essentially, money is the representation of value that aids exchange — this is exactly why money was created. Before we had money, there was a barter system where one product or service was simply exchanged for another. That’s how people got everything they needed. It was a very complicated and inconvenient system, and as mankind progressed from subsistence production to an economics system with specialized manufacturing, it became harder and harder to for the barter system to be used. The system that followed involved the use metals, such as bronze, silver, and gold as means of exchange, which was much more convenient. While people were using these precious metals, inflation couldn’t exist, because the monetary units — coins made out of precious metals — had a tangible value. Eventually, dealing with metal money also became too inconvenient, which led to the creation of paper money and bonds. To ensure people’s trust and enable this new money to be used as means of exchange, the gold standard started being applied. The concept of the gold standard was banks would only issue paper money that was guaranteed to be exchanged any time for gold. For this reason, paper money eventually became the primary means of exchange. Naturally, the idea of using gold is not absolute either. If the amount of gold being mined were to drastically change, that would also influence the value of money.

Ending the gold standard, as economists say, was necessary for economics to develop. The amount of gold was limited while the amount of valuables produced in the world increased. Therefore, the supply of money had to be increased. However, at the same time, it enabled governments to print money at their own discretion. When the amount of money printed becomes greater than the amount of valuables manufactured, we have inflation. And the less confidence people have in the government’s sanity and the stability of the economy in the country, the less valuable that money becomes. The less confident we are that tomorrow the money will buy us something, the more we desire to exchange it for another currency and vice versa. As the country’s economy becomes stronger, and the more sanity the government shows in its money management, the stronger the nation’s currency becomes.

Since the monetary reform of 1897, when paper money received the backing of gold, the economy of the Russian Empire received a large amount of internal and external investments. People’s trust in money has greatly increased and so has its value. But the turn away from the gold standard in 1914 due to the war and the revolution that followed led to the Russian Empire’s paper money completely losing its value.

Therefore, money itself does not bear any value simply because you can buy something with it. From the viewpoint of an organization’s activities, money is the equivalent of different resources that are necessary for operations. By the way, this is why when someone tells me that earning money is the goal of their business, it’s clear to me that this person doesn’t have any idea what money actually is. To say that earning money is a business’ goal is to say that using and accumulating resources is the goal of manufacturing. Suppose that a concrete manufacturing factory’s goal is to accumulate materials in its warehouse, hire as many employees as possible, and purchase new equipment. All of these things are the primary resources. It seems silly, because such a factory may have the goal «To provide concrete blocks to local builders», but it can never be «to accumulate resources».

And what about business owners whose goal is to expand a company to certain level and then sell it at a high profit? Well, the interesting thing is that even in that situation money is not the goal. While someone creates a business and grows it, his team is working toward achieving a common goal, which is connected to the benefit that this business brings to its consumers. In this case, we are dealing with a contradiction, because the goal of a business and the goal of a business owner are two completely different things. The owner is creating «value» — a well-functioning company with very specific goals. And the result of his work is usually valuable, because the company he has created is able to successfully manufacture a product, generate income, achieve goals, and yield profits for the owner. This company will become a valuable resource for someone. Private companies are usually bought because the buyer needed a very specific resource: technologies, certain products, a distribution network, etc. Once an owner has created a company, he can expect to exchange this value for money. My experience from working with over 500 companies has shown me that it’s impossible to create a strong company if your goal is to sell it later. It goes against the very idea of teamwork, when you’re supposed to unite people in achieving a common goal.

Money as the equivalent of resources necessary for the company’s operations is not the goal. It is more comparable to the energy you need to achieve goals. The more «energy» you have, the more resources you can acquire to facilitate your goals: equipment, good specialists, warehouse stock, marketing, etc. Many brilliant business ideas have failed only because the competition had more money to make their products known, improve manufacturing, and expand quickly. A sound financial management system will help you squeeze the most out of your ideas.

At this point, you may be pondering a logical question, «Who would be the best to manage a company’s resources? Would it be the CEO or — the person who actually uses the resource?» Imagine a maintenance manager whose job is to ensure that all office equipment and tools are working well. If a chair is broken, this person has a few ways to fix it. He can buy the necessary screws and bolts and fix the chair on his own, he can hire a furniture repairman, or he can request that a new chair be bought. In any of these three cases, the problem will be resolved; however, the efficiency of the solution will vary, as the monetary expenses could end up being 100 times higher or 100 times lower. However, there is only one solution that is correct, and only the maintenance manager can truly know which option leads to the right solution. Imagine how this situation looks from the viewpoint of hands-on financial management: a manager has to study all the details and make a decision on which solution should be employed and how much money should be allocated for it. Add to that the manager’s excessive workload as he definitely has other concerns besides resolving furniture repair issues. The result is obvious: in most cases, the manager will not be able to make an optimal decision, he will make mistakes, he will not choose the most efficient solution, and he will waste money.

Actually, the game of «hands-on» financial management seems efficient only to the manager. With this approach, subordinates are often puzzled when they see an obviously inefficient use of money. Don’t believe me? Just think back and remember the software that was bought because the CEO wanted it but was never actually implemented. What about the new equipment at a company that went unused? What about any unusual ideas in regards to marketing, and many other things? These mistakes also have another downside by the way — they demotivate employees by making them feel useless and decreasing their trust in the manager’s decisions.

Imagine you are the manager of the Department of Promotion. This activity determines the number of people who will approach the company to buy products or services. To achieve perform well, the department must conduct research and surveys, plan marketing campaigns, design advertisements, publish them, and collect data on the results. To do so, the department needs a lot of resources: designers, photographers, distributors, mass media, etc. And this field of operation is not particularly simple, so the prices and service quality may be very different from each other. In some cases, it may be enough to hire an average designer, while in other cases you would need a professional. This area of work contains many nuances that greatly influence the decision-making process. If the head of such a department manager is not able to make decisions on his own in regards to buying resources, he will simply not be able to create satisfactory results. And even in a small company with a few dozen employees, at least ten decisions have to be made every day. Multiply this by the number of departments — each of them will require some amount of resources — and you will see that a division head’s attempt to resolve all these issues on his own is destined for failure.

A CEO usually gets worried when a new marketing specialist arrives at the company and one of his first questions is, «What is our marketing budget?» The CEO flinches like a guard dog. He is already worried that this new specialist is trying to dive into the company pocket. It’s funny, because this is a quite natural question for a good marketing specialist to ask. While he is planning out his work, he has to have the resources he can count on. Only a crazy person is not interested in resources in planning these things, as any plan is the idea of how to achieve maximum results using the available resources. So, if your new marketing specialist is not interested in the marketing budget, he is either crazy or he doesn’t plans to achieve any results. And I don’t think you would be fond of either one of those scenarios.

