Бесплатный фрагмент - Development of financial intelligence

8 Key Zones of Growth in Your Financial Capabilities

Introduction

There are eight main reasons why you can stay in poverty for a long time and deprive yourself of money. And this is not just a low self-esteem or lack of clear financial goals, which is quite obvious and easily eliminated. There are much less obvious, but at the same time, very important underlying causes of your (of course, temporary, as you read this book!) Poverty. They are the key areas for the growth of your financial opportunities!

Before you get acquainted with them, take note of one fact: while you agree to poverty and think that you do not deserve more, someone earns the money intended for you and spends it for their own needs!

Do not you want to put up with poverty?

You do not agree to live in cramped conditions?

Do you think that you deserve more?

Then carefully read this book. It will allow you to understand the peculiarities of thinking of rich and wealthy people, develop your financial intelligence and eliminate the eight main causes of poverty, which are:

• Cause of poverty number 1. Elementary financial illiteracy

• Cause of poverty number 2. Unwillingness to take responsibility for own well-being

• Cause of poverty number 3. Wrong investment of time and money

• Cause of poverty number 4. Hope for a single source of income

• Cause of poverty number 5. The conviction that the spiritual is more important than the material

• Cause of poverty number 6. Misunderstanding the difference between price and value

• Cause of poverty number 7. The propensity to save and reduce costs, instead of increasing the cost of one’s time and increasing incomes

• Cause of poverty number 8. Unwillingness to benefit people

Waving to yourself and accepting poverty, you may find yourself in time in even more constrained conditions. So do not delay the decision of such an important issue as money. You have the opportunity right now to change your financial situation and enter a new level of life. Take advantage of this!

Perhaps in the past you have repeatedly made some efforts to improve life, have stepped on some rake and learned that it is better to reconcile with what is and not try to change anything. But the past does not exist. The past has already passed and there is only the present. And in the present you can change everything, even if in the past you made some mistakes! With today’s thoughts, words and actions, you can correct everything if you want.

From this book you will learn how to do it!

P.S. Initially, the book was written in Russian and only after that it was translated into English. Due to the specific differences between Russian and English, the author could allow minor inaccuracies in the translation. Do not judge strictly, for the English language for the author is not native. If possible, treat indulgently with possible mistakes and wrong words in the text. Remember that only those who do nothing do not make mistakes! Try to understand the essence of what the author wanted to say. Then you will get the most benefit from reading this book.

Cause of poverty number 1. Elementary financial illiteracy

The most common cause of poverty is financial illiteracy and low financial intelligence. A person with a low financial IQ simply does not know how to manage money and does not have the skills to handle them correctly.

The fact is that neither schools, nor universities, do not teach financial literacy. Even in economic faculties there is no such thing as to teach how to manage money. Therefore, everyone should study the science of money independently. But not everyone has enough time and desire for this. In words, all want to be rich and successful. But in reality, to study the science of money in good faith, only a few give themselves work.

Meanwhile, until you understand the laws by which money is distributed in the economy and you do not learn how to manage your money, you will be poor, no matter how much you earn. Surprisingly, even if you start earning a million dollars a month, you will still be poor if you do not learn how to keep what you earn and multiply. Why? Because it all depends not on how much you earn, but on how much you spend! You can earn a million dollars a month, and spend — more than a million, climbing into debt and loans!

Of course, the first thing you need to learn is to earn good money! But this is only the first stage of financial literacy, on which, unfortunately, many people stop and continue to be poor!

However, there is a second stage of financial literacy — the ability to save money and save money, forming capital from them. Anyone who goes to this stage, ceases to be poor. But it does not become rich either, because money is constantly depreciating!

For those who want to grow rich, there is a third stage of financial literacy — the ability to invest time and money in profitable projects and constantly increase capital!

The mechanism of enrichment is very simple: in order to constantly grow rich and live on passive income, you need to postpone a certain amount of money from each earnings and form capital from it; and at the same time, invest part of the money in what will eventually bring even more money (the so-called “assets”) and multiply your capital.

