Бесплатный фрагмент - The Crypto Time Machine

Envisioning the Future of Bitcoin and Cryptocurrencies in 2028

Financial Disclaimer

The information and opinions expressed in «The Crypto Time Machine: A Journey to 2028» (hereinafter referred to as «the Book») are for general informational and educational purposes only and should not be considered as financial, investment, or professional advice. The author and publisher of the Book are not financial advisors, and the content provided herein does not constitute a recommendation to buy, sell, or hold any securities, cryptocurrencies, or other financial instruments.

The Book is not intended to provide personalized investment advice or recommendations, and readers should consult with a qualified financial professional before making any investment decisions. The author and publisher of the Book shall not be held responsible or liable for any losses, damages, or expenses that may arise, directly or indirectly, from the use of or reliance on the information provided in the Book.

The Book may contain forward-looking statements, opinions, and projections regarding the future of cryptocurrencies and the financial markets. These statements are based on the author’s personal beliefs, assumptions, and expectations, and they involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the Book. The author and publisher of the Book do not guarantee the accuracy, completeness, or timeliness of the information provided and shall not be held responsible for any errors or omissions.

The Book may also contain references to third-party websites, products, or services. The inclusion of such references does not imply any endorsement, approval, or recommendation by the author or publisher, and they shall not be held responsible or liable for any content, products, or services available on or through such third-party websites.

By reading the Book, you acknowledge and agree that any investment or financial decision you make is solely at your own risk, and you should not rely on the information provided in the Book as the basis for such decisions. The author and publisher of the Book disclaim any and all liability for any losses, damages, or expenses that may arise from the use of or reliance on the information provided in the Book.

The information provided in the Book is subject to change without notice, and the author and publisher reserve the right to update, modify, or remove any content at any time. The Book is provided «as is» and «as available» without any express or implied warranties, including but not limited to warranties of merchantability, fitness for a particular purpose, or non-infringement.

Dear reader,

We are delighted to welcome you to “The Crypto Time Machine: A Journey to 2028.” As the founders of Pro Blockchain Media Agency, we have had the privilege of witnessing the incredible evolution of the blockchain and cryptocurrency industry over the years. Our passion for this technology and its potential to revolutionize the world has driven us to share our knowledge and insights with others. This book is the culmination of our experiences, research, and vision for the future of this groundbreaking technology.

of the 2018—2019 Bitcoin documentary

The idea for «The Crypto Time Machine» was born out of our desire to explore the potential future of the blockchain and cryptocurrency industry. We wanted to create a comprehensive guide that would not only educate readers on the fundamentals of this technology but also provide a glimpse into the future of the crypto world. Our goal is to inspire readers to imagine the possibilities and prepare for the exciting changes that lie ahead.

In this book, we will take you on a journey through time, exploring the origins of blockchain and cryptocurrency, the challenges and triumphs of the industry, and the incredible innovations that are shaping the future. We will delve into the world of decentralized finance, tokenization, and digital identity, as well as the impact of blockchain on industries such as supply chain management, healthcare, and energy.

As we embark on this journey together, we will also introduce you to some of the most influential figures in the blockchain and cryptocurrency space. Through interviews and personal stories, you will gain valuable insights into the minds of the pioneers who are driving the industry forward.

We believe that the future of blockchain and cryptocurrency is bright, and we are excited to share our vision with you. As you read «The Crypto Time Machine,» we hope that you will be inspired to think critically about the potential of this technology and the role it will play in shaping our world in the years to come.

Thank you for joining us on this journey. We hope that «The Crypto Time Machine» will serve as a valuable resource and a source of inspiration as you navigate the ever-evolving landscape of blockchain and cryptocurrency.

Sincerely,

Viacheslav Nosko and Max Burkov

Founders, Pro Blockchain Media Agency

Chapter 1: Introduction

In the past decade, the world has witnessed a financial revolution with the emergence of a new form of digital currency: cryptocurrency. This digital asset, designed to work as a medium of exchange, has evolved from being an obscure concept to a global phenomenon, challenging the traditional financial systems and reshaping the way we perceive money. This book, «The Crypto Time Machine: A Journey to 2028», aims to provide a comprehensive understanding of the world of cryptocurrency, its evolution, and its potential impact on the future of finance.