Now we will get into responsibility taking for results. A person shows responsibility when he is certain that he is at the cause of what’s happening to him. And the opposite of that would be irresponsibility, which is the concept that something else is the cause of what’s happening. For example, a manager responsible for a pressroom knows that the results of these operations depend on him. He has to hire suitable specialists, plan the work that they have to do, and provide them with equipment and materials. He will remain responsible for as long as he has this certainty. If, for whatever reason, he finds out that he cannot influence this and concedes that, he will become irresponsible. For example, imagine that an manager has prepared everything, coordinated everything, and suddenly the company CEO comes down to the pressroom and makes a «discretionary decision» to change the printing schedule. Have you noticed that people tend to react very differently in these types of situations? Responsible people will go to the CEO and ask why he did that, and if there is a serious reason. They will try to consider that while conducting their own future planning. Irresponsible people simply shrug their shoulders and say, «Well, that’s life. He is the boss and has the right to do that.» They thus continue to find «evidence» to prove to themselves that they have no effect on anything.

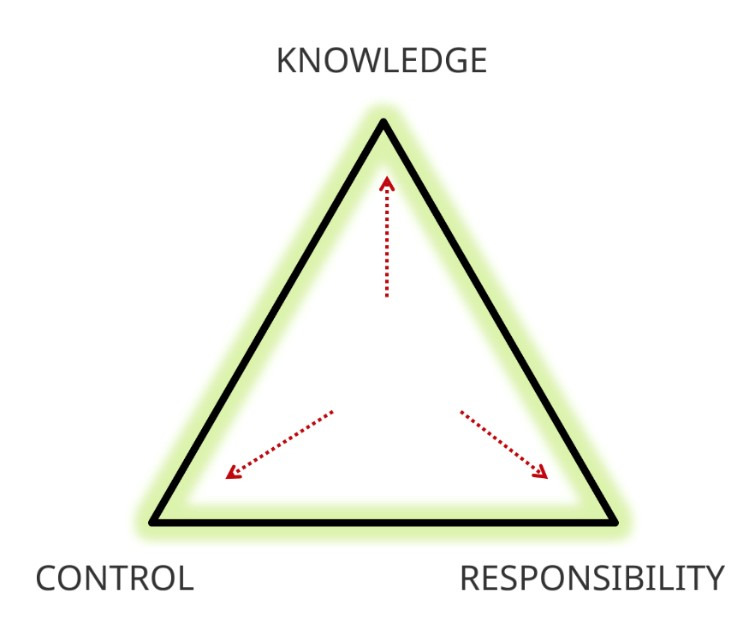

There is a law called The KRC Triangle (short for «Knowledge-Responsibility-Control») that provides an amazingly simple and precise description of how to raise employees’ level of responsibility. This law was described by L. Ron Hubbard in his articles on management. The idea is that the three elements are connected to each other as if forming a triangle, and an increase in any one of the elements will cause an increase of the two others; a decrease or absence of any one element will negatively impact the other two. Please note that «control» in this triangle refers to one’s ability to control an object. For example, if a person is able to get on a bicycle, ride a certain distance, and then successfully stop, he is able to control the bicycle.

A person could also fall off the bicycle and hurt his knee, i.e. the «control» element in his KRC triangle in regards to the bicycle is lacking. Since all three points are interconnected, he will have a low level of responsibility in regards to the bicycle, because he is not able to affect the bicycle as much as he needs. And, most likely, he won’t have the knowledge of how to ride this bicycle. When we teach a child to ride a bike, we first explain to him what he needs to do, or he will acquire this knowledge by simply observing how other people do it. This is the K (knowledge) going up. Then he attains a certain level confidence that he will be able to control it. This is the R (responsibility) going up. He attempts to control the bicycle, and if we help him and hold him on it, he will find his balance on his own — the C (control). Successfully controlling the bike increases confidence, so responsibility goes up. Once he’s learned how to ride in a straight line, he will start asking about how to turn. Bit by bit, increasing one element after the other, his whole KRC triangle will go up. But if you try to get him to be a responsible bike rider without giving him knowledge on how he can control the bike and how he’s supposed to act on the road, or if you try to increase his responsibility level by riding him around on the bike yourself (controlling the bike yourself), you will achieve nothing but failure. In order to succeed, you need all three elements.

The same thing happens to managers — they start encountering problems with responsibility if they don’t have control over the areas assigned to them. They cannot manage resources to achieve results. As described in the example above, if a marketing head doesn’t have a way to ensure payment for the designer or advertising in mass media, he will not be able to be responsible for the results. Moreover, if he doesn’t have a simple and clear method to get marketing expenses approved and he doesn’t know what kind of money he can use in his job, his responsibility level will go down. From the perspective of the KRC triangle, when working in an organization, a manager has to know what kind of resources he can count on in the first place. He has to have a way to «control» the right to manage marketing expenses. Only given this condition will be able to connect the results of his control to the results he is achieving and gain more confidence in his ability to benefit the company by creating a flow of customers contacting the sales department or simply walking into the shop.

Therefore, we could say that involving division heads in the financial management processes is necessary in order to, first of foremost, ensure that money is being used rationally and, second of all, to get the managers to take responsibility for the results they achieve.

If we take the company hierarchy and descend to the level of a simple employee, we will see the exact same thing. To even allow a simple employee to perform his duties, he will also need a means to earn money for everything he needs. In company management, one very often encounters companies that lose out on quite a lot of money simply because one of the lower-level employees doesn’t have enough resources.

«For want of a nail the shoe was lost, For want of a shoe the horse was lost, For want of a horse the rider was lost, For want of a rider the battle was lost, For want of a battle the kingdom was lost, And all for the want of horseshoe nail.» — Samuil Marshak

I am sure you’ve seen an expensive piece of equipment break down only because a spare part wasn’t purchased on time, or you’ve seen a huge project fail just because one small bill remained unpaid. There was a situation when, in the thick of a marketing campaign, one of a company’s websites was shut off on account of too much traffic — all because an employee wasn’t able to get the internet bill paid. Can you imagine that? They spent tons of money and time to launch this internet campaign, and the site simply went offline because they company had to switch to a bigger plan, but that wasn’t done on time. The employee simply didn’t know how to get the bill paid quickly. There’s no one to blame in that situation since the manager was approving every bill himself and, naturally, he had more important things to do than to approve the payment of a small bill from the internet provider.

To ensure that this doesn’t happen, a financial management system must provide each employee with a way to get important expenses paid regardless of their level in the company hierarchy and the amount of the bill. In the next chapters, we will give you a detailed description of how exactly this should be organized in a company.

In conjunction with all of the above, the subject of the gross company profit deserves special attention. Obviously, gross profit is the result of teamwork among the heads of all the divisions. Its amount depends both on how good the Department of Routing and Personnel is at hiring competent employees, and on the manufacturing or supply workers. These people’s abilities will influence the amount of the expenses. First and foremost, gross profit is influenced by the managers in charge of marketing and sales. However, a common situation in business is when none of the managers except for the CEO consider themselves responsible for the gross profit amount! The managers tend to have their heads in the clouds in regards to the total gross profit the company has to generate in order to pay for all current expenses and expand. Naturally, this shows us that these managers are completely irresponsible when it comes to the total gross profit.

