Бесплатный фрагмент - There is always money!

Boost your financial intelligence!

Introduction. How does your financial intelligence actually work?

Curiously, financial intelligence, which is the subject of so much fuss when it comes to money, is really just one facet of your powerful intelligence. That is, it does not exist apart from other types of intelligence. Accordingly, in order to understand how financial intelligence works, you need to understand how intelligence works in general.

What is intelligence in general?

Intelligence is the ability to solve various life tasks, find a way out of difficult situations and achieve the desired results. Moreover, the results achieved always correspond to the level of development of one or another facet of your intelligence. Good health and athletic performance are indicative of high bodily intelligence. Success in career and communication speaks for high emotional intelligence. Family happiness and charismatic attractiveness speak of high sexual intelligence. And financial success and an abundance of free time speak volumes about high financial intelligence.

Achievements in one area of life do not automatically lead to achievements in other areas of life. However, there are always certain chains of sequences and patterns, when one facet of intelligence strengthens another, connected with it, and contributes to success in related areas. For example, learning success (cognitive intelligence) strengthens analytical and creative intelligence, while creative success in turn strengthens speech and cognitive intelligence.

Perception, thinking, memory, attention, imagination, planning, speech and actions are the main tools of the intellect, with the help of which it, in fact, solves the tasks before you. The way you relate to certain situations, what you think, what you remember, what you pay attention to, what you dream about, what you plan, what you talk about and how you act — all this does not just characterize you as a person, but is a reflection your intelligence. The higher it is, the easier, faster and more correctly you solve certain life tasks.

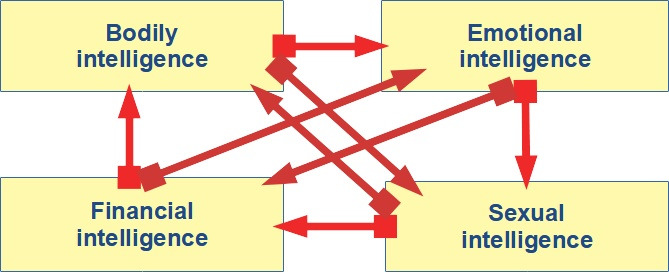

How are things going with financial intelligence? Financial intelligence is the ability to solve various monetary issues and achieve the desired results in the field of money. At the same time, financial intelligence is born at the junction of the interaction of emotional and sexual intelligence, which, in turn, are based on bodily intelligence:

We will not touch upon bodily, emotional and sexual intelligence in this book. This is a topic for a separate book. We will only touch on financial intelligence. But keep in mind that it does not function by itself, but in active interaction with other parts of the intellect.

At the same time, financial intelligence is a skill that lends itself to training and can be easily measured by key indicators (cost of an hour of time, rate of monthly income, delta size and total asset value). By and large, training financial intelligence includes changing attitudes towards money, raising financial expectations (financial thermostat, financial goals, financial plan), transforming thinking strategies and pumping skills that are responsible for growth in key indicators (for example, systemic decision-making skill in uncertainty or systemic problem solving skill).

Financial intelligence is based on a financial program and a financial scenario based on a certain attitude towards money and financial expectations. Financial expectations can be completely different, and the attitude towards money can be negative, conditionally negative, neutral or positive. The financial scenario can be negative (financial dependence scenario), positive (financial security scenario), natural (financial independence scenario), and absolute (financial freedom scenario). Financial programs also four: this is a bankruptcy program (when a person spends more than he earns and lives in debt), a poverty program (when a person spends everything that he earns), a delayed poverty program (when a person spends everything that he earns, but not immediately) and a program wealth (when a person sets aside part of their income and creates investment capital).

At the same time, financial intelligence has the same 8 tools at its disposal as intelligence in general. It is with their help that he solves all the financial problems facing you. So ask yourself:

— perception: how do I react to life circumstances? Is it aggressive or calm? Do I avoid or overcome difficulties?

— thinking: what do I think about money? How do I think about money and opportunities — positively or negatively?

— memory: what do I know about money? What is my memory clogged with?

— attention: what am I focusing on? Is it abundance or scarcity? Is there enough money in my reality or not enough?

— imagination: what am I dreaming about? What picture in my imagination about money am I painting?

— planning: what am I planning? What’s my enrichment plan? How do I plan to manage my time and money?

— speech: what am I talking about money? Who and what do I communicate with?

— actions: what am I doing to increase my value to society and earn more?