Anyone who understands this mechanism can get out of poverty and begin to grow rich. Even with one dollar you can start to form your capital. But one who does not understand the mechanism of enrichment, can never get rich, no matter how much he earns. Therefore, learn to understand this mechanism. Understand its essence. Understand the basic financial concepts to better understand what is happening to the economy.

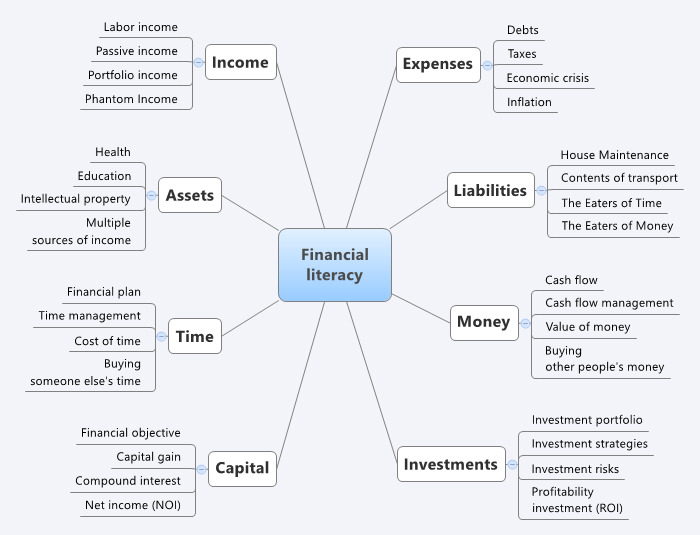

The backbone of financial literacy is only 8 key concepts:

— income and expenses

— assets and liabilities

— time and money

— capital and investments

Of course, each concept includes a number of key terms that every financially literate person should know and understand. The most important financial terms are presented below, on the mental map:

If you develop your financial intelligence and increase financial literacy yourself, find and carefully study at least one book for each term. Without a deep understanding of these key terms, it is impossible to start to grow rich consciously!

First, look at how income and expenses are formed. Learn how to increase your income and take control of your expenses. Then sort out what relates to the assets, and what concerns the liabilities. Learn to distinguish them from each other, acquire any assets and get rid of excess liabilities. After that, sort out the nature of time and money. Learn to manage your time and generate cash flow. And at the last stage of your independent financial training, understand how to create capital and what to invest in it. Learn to set clear financial goals, increase capital and invest it in certain profitable assets, getting a good net profit, which is not taxed or subject to minimum taxes!

Continually develop your financial intelligence, increasing your financial literacy and using the knowledge you have gained in practice. Remember that only a financially literate person can become a truly rich person and not lose at the same time such important values as health, freedom, trust and happiness! Honor your financial IQ and you will achieve in this life everything you want!

Step-by-step scheme for eliminating the first cause of poverty

1. Find any sane financial literacy course and study it carefully; move from simple to complex and study the following topics consistently:

• Formation of income and expenses

• distinction of assets and liabilities

• the nature of time and money

• capital formation and investment

2. Find recommendations and carefully study the 10 best books on the nature of money (and if possible, make brief notes of these books to occasionally return to them and remind yourself of the most important things);

3. Find a mentor and constantly improve your key professional skills to start earning well;

4. Start to spend less than you earn and regularly, with every earnings, save some money for the formation of your future capital (even for a start it will be a ridiculous amount, for example 100 dollars a month, over time, thanks to investments and compound interest, you easily multiply this money and get the amount with six or seven zeros);

5. Start investing time and money in potentially profitable projects and multiply your capital.

Cause of poverty number 2. Unwillingness to take responsibility for own well-being

Nobody except you is not interested in making you rich! Nobody except you is not interested in making you live better! No one except you can take and change your life for the better! Therefore, no one except you and not responsible for your well-being!

For your life and your well-being, you are responsible only yourself!