A manufacturing worker who fails to follow the production plan for client orders, may sadly shake his head. An HR department may justify it blaming the lack of suitable specialists that could be hired. Even a Sales Department may complain of low demand. At the same time, the CEO struggles to explain to the division heads the amount of gross income the company needs compared to the expenses to generate a gross profit high enough to maintain operations. But even when the results are so low that the gross profit is obviously insufficient for everything, the heads of the divisions, without any second thought, demand their salaries be paid on time, and that all the expenses are paid for their divisions. They don’t even consider where this money needs to come from. The most amazing thing is that most of them, deep down, believe that the company has enough income to secure operations. When encountering such an attitude, the company CEO simply feels betrayed. He feels that the division heads are not willing to take on any responsibility for the profits. Sound familiar?

If you look at this situation from the perspective of the KRC triangle, you can easily see why this goes on. The thing here is that usually the financial «knowledge» of division heads in is limited — they only know the size of the gross income. The amount of income is discussed at meetings, it is planned, people get rewarded for it, or they are penalized. At the same time, managers usually don’t have a clear idea of the size of the expenses. Their «knowledge» is limited. The amount of expenses is only known to people who are directly dealing with financial management. This is why, if you wake a CEO up in the middle of the night and ask him how much the company has to pay for rent or how much the total payroll is, he can easily answer that question half asleep. The CEO and managers have different concepts of what the gross profit the company needs to generate is. If you were to survey the managers of a small company and ask them what in their opinion is the minimum amount of gross profit the company needs, the answers you’d get would be far lower than the correct amount. There is something really scary about that, because it means that only the CEO is working on fulfilling the gross profit plan, while the others are just watching him.

Let’s look at the next element, control, in regards to gross profit. Usually, the division heads have very limited control over the gross profit. A Sales Department manager may control the gross income by ensuring sales, but he is cut off from control over the allocation of gross profit because he doesn’t make any decisions on how the money should be spent. The head of the Division of Production usually only has a way to control the portion of the expenses related to his area but cannot influence other expenses. You could definitely say that none of the managers has any way of controlling the overall gross profit amount. The amount, in which the «K» and «C» are present, will determine the amount of the managers’ responsibility in regards to the gross profit. And the amount, in which first two elements are cut off, will be the exact amount, in which the «R» is the responsibility of managers in regards to the gross profit — may exist.

Here is the ideal scenario: all the divisions heads know the exact amount of the gross income but also know the exact amount of company expenses, because they are directly involved in the process of allocating the company’s income. Only in this scenario will they be able to develop a responsible attitude towards the state of the company’s finances. Moreover, the money will be used much more efficiently, and the company CEO will be able to escape beyond hands-on financial management. Naturally, to ensure that such a system works, you have to lay down the rules for money allocation and methods of control. In the following chapters, we will talk about these points and the way they are supposed to work.

When this approach was put into practice in my manufacturing company, it only took a couple of months for the division heads to completely change their attitude toward income. At that time, I was one of the co-owners and the company CEO. In carrying out my duties, I spent a long time, to no avail, trying to get my head of the Division of Production to come up with ideas on how to increase the amount of production. He would only give me reasons why it could not be increased any higher. But after this manager had participated for six weeks in a row in council meetings, the purpose of which was financial planning and money allocation, he increased the amount of production by 20%. After another few weeks, he came up with a proposal on how small investments to improve equipment would allow us to increase our weekly production by another 40%. The only thing that changed during this time was his knowledge of the actual financial state of the company and his participation in money control. His level of responsibility went up, and his attitude changed completely. Similar changes occurred with other managers as well. As a result, I now had managers of a completely different level, and it helped the company soar to new heights of expansion.

A company’s success depends on the coordinated effort of the entire team. You can ensure such cooperation only if the team members have access to resources, including the monetary resources of the company. Furthermore, the closer the employee is to the area of operations, the more sanely he can manage the money. Naturally, with this approach, you need to ensure that the money is spent rationally in accordance with the priorities, and you need to maintain strict control to ensure security. In this book, we will talk about a financial management system that encompasses all elements, not just one magic rule to solve all a company’s problems. However, team members’ participation is an important element of such a system.

CHAPTER 3

SEPARATION OF ACCOUNTS AND CONTROL

I am sure you’ve noticed that there’s no limit to the amount of money a person is able to spend. Most people spend all the money they get their hands on, and thanks to the «concern» of the credit card companies, they are able to spend much more than they actually have. The same happens in any organization — the need for money is usually higher than the amount of money available. For instance, if you send your kid to the grocery store for a gallon of milk, and if you don’t want him to spend the change on something silly, you will give him the exact amount of money for a gallon. That’s how you get exactly what you want and will end up with a carton of milk. A good housewife, even with a low income, will handle all the expenses the same way. Once she receives the money, she will thoughtfully allocate it and place it in different envelopes that each have their own purpose. So, if a certain amount of money is allocated for food and the amount is set, then this is exactly the amount that she is going to spend to buy food.

Organizations should employ a similar tactic. If you want a certain amount of money to be spent purchasing equipment, you simply set this amount aside and follow the rule: «We spend based on a plan and not a penny more». Don’t give a person more money than necessary and the person in charge of this purchase will not spend a cent more. Amazingly, he will normally spend the entire amount you’ve given him — to the last cent. With this concept, we can formulate one of the most basic financial management rules: a person should only be given the money that has been assigned a purpose.

We can also confidently say that an organization will try to spend all the money it receives. My experience in founding new businesses shows that most start-ups start to generate money only when the investor stops financing the project. At this point, the company will either start making money or sink to the bottom. «An organization, whether Standard Oil or any other, will always spend all it makes and try to spend more,» — L. Ron Hubbard. It is amazing, but even though I know this law as a business owner and an investor, I am completely amazed every time at how a new company’s income starts going up only after it stops receiving financial assistance. The most recent example is a distance learning system we’ve created — Einstein. We invested money into this company for a while, but there was always some little thing that was missing before we could actually launch operations. Eventually, once the company managers realized that they wouldn’t receive any more financing, they started selling and the income started to rise.

Here is further proof of this concept: most companies don’t have any savings. Any sane person understands that one needs to have savings to cover any unexpected and dangerous situations. Who knows what could happen? Someone could file a lawsuit against you, an expensive piece of equipment could break down, something could happen to your property which would endanger company operations, etc. There are insurance companies, but usually you need time and additional expenses to receive compensation to repair the damage. Situations arise where you suddenly need legal consultation or something else. The bigger the company, the higher the risks and, therefore, the bigger the reserves you would need. In the next chapters, we will talk about these reserves, what kind of reserves you need, and how to manage them. While it is quite obvious that a company has to have some kind of reserves, they tend to be non-existent. Companies attempt to create reserves by thinking, «When we have money left over, we will set a portion of it aside for reserves.» This approach almost never works because an organization will generally spend all the money it makes! The one way to create reserves is to ensure that the money intended for savings doesn’t rest in the hands of company managers. If no one gets their hands on the money, they won’t be able to spend it.