Cryptocurrency has its roots in the 1980s and 1990s when cryptographers and computer scientists started experimenting with digital cash systems. However, it was not until 2009 that the first successful cryptocurrency, Bitcoin, was introduced by the pseudonymous creator, Satoshi Nakamoto. Since then, thousands of cryptocurrencies have been created, each with its unique features and applications.

The advantages of using cryptocurrency as a form of payment are numerous. Transactions are fast, secure, and relatively cheap compared to traditional banking systems. Moreover, cryptocurrencies offer a level of financial privacy and autonomy that is not possible with traditional currencies. However, there are also disadvantages, such as price volatility, regulatory uncertainty, and the potential for misuse in illicit activities.

The current state of the cryptocurrency market is both exciting and uncertain. With a market capitalization of over $2 trillion, cryptocurrencies have attracted significant attention from investors, governments, and businesses alike. While some experts predict exponential growth in the coming years, others warn of potential market crashes and regulatory crackdowns.

This book is structured to provide a comprehensive understanding of the cryptocurrency landscape, with each chapter focusing on a specific aspect of the industry. The topics covered include the technology behind cryptocurrencies, the various types of digital assets, the role of blockchain, the regulatory environment, investment strategies, and the potential impact of cryptocurrencies on various industries.

Understanding cryptocurrency and its potential impact on the future of finance is crucial for anyone interested in the world of digital assets. As the market continues to evolve, it is essential to stay informed and adapt to the changes. This book aims to provide readers with the knowledge and tools necessary to navigate the complex world of cryptocurrency and make informed decisions about their investments and financial future.

Key players in the cryptocurrency industry include developers, miners, investors, and regulatory bodies. Their roles in shaping the market are diverse and often interconnected. Developers create and maintain the underlying technology, miners secure the network and validate transactions, investors provide capital and drive market growth, and regulatory bodies establish rules and guidelines to protect consumers and maintain financial stability.

In conclusion, the world of cryptocurrency is an exciting and rapidly evolving landscape with the potential to reshape the future of finance. By understanding the history, technology, and market dynamics, readers can better appreciate the significance of digital assets and make informed decisions about their role in this new financial frontier. As we embark on this journey to 2028, it is essential to keep learning, exploring, and adapting to the ever-changing world of cryptocurrency.

Chapter 2: The Early Days of Cryptocurrency

The concept of cryptocurrency, a digital or virtual currency that uses cryptography for security, can be traced back to the early days of the internet. However, it wasn’t until 2009 that the first successful implementation of this idea came to fruition with the creation of Bitcoin by an individual or group of individuals using the pseudonym Satoshi Nakamoto.

Bitcoin was designed as a decentralized digital currency, free from the control of governments and financial institutions. It was built on a revolutionary technology called blockchain, which serves as a public ledger for all transactions made using the currency. This technology ensures that transactions are secure, transparent, and irreversible.

In the early days of Bitcoin, the digital currency faced numerous challenges. One of the most significant issues was the lack of understanding and acceptance of cryptocurrency by mainstream society. Many people were skeptical of the concept, and there were few places where digital currencies could be used for purchases.

Another challenge faced by early adopters was the difficulty of acquiring and using digital currencies. In the beginning, the primary method of obtaining Bitcoin was through a process called mining, which required specialized computer hardware and a significant amount of time and energy. This made it difficult for the average person to get involved in the world of cryptocurrency.

Despite these challenges, the development of blockchain technology continued to progress, and its potential applications began to expand beyond cryptocurrency. Blockchain technology has the potential to revolutionize industries such as supply chain management, voting systems, and digital identity management, among others.

As the world of cryptocurrency grew, so too did the number of digital currencies. In addition to Bitcoin, other digital currencies such as Litecoin and Namecoin emerged, each with its unique features and applications.

Namecoin is a decentralized, open-source cryptocurrency and domain name registration system based on the Bitcoin protocol. It was created in April 2011 by Vincent Durham, making it one of the first altcoins to be developed after Bitcoin. Namecoin’s primary purpose is to provide a decentralized and censorship-resistant domain name system (DNS) for the. bit top-level domain (TLD).

The main features and benefits of Namecoin include:

1. Decentralized Domain Name System: Namecoin allows users to register and manage domain names on the. bit TLD without the need for a central authority. This makes it resistant to censorship and provides an alternative to the traditional domain name system, which is controlled by organizations like ICANN (Internet Corporation for Assigned Names and Numbers).