In addition to these tools, financial intelligence has 16 main markers by which you can track its development :

After looking closely at this table, you will immediately understand a lot. If you have a negative attitude towards core values, this will prevent you from attracting good money into your life and keeping it. If a poverty program is running in your head, it will prevent you from living the life of your dreams. If the cost of an hour of your time is below the norm, if you have no assets, if you invest money and time in the wrong things that rich and successful people invest in, what do you want? How can money come into your life?

Train your thinking! Upgrade your financial intelligence! How? To get started, print a Pivot Table with 16 financial intelligence markers and hang it up in a prominent place to remind yourself of the most important things in your life! Use this chart to improve your life! And don’t stop there! Go on and on! Learn everything about money, financial intelligence, financial literacy and mindset transformation! In this book, you will find a number of practices that will help you pump your financial intelligence and reach new levels of income.

Fear nothing! You will definitely succeed! Your rich brain is sure to win the battle against the poor brain if you side with it! The main thing is never, never, never give up! Change your attitude towards money, set ambitious financial goals, overcome difficulties, increase the value of your hour, increase the total value of your assets, and never stop learning! If you are serious, then you will definitely succeed!

P.S. Initially, the book was written in Russian and only after that it was translated into English. Due to the specific differences between Russian and English, the author could allow minor inaccuracies in the translation. Do not judge strictly, for the English language for the author is not native. If possible, treat indulgently with possible mistakes and wrong words in the text. Remember that only those who do nothing do not make mistakes! Try to understand the essence of what the author wanted to say. Then you will get the most benefit from reading this book.

Lesson number 1. Cost per hour

Theory

Time is the most important and invaluable resource that cannot be bought, stopped, extended or prepared for future use. It just flows, but a lot depends on the efficiency of its use, both in work, and in creativity, and in business, and in relationships.

Therefore, it is important to immediately understand how much your time is worth. And then — to understand how to dispose of them wisely.

The cost of an hour of your time is one of the main indicators of the level of development of your financial intelligence (other key indicators of the level of development of financial intelligence are the scale of financial goals, delta size, and total cost of capital). The higher your financial intelligence, the higher the cost per hour of your time (as well as the scale of financial goals, delta size and total cost of capital).

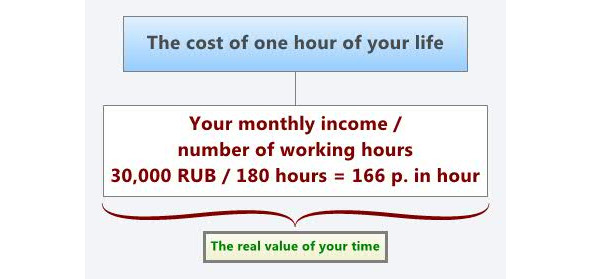

To determine how much one hour of your life is really worth, take your monthly income and divide it by the number of hours you spend working. If you work for an employee in a government organization, then this is usually the standard 170—180 hours per month (provided that you live close to work and do not spend a lot of time traveling). If you work in a commercial structure or build your own business and devote more than 8 hours a day to work, then add the required number of hours to the standard working time, and then add to this amount the time you spend on the road to work and home, and then calculate the real cost of your time using the formula:

monthly income / working hours per month = the real cost of an hour in your life

Let’s say 30,000 rubles. / 180 hours = 166 p. in hour. Or 100,000 rubles. / 80 hours = 1250 p. in hour.

Practice

Calculate the cost per hour of your working time using the formula above.

If you are a wage earner, take your monthly income and divide it by the number of hours you spend in a month working and commuting from / to work.

If you are working as a self-employed or sole proprietor, divide the cost of your services by the number of hours you work. If you receive money not for the result, but for the time (for example, you consult or teach with an initial reference to the cost of an hour), then take as a starting point the lowest cost threshold, below which you do not take on work.

If you are an investor (that is, you live on income from capital) or have several sources of income, then calculate the average monthly total income and divide it by the number of hours you spend per month working.

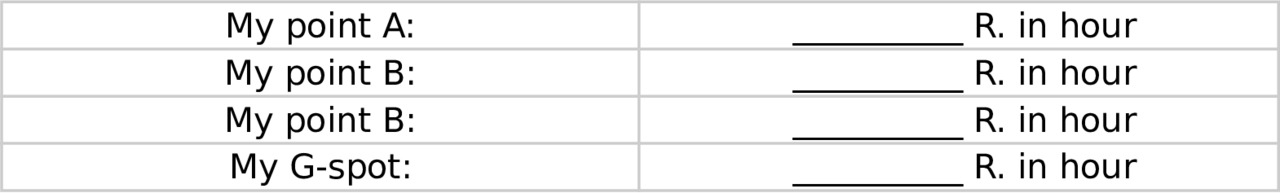

Remember the resulting cost of time. This is your point A (the point where you are right now). Think of what should ideally be a point B (cost of one hour of your time in a year), point B (cost of one hour of your time in 5 years) and point D (cost of one hour of your time in 10 years).