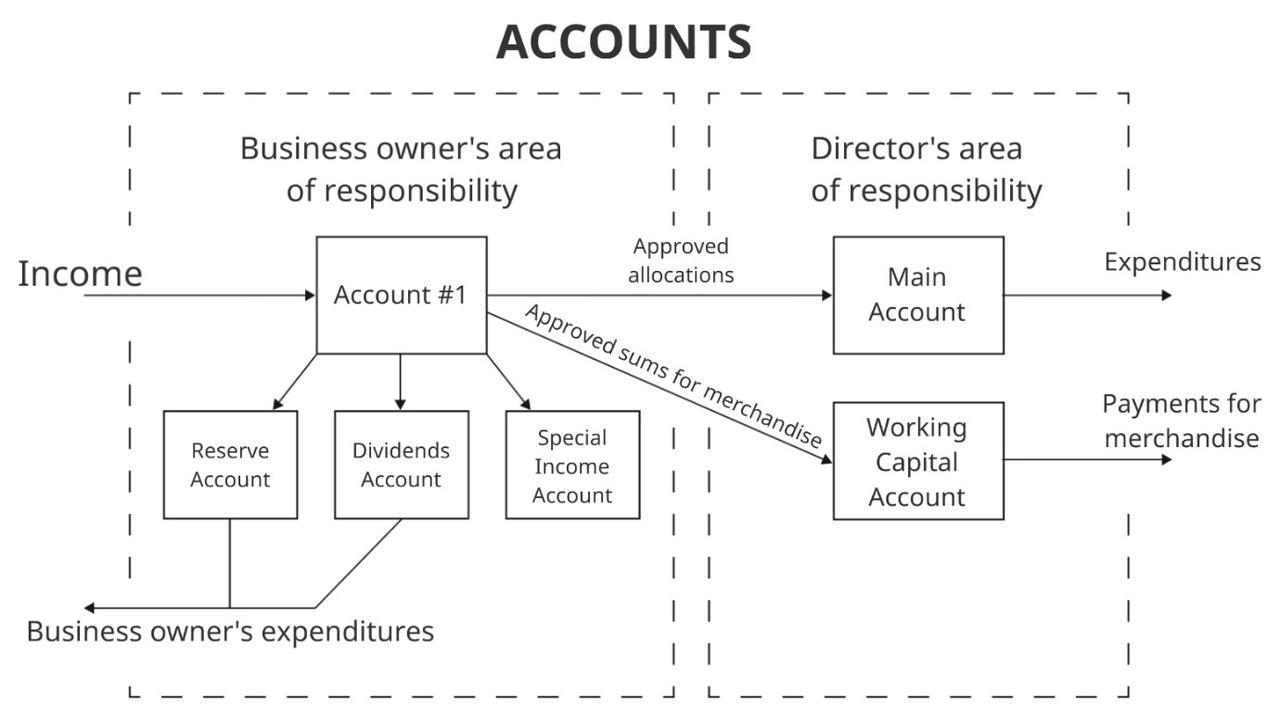

The same goes for working capital. If you allow for the possibility of using working capital for the company’s current needs, this pool of money will become smaller and smaller, and it will for sure affect the company’s income and expansion. The ideal solution would be to physically separate the funds according to their purpose. In his works, L. Ron Hubbard described the principle of «accounts separation”1, according to which an organization needs to have multiple accounts, each one with a specific purpose, and these accounts are to be managed by different people. The transfer of money between these accounts is only to be performed according to strict rules. The following chapters will describe the practical ways in which this principle can be applied in a company’s financial management.

All of a company’s income goes to a single account called «Account No. 1». This account is managed by the Chief Financial Officer in the Office of the Owner. All cash payments received via the company cash registers are deposited into this account only. Only the Office of the Owner can manage this account. You may be thinking, «How are we going to create the first account if there are several legal entities for tax purposes within a single company?» Let’s put off this question for now and first understand how the financial system is supposed to work within the company. At the end of the book, I will explain how you can apply these ideas to a company consisting of multiple legal entities.

To pay all the company’s expenses, another account is used — the Main Account. This account is managed by the CEO. Transactions on this account are carried out by the Division of Finance, which is below the CEO. Every week, a council of company managers prepares a money allocation proposal, and once the CEO has approved this proposal it is verified and approved by the Chief Financial Officer in the Office of the Owner. The CFO transfers the approved amount onto the Main Account and the company uses this money to pay for all approved expenses. Therefore, the CEO only receives the money that he needs to pay for the approved expenses.

It would make sense to create another account in trading and manufacturing companies — a Working Capital Account. Every week, or every few days, a portion of the income must be transferred to the Working Capital Account to be used for goods purchases or the manufacture of materials. It allows one to easily exercise control and ensure that the working capital is used according to its purpose.

Also, every week, certain amounts are transferred from Account No. 1 to the Reserves Account and Dividends Account. These accounts are managed by the Office of the Owner. Dividends are another important matter. The success of a business greatly depends on how well the company owner is doing his job. It is quite odd that the company founder, on whom the strategy, product improvement, and many other things depend, only gets compensated when there is some money left over. It is great when a company expands and its value increases, but most company owners do not intend to sell their companies. Also, owners have needs that need to be met right now. They invest money and energy, and these investments must in return give something back, just as employees’ work is compensated by a wage. If a financial system does not allow for regular compensation of the owner’s work, that is not normal and will create problems. A business owner is like any other person with their own needs, and they need to know how much money they are making. The only proper state of affairs is one in which the owner gets his dividends on the same regular basis as the employees get their salaries.

Sometimes a company will receive a deposit without having the complete confidence that a service or a product will be delivered. Perhaps this money will need to be refunded. For example, sometimes there are payments that arrive without an invoice being issued and there are no contracts signed. In this case, there is no official confirmation that allows one to say what this money is for and, therefore, one cannot predict if the service will be delivered. Or a company may receive a deposit, but still has to make a decision on whether or not it can deliver a service using the resources on hand. When a company receives this kind of payment, the money is transferred in full to a separate account — the Special Income Account. Once a decision is made regarding the ambiguous income, the money is either refunded to the client or transferred to Account No. 1 and treated the same way as any other payments.