If you are poor, this is your choice. If you are rich — this is also your choice. No one, including your parents, neighbors, government officials, ill-wishers and competitors, is not responsible for your choice! Of course, people around you can put a stick in your wheels, do not work properly, interfere with your goals, and behave badly towards you in general. But in the end, not they are responsible for how you react! They are not responsible for how you see the world, how you act and what you are striving for! And they are not responsible for what results you get from your decisions.

Attempts to shift responsibility for one’s own well-being onto the shoulders of other people always end in poverty. Therefore, if you do not want to be poor, do not give your well-being to other people’s hands and do not let other people make decisions for you. Decide who to be, how to act and what life to live.

Remember that your well-being is formed not only by money, but also by values such as health, education, business and personal connections. The better you feel, the better your brains understand and the richer your circle of communication, the higher your well-being. At the same time, your financial potential directly depends on your health and your thinking strategies!

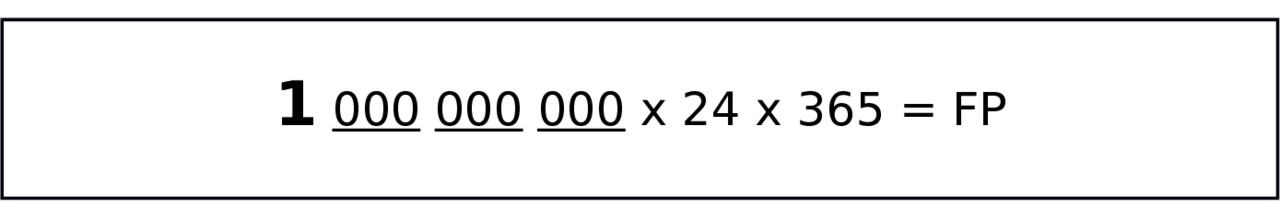

This fact allows you to derive a formula for your financial potential:

,where 1 is your health (and health includes such components as proper breathing, proper nutrition, regular movement and regular cleansing), three triplets with zeros are your brain, connections and money, 24 is the number of hours in a day, 365 is the number of days in a year, and the FP is your financial potential.

If you have health — this is conditionally just a unit of your financial potential. But if you add brains to your health, you will already have a thousand units of potential. If you add healthy business and personal connections to your health and brains, then you will have 100,000 units of capacity. If you add money to your health, brains and connections, then you will have a million units of potential!

If you multiply a million units of capacity by 24 hours and multiply the total by 365 days a year — you will get a staggering amount of your annual capacity, which you most likely do not use even 1% to achieve financial success!

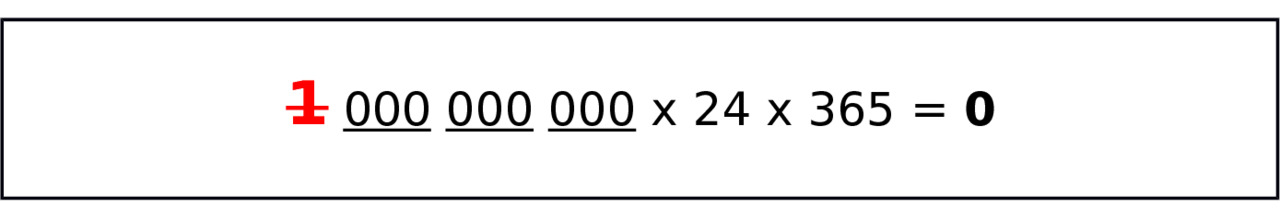

It is interesting that if you do not have the most important thing — health — then everything else in any scenario will remain useless zeros. And how much you do not multiply zeros by 24 hours and 365 days in a year, you will still end up with zero as a result:

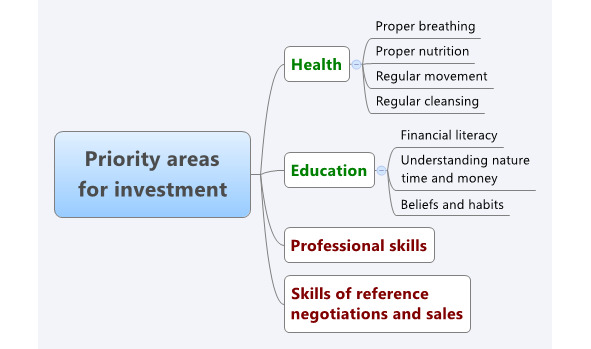

Few people understand that time and money, if they exist, should be invested primarily in maintaining their sound health and training thinking. It is health and thinking that determines all your financial achievements! Therefore, at the first step of your journey to wealth, invest time and money in strengthening health and getting a good education in personal finance. And only then, when you learn how to easily earn and competently postpone, think about which assets to invest your money. It can be intellectual property, own business, commercial real estate, investment in shares of industrial enterprises or mutual funds (mutual funds), etc.

But remember that in any case, the main asset is yourself! Whatever you invest your time and your money, do not forget about health and education! ROI (return on investment) from investing in yourself is always higher than ROI from investing in any other assets!

The state of your body (which can be reduced to well-being) and the state of your consciousness (which can be reduced to self-esteem) are two wings that will allow you to fly to any financial height! Therefore, always take care of your body, learn to breathe properly, eat right, move regularly and cleanse the body of toxins. Take care of your purity, beauty, strength and youth! But do not forget about the brains! Constantly increase your financial literacy, study macroeconomics, perfect your thinking and develop your financial intelligence! Try not to confine yourself and your needs, but learn to go beyond them to see the world wider, to understand global financial processes, to track trends and get more financial opportunities than other people.

Step-by-step scheme for eliminating the second cause of poverty

1. Take for granted that you are responsible for your life and your well-being (that is, you are responsible for your words, decisions and consequences), only you!

2. Take control of your health, your beauty, strength, youth and learn to feel good in any, even the most difficult, situation. Cultivate yourself with energy, grow enthusiasm and more often do what improves your state of health.

3. Take control of your thinking, your beliefs, thoughts, emotions and learn to appreciate your time, your work, your potential, your achievements. Cultivate awareness in yourself, develop your financial intelligence and set yourself such ambitious financial goals that will constantly remind you of your commitments and one’s own self-esteem.

4. Maintain both wings (health and education) in balance, seeking their harmonious coexistence.

Cause of poverty number 3. Wrong investment of time and money

You have 24 hours in a day. And you also have 365 days a year, which you can invest in assets, and you can lose. The same goes for the money that you have. You can invest them competently, multiplying your capital, or you can simply lose them by purchasing any trinkets. But you are investing in any case. You can do it competently, and you can invest your time and your money in a hurry. In the first case, your investments will make you richer, in the second — poorer. If you do not want to learn a literate investment, you just doom yourself to become poorer and poorer every year!

First of all, time and money need to be invested:

— in health (proper breathing, proper nutrition, regular movement and regular cleansing of the body of toxins and toxins)

— in the brains (understanding the nature of time and money, financial literacy and knowledge of all that raises your financial IQ)

— in professional skills (the skills by which you earn and receive basic income)

— the skills of negotiation and sales (the ability to negotiate, influence people, convince them of their rightness and lead them by buying the time of other people for little money or getting their money in exchange for their time at a favorable rate).

Only then can you invest in assets (your business, intellectual property, useful business connections, securities, commercial real estate, professional equipment, precious metals, etc.) or liabilities (new housing, car, expensive gadgets, etc.).

Moreover, when it comes to acquiring assets, you need to understand that they will provide you with money for the rest of your life (of course, if you do not lose or resell your assets), so you can pour in all the free money and even take for their purchase loans. Probably, many financial advisers will advise you never and under no circumstances to take loans to avoid getting into debts. But the truth is that the loan to the loan is different!! If you take a loan for the acquisition of an asset, it will in any case pay off and bring in the end profits! Therefore, rich and wealthy people easily and often enough take loans to acquire assets and become even richer! But rich and wealthy people never take loans to acquire liabilities! They are only interested in assets!

Бесплатный фрагмент закончился.

Купите книгу, чтобы продолжить чтение.