2. Cryptocurrency: Namecoin is also a digital currency that can be used for transactions, just like Bitcoin. It uses the same proof-of-work algorithm (SHA-256) as Bitcoin, and its total supply is capped at 21 million coins.

3. Merged Mining: Namecoin can be mined simultaneously with Bitcoin, a process known as merged mining. This allows miners to secure both networks without any additional computational resources, making the Namecoin network more secure.

4. Privacy and Security: Namecoin’s decentralized nature ensures that domain name ownership and transactions are secure and private. It is resistant to hijacking, domain seizures, and other forms of censorship that can occur in the traditional domain name system.

5. Open-Source: Namecoin is an open-source project, meaning anyone can review its code, contribute to its development, or use it to build their applications.

6. Wallet Support: Namecoin has wallet support for various platforms, including Windows, macOS, and Linux. Users can store, send, and receive Namecoins using these wallets.

Despite its innovative features, Namecoin has not gained widespread adoption, and the. bit domain remains relatively obscure compared to traditional domain names. However, Namecoin still serves as an important experiment in decentralized domain name systems and has inspired other projects in the cryptocurrency and blockchain space. The early history of cryptocurrency was marked by several key events that shaped its development and perception.

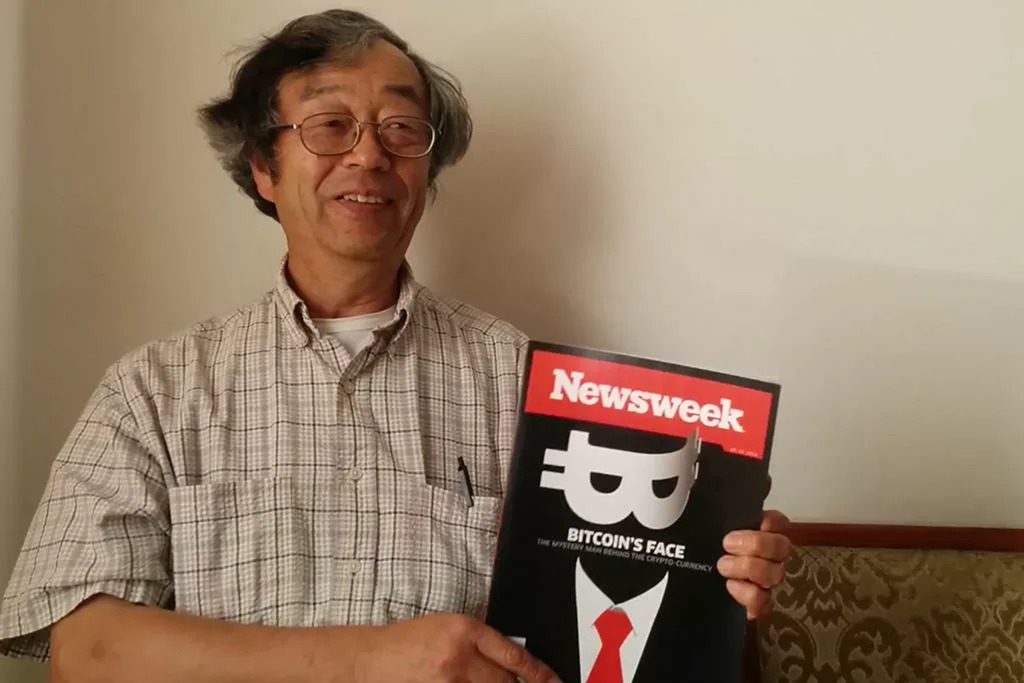

Tim Hornyak

One of the most notable was the Mt. Gox hack in 2014, which resulted in the loss of approximately 850,000 Bitcoins, worth around $450 million at the time. This event highlighted the need for improved security measures within the cryptocurrency industry.

Another significant event was the Silk Road scandal, an online marketplace that facilitated the sale of illegal goods and services using Bitcoin. The eventual shutdown of Silk Road and the arrest of its founder,

These events, along with other challenges faced by the cryptocurrency industry, have shaped its development and perception over the years. Today, the world of cryptocurrency is more diverse and robust than ever before, with new digital currencies emerging regularly and continued development of blockchain technology.