For example, let’s take a look at a printing company that prints magazines, leaflets, brochures, and other items. Clients contact the printing house and a specialist provides them a quote for their order. This quote includes the costs of paper and other main materials, as well as the costs of the work of the printing house. Based on this quote, the sales managers create orders and issue invoices to the clients. All payments from clients arrive on Account No. 1. The Chief Financial Officer (Office of the Owner) checks all payments that are received on a daily basis. Based on a calculation of the primary expenses, the CFO transfers the necessary amounts to the Working Capital Account for the purchasing of the main materials. I would like to point out that for many businesses it is not necessary to transfer money into the Working Capital account every day — once a week is fine. But if the printing house uses different types of paper and cardstock, and the suppliers won’t sell the materials on credit, a company will be forced to perform these transfers every day. Due to short manufacturing deadlines, the Supply Department has to work very fast. Please note that only specific amounts of money are transferred to the Working Capital Account to be used for specific types of materials, and it gives one the chance to then control and ensure that money is only being used according to its purpose.

By the end of the accounting week, a certain amount of money is accumulated on Account No. 1, and this amount is distributed between the Main Account, the Reserves Account, and the Dividends Account.

Here’s a general word of advice: the accounting week ideally should not start on Monday, since weekly plans have to be written, approved, and coordinated with the heads of other divisions right at the beginning of the week. The heads have to hold a series of meetings to approve the plans, which takes time. Monday is always an inconvenient day for holding meetings, as the workload on Monday morning is too high as it is. In my companies, the accounting week starts on Wednesday and ends on Tuesday. Therefore, when we talk about income for the week, we mean money that was received on the accounts between Wednesday and the Tuesday of the following week. In this case, it is convenient to evaluate the week’s results on Wednesday morning, coordinate work plans for the next week, review all the funds allocation orders, and then hold the weekly financial planning meeting. On Wednesday afternoon, the money for approved expenses can be transferred onto the Main account. By Thursday, the Division of Finance will be able to start paying the approved purchase orders provided by the employees. Having applied this approach, experience has shown us that the most convenient periods for the accounting week is either from Wednesday to Tuesday or from Thursday to Wednesday.

Thanks to the separation of accounts, the Office of the Owner fully controls the transfer of money without taking responsibility away from the managers. On a weekly basis, the heads work out a money allocation proposal by creating an exact list of orders for all necessary expenses to be paid over the week. The CEO approves this proposal and sends it to the Office of the Owner, where the proposal is either approved or corrected, and only after that the amount of money — exactly the amount of money according to the list of approved orders — is transferred onto the Main Account. The company will not be able to spend more than what was approved, and the Chief Financial Officer in the Office of the Owner will be able to monitor and ensure that this money is used exclusively according to its purpose. Similarly, the Working Capital Account won’t be hard to check at all if the money is spent according to purpose. Therefore, we ensure perfect control.

As an example, one of our client’s companies — a logistics firm — was using «virtual accounts separation». The Chief Accountant at the company was a very good and loyal employee. But due to the fact that the accounts weren’t separated physically, and all the money was stored on one account, he was making mistakes in calculations. As a result, the company was spending a little more money than the amount that should have been stored on the Main Account. When they finally discovered this mistake in calculation, the total amount overspent was already more than half of the reserves the company had accumulated. The company had to spend the majority of its reserves to fix the problem. If the accounts had been separated physically, the company would have been able to spot the mistake in calculation right away, because the balances on the accounts would be different from the calculated amounts.

«If you know how to spend less than you make, you have the philosopher’s stone.» — Benjamin Franklin. Let’s look at the functions of the primary roles in financial management and their areas of responsibility.

The Chief Financial Officer (Office of the Owner) is structured below the executive of the Office of the Owner (usually, this is the company owner) and is constantly monitoring adherence to the financial management rules. He ensures that all company income is received on Account No. 1. Every week, he provides the CEO with information on the income amount for the week as well as the income sources. Once the company managers provide him a money allocation proposal, he verifies it to ensure it complies with the established rules. He has a final word on the amounts that transferred from Account No. 1 onto other accounts. He personally transfers the funds. He also keeps records of the amounts on the accounts pertaining to his area of responsibility (see illustration). He is responsible for ensuring that the company money is allocated to achieve successful operations and expansion. Please note that the Chief Financial Officer does not run the company’s operations, and the CEO is not structured directly under him. The CFO is only responsible for financial management and that it operates free of errors. In small companies, this function is usually performed by the owner himself. In these cases, this function doesn’t take up that much time — only a few hours a week.

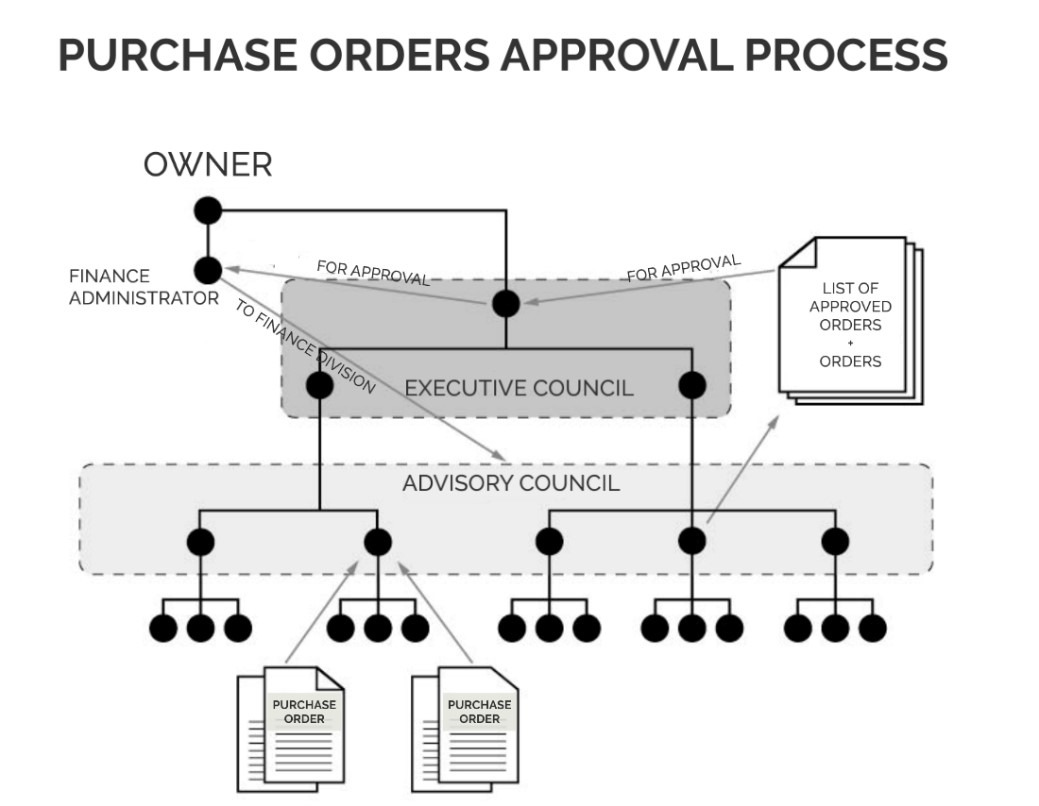

The Council of Executives consists of executives from all the divisions and is responsible for planning company operations and the coordination of all the divisions’ activities. The council meets every week to work out the overall work plan and a money allocation proposal. To do so, the council members bring funds allocation orders for everything they need to carry out their work. The council compares the needs of the different divisions with the operations priorities and the amount of money available. The operations plans and the list of orders are first approved by the company CEO. Then they’re sent to the Chief Financial Officer for final approval.