Results

Record the calculation results in the table:

Now that you know the value of your time, you can consciously spend your money shopping. Let’s say if you spend 500 rubles. per book, you understand that this price is equivalent to 3 hours of your work. If you need to buy shoes or a dress for 5,000 rubles, you understand that this price is equivalent to 30 hours of your work or 4 full working days. If you need to buy a sofa or a table for 15,000 rubles, you understand that this price is equivalent to 90 hours of your work, or 11 full working days.

So, when you spend your earned money on goods and services — you are actually spending small chunks of your life! Understanding this, you will not waste money just like that, buying what you do not need. You will begin to analyze not how much a given purchase costs in rubles, but how much it costs in terms of the time of your life. And then you will buy some important things despite the high price in monetary terms, and on the contrary, you will refuse some important things, despite the low price in monetary terms.

Homework

Think about how you could add value to your time. Answer the following questions in writing:

— What am I good at? What exactly do I get money for?

____________________________________________________________________

____________________________________________________________________

____________________________________________________________________

— How can you increase your income by investing less time in your work than you do now?

____________________________________________________________________

____________________________________________________________________

____________________________________________________________________

— What knowledge and skills do I need to acquire so that my value to the employer, determined by the cost of one hour of my work, doubles?

____________________________________________________________________

____________________________________________________________________

____________________________________________________________________

— What can you invest the time freed from «extra work»

____________________________________________________________________

____________________________________________________________________

____________________________________________________________________

Continuing the topic:

Think about how much time is left in your account and how much it should really cost. Write down (in a notebook, in a notebook, in a diary, in your blog) what you learned today and what conclusions you made today:

What new have I learned?

____________________________________________________________________

____________________________________________________________________

____________________________________________________________________

What conclusions have I drawn?

____________________________________________________________________

____________________________________________________________________

____________________________________________________________________

Yes, it must be done in writing! Yes, it must be done! Yes, you need to do it now! Yes, if this is not done in writing and immediately, then it is not done at all. How do you — go to the second lesson.

Lesson number 2. Financial thermostat

Theory

One part of our brain (guess which one!) Works like a thermostat. If the thermostat is set to 22 degrees, then the room temperature will be kept around 22 degrees, whatever it is outside. If the room gets colder or hotter, the thermostat will automatically work and return the temperature to the programmed level. The only way to change the temperature in the room where the thermostat is working is to reprogram the thermostat!

Our brain has a similar internal thermostat. In numerical terms, the financial thermostat is always equal to your average monthly income. If on average you earn 50,000 rubles a month and you are relatively comfortable at the same time, then your financial thermostat is set at exactly 50,000 rubles. This is your norm.

If you have convinced yourself (or allowed other people to convince you) that your norm is 20,000 rubles per month, then your internal thermostat will be set to 20,000 rubles per month. Whatever happens around, you will look for an opportunity to get your 20,000 rubles per month!

If you have convinced yourself that your monthly norm is 100,000 rubles, then your internal thermostat will be set exactly for this amount and will not let you calm down until you fulfill your norm.

The financial thermostat is the image that paints your imagination about what specific level of income you are worthy of. And this very image is at the heart of your financial program. As an accurate reflection of your current income level, the financial thermostat dictates your standard of living. Whatever the amount of your rate, you cannot afford to earn less. You will look for an opportunity to fulfill the quota by all means. And if you accidentally overwork, your internal thermostat will force you to quickly flush out the excess and get you back to normal.

For poor and beggars people, the financial thermostat is limited to the cost of living. Therefore, they avoid risk by any means and save on everything. Rich and wealthy people, on the other hand, set their financial thermostat for exorbitant amounts that frighten ordinary people. The amounts that they imagine in their imaginations are hundreds and thousands of times higher than the amounts that poor and beggars people agree to! Therefore, they are not afraid to take risks and instead of saving, they constantly increase their income.

Бесплатный фрагмент закончился.

Купите книгу, чтобы продолжить чтение.