As we look to the future, the potential applications of blockchain technology and the continued growth of cryptocurrency are vast. While challenges still exist, the early days of cryptocurrency have laid the foundation for a digital revolution that has the potential to transform industries and the way we conduct transactions on a global scale.

Chapter 3: The Rise of Bitcoin

Bitcoin, a digital currency that has taken the world by storm, has revolutionized the way we think about money and finance. It has introduced a decentralized, peer-to-peer system that allows for secure and efficient transactions without the need for intermediaries such as banks or governments. This chapter will delve into the origins of Bitcoin, the factors that have contributed to its rise, and the data that illustrates its growth and adoption in the world of finance.

Origins and Early Development

Bitcoin was first introduced in 2008 by an individual or group of individuals using the pseudonym Satoshi Nakamoto. The concept was presented in a whitepaper titled " Bitcoin: A Peer-to-Peer Electronic Cash System, which outlined the principles and mechanics behind the digital currency. In 2009, the first Bitcoin software was released, and the first block of the Bitcoin blockchain, known as the «genesis block» was mined.

The early development of Bitcoin was marked by a small community of enthusiasts who were intrigued by the idea of a decentralized digital currency. These early adopters began mining and trading Bitcoin, and as the network grew, so did the interest in the cryptocurrency.

Factors Contributing to the Rise of Bitcoin

There are several factors that have contributed to the rise of Bitcoin as a prominent player in the world of finance. One of the most significant factors is its decentralized nature. Unlike traditional currencies, which are controlled by central banks and governments, Bitcoin operates on a decentralized network of computers that validate and record transactions. This decentralization eliminates the need for intermediaries, reduces transaction fees, and increases the security and privacy of transactions.

Another factor that has contributed to the rise of Bitcoin is its limited supply. There will only ever be 21 million Bitcoins in existence, which creates a scarcity that can drive up the value of the currency. This limited supply has led some to view Bitcoin as a digital equivalent to gold, a store of value that can act as a hedge against inflation and economic instability.

The growing acceptance of Bitcoin by merchants and businesses has also played a significant role in its rise. As more and more companies accept Bitcoin as a form of payment, the utility and value of the digital currency increase. This growing acceptance has been fueled in part by the development of user-friendly platforms and applications that make it easier for businesses to integrate Bitcoin payments into their existing systems.

The growth of Bitcoin can be seen in various statistics and data points. One of the most notable is its market capitalization, which has grown from virtually nothing in 2009 to over $1 trillion in 2021. This growth has been accompanied by an increase in the number of daily transactions, which has risen from just a few hundred in the early days of Bitcoin to over 300,000 in 2021.

The adoption of Bitcoin by merchants and businesses has also grown significantly. According to a 2020 study by Fundera, approximately 2,300 U.S. businesses and 15,174 global businesses accept Bitcoin as a form of payment. Additionally, major companies such as Microsoft, AT&T, and Overstock.com have integrated Bitcoin payments into their platforms.

Impact on the Cryptocurrency Market

The introduction of Bitcoin in 2009 marked the beginning of a new era in the world of finance, as it became the first successful implementation of a decentralized digital currency. Its rise to prominence not only changed the way people perceive money but also had a significant impact on the broader cryptocurrency market.

Bitcoin’s success paved the way for the development of other cryptocurrencies, often referred to as altcoins. These digital currencies were created to address some of the perceived limitations of Bitcoin, such as transaction speed, scalability, and privacy. As a result, thousands of cryptocurrencies have emerged, each with its unique features and value propositions.

Some notable examples of cryptocurrencies that have gained popularity and market share as a result of Bitcoin’s success include Ethereum, Ripple (XRP), Litecoin, and Bitcoin Cash. Ethereum, for instance, was developed to enable the creation of decentralized applications (dApps) and smart contracts, allowing for more complex and programmable transactions. Ripple (XRP), on the other hand, was designed to facilitate fast and cost-effective cross-border transactions, targeting the remittance market and financial institutions.

The rise of Bitcoin and other cryptocurrencies has also led to the development of various supporting services and platforms, such as cryptocurrency exchanges, wallets, and payment processors. These services have made it easier for individuals and businesses to access, trade, and use cryptocurrencies, further fueling their adoption and growth.

Бесплатный фрагмент закончился.

Купите книгу, чтобы продолжить чтение.