The Head of the company’s Division of Finance is responsible for the operations of his division, for managerial and bookkeeping accounting, and for the preparation of all documents necessary for financial planning (in a separate chapter, we will talk about his area of responsibility and functions in greater detail). Once a money allocation proposal is approved, he is responsible for properly paying for all the approved expenses and ensuring that money is used precisely according to the purposes for which it was allocated.

These are just brief descriptions of these functions, and each one will be described in greater detail in the following chapters. I have provided these descriptions to you here only to give you an idea of how the accounts separation system generally works. Naturally, the use of such a system becomes complicated if a company consists of only a few legal entities cooperating with each other, for example, to lower taxes or for some other reason. In this case, each legal entity will have to open multiple accounts, and this will drastically increase the workload of the CFO and the employees of the Division of Finance. But even in this case, it makes sense to do so, because only a physical separation of accounts will allow you to have a high level of control over your finances.

If the accounts cannot be separated physically for whatever reason, you can still use this approach to managing money. Only instead of real separate accounts, you would use funds where all the money is stored together in one or multiple accounts. However, as a disclaimer, if you use a «virtual» accounts separation system, it will be much harder to manage the money and you will have more mistakes that will need to be fixed. We’ve observed companies that have implemented an accounts separation system and organized financial management as described above, and these companies are much more successful at managing money.

Many business owners, sooner or later, will want to delegate operational planning to a hired executive. One of the barriers is the fear that the CEO may fail at managing finances. The accounts separation system allows you to delegate management to the CEO, while maintaining sufficient control over finances. If money is allocated weekly, it is almost impossible to make a mistake that would create big problems for the company, because any serious financial problems are the result of many recurring mistakes. Even if the council of executives and the CEO somehow manage to make a huge mistake — for example, waste a lot of money that entered on the Main Account — it will not cause the company to crash. Moreover, you will discover such a problem very quickly. You could say that accounts separation is an important step in delegating operational management.

Recently I spoke to one of our clients, a co-owner of the renowned company «Pokroff», consisting of six factories manufacturing roofing materials. Pokroff is a very successful company that recently celebrated its 16th anniversary, and their financial management has always been very well organized. A few months ago, they reorganized their financial management system by separating their accounts as described above. They have never had such a sound, simple, and effective system for controlling money on their co-owners’ accounts before. Thanks to accounts separation, they immediately discovered a number of mistakes that were previously costing the company quite a lot of money.

So, all the money the company receives only arrives on Account No. 1 and then is distributed between the: • Reserves Account: the Office of the Owner’s monetary reserves. • Dividends Account: the owners’ dividends. • Special Income Account: money, which you don’t yet know how to allocate and which perhaps will need to be taken back out. • Main Account: money used to pay for all the company’s needs. • Working Capital Account: money for purchasing goods or main materials.

To get this system to work, you will need to describe the rules according to which it is supposed to work and create job descriptions for the different managers. This book will help you do that. This chapter only details the general idea of such a system. Later on, we will take a more in-depth look at managers’ duties and the rules that you will need to implement in the company, as well as recommendations regarding the implementation process. Reorganization of financial management in a company will require a certain amount of effort. You will need to ensure that all managers understand how it is supposed to work. But the result is worth going all the way.

CHAPTER 4

EXPENSE APPROVAL PROCEDURE

Let’s look at the document flow during the process of expense approval in a company. This chart is only a general description of the mechanics of how money is allocated and it won’t ensure the effective use of money without establishing the correct allocation priorities. We will talk more about that in the following chapters. However, first we need to understand the procedure for approving expenses, which is a part of a company’s financial management system. If, in the study of this chapter, you find it hard to imagine it in practice, I recommend drawing an outline of the process. It will help you understand the material better.

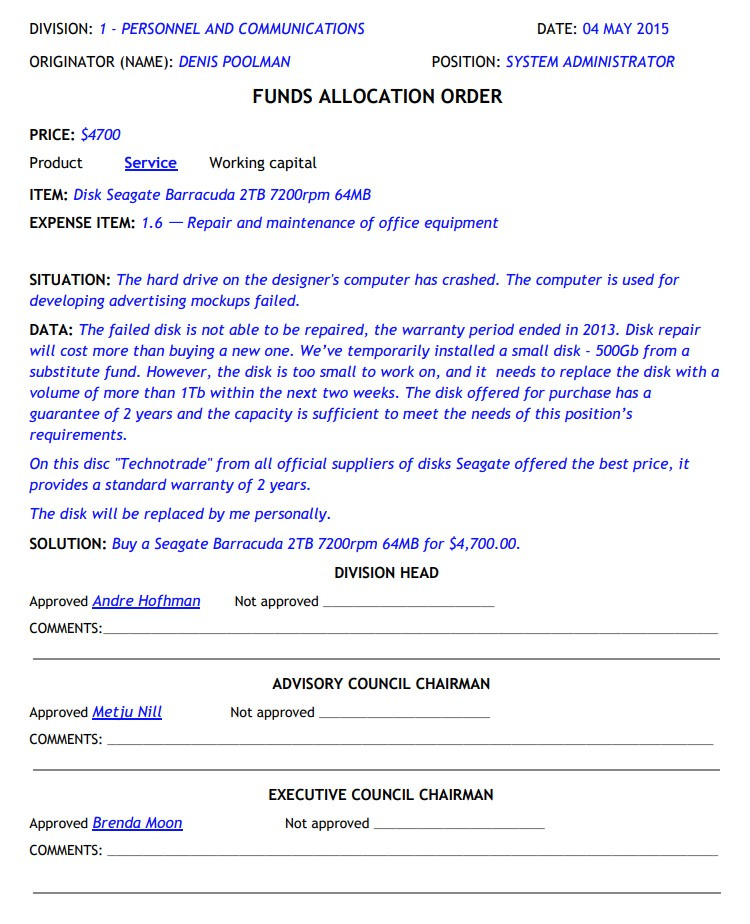

The main document used for the procedure of approving company expenses is a funds allocation order. It is written and submitted by an employee overseeing a particular area of operations. For example, a company has a system administrator in charge of the error-free operation of all computers, networks, and printers. His job responsibilities entail receiving equipment maintenance or new equipment requests from other employees and complying with these requests. To do so, he must buy equipment, tools, parts, and expendable materials. When a company hires a new employee, the administrator must equip his workplace according to the established standards. To do so, he must buy a computer and other additional devices. Furthermore, the system administrator is usually in charge of the functionality of websites, regularly paying for Internet providers’ services, etc.

To perform his job properly, this employee must have a way to buy new tools, materials, parts, computers, and certain types of services. A portion of these purchases is related to maintenance, another part is related to expansion, and different purchases are prioritized differently. Some of them may be postponed for a certain time, while others are urgent. As we saw in Chapter 2, the system administrator will always have the most specific idea of the priorities in his area, because he is the specialist working in that area.

To get what he needs to do his job, the employee must write an order using a standard form for each separate purchase. This order is then given to his direct superior for approval, then it is approved along with the other orders for the week by the Chief Financial Officer (CFO) at the weekly council meeting of executives, where it receives final approval. After that, the set of approved orders will arrive at the Division of Finance, which means that money for these orders has been allocated. After that, the employee has to provide the Division of Finance with an invoice or a contract, based on which a payment can be completed and the purchase can be made. Funds allocation orders that weren’t approved are sent back to the originators — in the following chapter we discuss exactly how that happens.

The fact that the employee has to submit orders for everything he needs will greatly influence his performance and force him to take more responsibility for the results. For instance, the system administrator will no longer be able to justify regular network failures with a broken network cable as his superior will immediately ask him if he submitted a funds allocation order to purchase a new cable. I see it quite often: irresponsible employees justify their own poor performance results by claiming a lack of resources. But when you take a closer look, you find out that they never requested these resources to be purchased! Proper use of the funds allocation orders returns to employees their sense of responsibility, which previously, for whatever strange reason, was resting wholly on the shoulders of managers. Naturally, the funds allocation order itself doesn’t guarantee that money will definitely be allocated for the purchase. However, given the absence of an order, the purchase will definitely not take place.

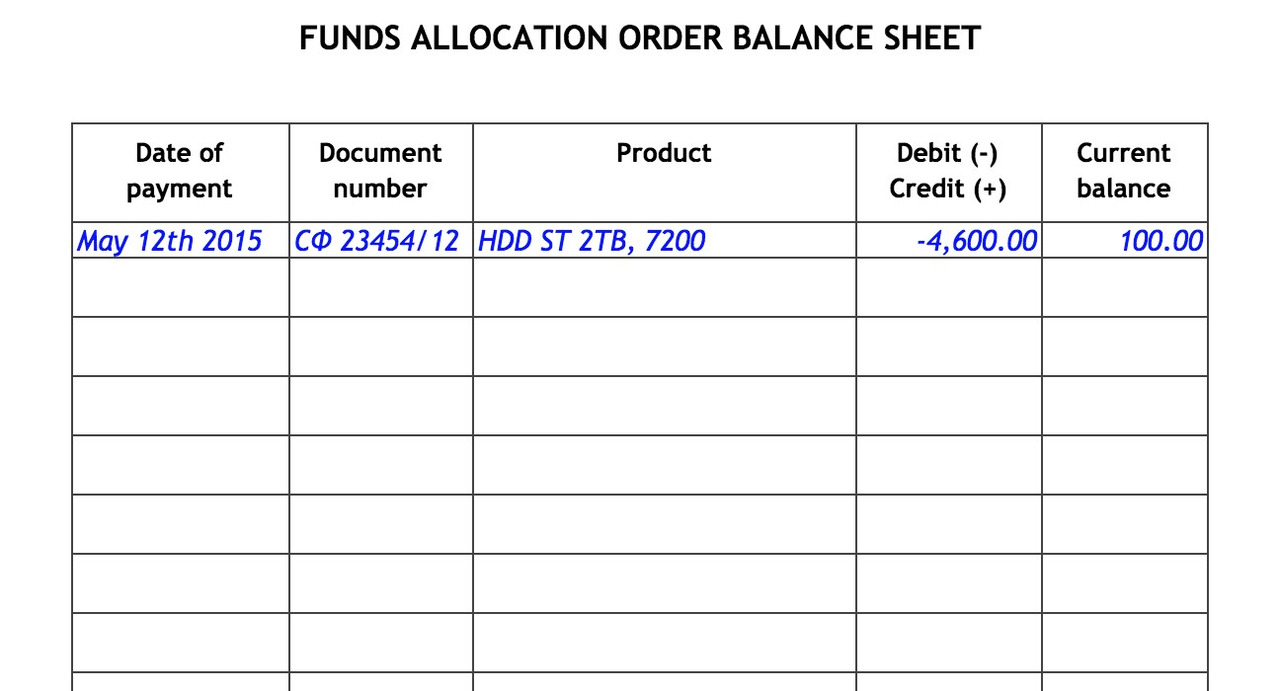

An important point is that the order must be written in such a way so as to avoid prompting any additional clarifications. It must contain all the information required for approval. During the approval process, it will be reviewed by various managers, and if the order doesn’t contain all the information required, they will have to waste time at each stage of approval to get answers to the questions specifying the details. For example, suppose a new computer has to be purchased, but the order only contains the brand and the price. During the process of approving this order, each manager will have tons of questions: «For whom is the computer? Why this exact model with these exact specifications? How will it affect the performance results?» If an order doesn’t contain all the required information, managers may waste a remarkable amount of time approving it, and the speed of the process will be nearly zero. Let’s take a look at a funds allocation order form which has proven to be successful and that is used, with minor adjustments, by many companies. Below you will find a brief description of each field and its purpose.

To get what he needs to do his job, the employee must write an order using a standard form for each separate purchase. This order is then given to his direct superior for approval, then it is approved along with the other orders for the week by the Chief Financial Officer (CFO) at the weekly council meeting of executives, where it receives final approval. After that, the set of approved orders will arrive at the Division of Finance, which means that money for these orders has been allocated. After that, the employee has to provide the Division of Finance with an invoice or a contract, based on which a payment can be completed and the purchase can be made. Funds allocation orders that weren’t approved are sent back to the originators — in the following chapter we discuss exactly how that happens.

The fact that the employee has to submit orders for everything he needs will greatly influence his performance and force him to take more responsibility for the results. For instance, the system administrator will no longer be able to justify regular network failures with a broken network cable as his superior will immediately ask him if he submitted a funds allocation order to purchase a new cable. I see it quite often: irresponsible employees justify their own poor performance results by claiming a lack of resources. But when you take a closer look, you find out that they never requested these resources to be purchased! Proper use of the funds allocation orders returns to employees their sense of responsibility, which previously, for whatever strange reason, was resting wholly on the shoulders of managers. Naturally, the funds allocation order itself doesn’t guarantee that money will definitely be allocated for the purchase. However, given the absence of an order, the purchase will definitely not take place.

An important point is that the order must be written in such a way so as to avoid prompting any additional clarifications. It must contain all the information required for approval. During the approval process, it will be reviewed by various managers, and if the order doesn’t contain all the information required, they will have to waste time at each stage of approval to get answers to the questions specifying the details. For example, suppose a new computer has to be purchased, but the order only contains the brand and the price. During the process of approving this order, each manager will have tons of questions: «For whom is the computer? Why this exact model with these exact specifications? How will it affect the performance results?» If an order doesn’t contain all the required information, managers may waste a remarkable amount of time approving it, and the speed of the process will be nearly zero.

Let’s take a look at a funds allocation order form which has proven to be successful and that is used, with minor adjustments, by many companies. Below you will find a brief description of each field and its purpose.

Division: name and/or number of the division of the employee who originated the order. Approved orders, for which money has been allocated, will eventually arrive at the Division of Finance and the employee will be notified that a certain amount of money has been allocated for his purchase and that he needs to submit an invoice or a purchase contract.

Date: the date the order was written. Some orders may be originally declined on one week, because their priority level isn’t high enough in relation to the operations plans. But the order may be submitted again and approved on another week. In addition, sometimes a few orders may be submitted for the same expense article. The date is important so that one can distinguish between the orders. For example, rent is usually paid once a month, but to ensure that there is enough money on the Main Account by the time the rent is due, the employee in charge of paying the rent must submit orders for a certain portion of necessary amount every week. As a result, you will have multiple approved orders for the same expense article and different amounts. The date of the order will allow you to easily see what which order is for.

Originator: the position and name of the employee who has written the order. This information is necessary, at the very least, to ensure that the Division of Finance knows who has to be notified once the order is approved and who, therefore, must submit an invoice or a contract for payment.

Price: the amount requested in the order. Even though this amount is written at the bottom, it is also written within the information providing the reasoning for the decision to be made. It is also written at the top of the order, so it is easy to quickly find the amount at a glance when looking through the orders.

Expense article: an exact expense article, if such an article exists. For example, most companies have an expense article called «Marketing expenses». These are all expenses for the purposes of attracting new clients and disseminating company products. If an expense article is not clearly written out, the managers and financial employees will have a hard time understanding what type of expenses the order is for. For example, if an order requests payment for the services of an electrician, it would be difficult to understand that this order is related to repair of the company signage and must be included with the marketing expenses.

Product/service: the name of the product/service to be purchased.

Situation: a brief description of the problem the employee is attempting to solve through this purchase or the reason why the item needs to be purchased. A description of the situation is a very important part of the order. When employees are just starting out writing orders, some of them are just starting to think about the purpose of a purchase for the first time in their lives.

Information: this is where the information goes based on which the employee made the decision that this purchase was necessary in the first place. This is where he must answer any and all questions that may arise during the approval process. In essence, this field contains evidence proving that the above situation can be resolved only by purchasing this exact item or service and with these exact conditions. On some orders, information is very brief. For example, if this is an order for paying the rent for the month, it would be enough to just list the total amount for the rent, the date of the next rent payment, and how much money has already been allocated for this payment. In other cases, when there are additional purchase options, the employee has to provide a lot more data.

Quite often we hear the following objections from employees: «Why should I even write it? Isn’t it clear already? Why should I spend my salaried time on this when it’s not what I was hired to do?» Truly, from the viewpoint of a person «in the thick of things», the situation may appear quite obvious. But if you look at it from managers’ perspective, who have to review dozens of orders every week and have to decide which of them are more important than the others, the situation may not be quite so obvious. Of course, when you look at an order for utility payments, it is obvious that it has to be paid. But still, there are questions about how much money has already been allocated for this expense article and when exactly the bill has to be paid.

Solution: full description where the originator writes what needs to be purchased, for what price, and from which supplier.

When an employee personally fills out the «situation», «information», and «solution» fields, it has a virtually magical effect on his level of responsibility. He personally has to think about benefits of the purchase and has to come up with convincing information to support the solution he is proposing.

Please note that if a company doesn’t use funds allocation orders and there is no system for approving them, employees will still ask their managers to approve any purchases they need to make. But in that case, they are doing it verbally and just to inform the manager that something has to be bought. It leads to a portion of such requests becoming forgotten, since the managers have so many things to do, and a portion of requests has to be discussed verbally over and over during the approval process. As a result, a lot more work hours are wasted and forgotten important purchases create big problems for the company’s operations. The proper state of affairs is one where an employee comes to his superior with a verbal request and the manager tells him, «Okay, write a funds allocation order and I will present it to the council.»

You will see the most amazing thing happen: sometimes an employee will go to write an order and never submit it, because while writing the order he realizes that his request is not important for carrying out operations. He has to describe the precise situation as well as provide the information and in doing so, he realizes that this purchase is not the solution or that there is another way to resolve the problem without spending money. Naturally, it may happen that an employee irresponsibly fails to write an order and lets the situation run its course, and when the lack of necessary resources creates major problems for the company and becomes obvious, the employee will try to shift the responsibility to the manager, saying, «I told you we needed to…» The only way to prevent these situations is to make sure that the manager gets his subordinates to plan out their work and submit all necessary orders. In the following chapters, I will explain what needs to be done to achieve this.

Written orders feature another huge advantage pertaining to the field of interpersonal relations. Paper documents are unemotional and objective; one can easily review them and make a logical decision quickly; it is impossible to emotionally influence a person through a written order. When employees verbally discuss purchases with their superiors, it takes much more time. During the approval process, the order must first be approved by the head of the Division, then pass through the council of executives, then get approved by the CEO, and, eventually, receive a final review and approval from the Chief Financial Officer. If each of the orders is discussed verbally, people will inefficiently waste a large amount of time. And managers’ time is much more expensive that the work hours of regular employees. So, even though this approach renders the life of an employee harder, it will yield substantial savings for the company as a whole.

Division head: a field where the head of the Division must place his signature on one of the lines — either the «approved» line or the «not approved» line. If the manager declines the order, he also must provide the reason the order was declined in the «comments» field. In this case, the head of the division simply returns the order to the originator for correction. This happens quite often, especially while employees are just starting out using these order forms. In the very beginning, you will see a lot of orders missing the necessary information or even a description of the situation or the solution. Since the division head approves orders directly during the weekly coordination meeting with his subordinates, they have the chance to quickly correct or complete the order and get it approved. Approved orders are presented to the weekly council of executives by the division head.

Council chairman: a field where the chairman of the Advisory council of managers records whether or not the order was approved by the council. This note means that the order was reviewed by the council and this purchase is necessary for the plans’ successful implementation. If the order is not accepted for any reason, the chairman places his signature on the «not approved» line and uses the «comments» section to state the reason. In this case, the order is returned to the division head.

CEO: this is the field where the company CEO states whether or not the order was approved. This is done at the Executive council meeting attended by the vice presidents. This is the council that is responsible for financial planning and ensuring that approved expenses are aimed at increasing income and expanding the company.