First published in 2020.

All rights reserved. No part of the electronic version of this book may be reproduced in any form or by any means, including posting on the internet and in corporate networks, for private and public use without the written permission of the copyright owner.

INTRODUCTION

This is more like a study guide rather than a book as such. Do you remember what a math book used to be called? A book of problems. It was easier for younger pupils and more challenging for senior ones. Either way, it contained problems to be solved. The right answers were given at the end of the book, but we had to go all the way to the solution by ourselves.

At the end of 2014, the Russian economy suffered another blow when oil prices more than halved. Naturally, the Russian ruble immediately collapsed against the dollar and the euro.

As the old Russian saying goes, ‘misfortune never comes alone.’ The course was set for the development of domestic multi-level processing and high technology. This was impossible for many businesses, as they simply could not replace materials and equipment overnight, nor could they invent or buy new technology. By mid-2015, the economy was on the brink of bankruptcy. Only one question remained: who would go bankrupt next?

It was a disaster for millions of businesses. That was when the most enterprising entrepreneurs ‘crash-dived’ into preparations for bankruptcy. It truly felt like a submarine dive: perfect concentration, steady nerves, unflappable composure, the whole crew ready to steer only one course — for survival.

It wasn’t the first time and it won’t be the last. Crises often come, like storm waves, and we must learn to deal with them. Theory will no longer help. What matters is practice. It is for this reason that I based this book on real events. They may not be described with pinpoint accuracy, but the conclusions are sincere. You know, as the credits of a film sometimes say: ‘Any resemblance to actual people or real events is purely coincidental.’ It is the same here. There may not have been identical situations, but the description is still 50—60% fair and square.

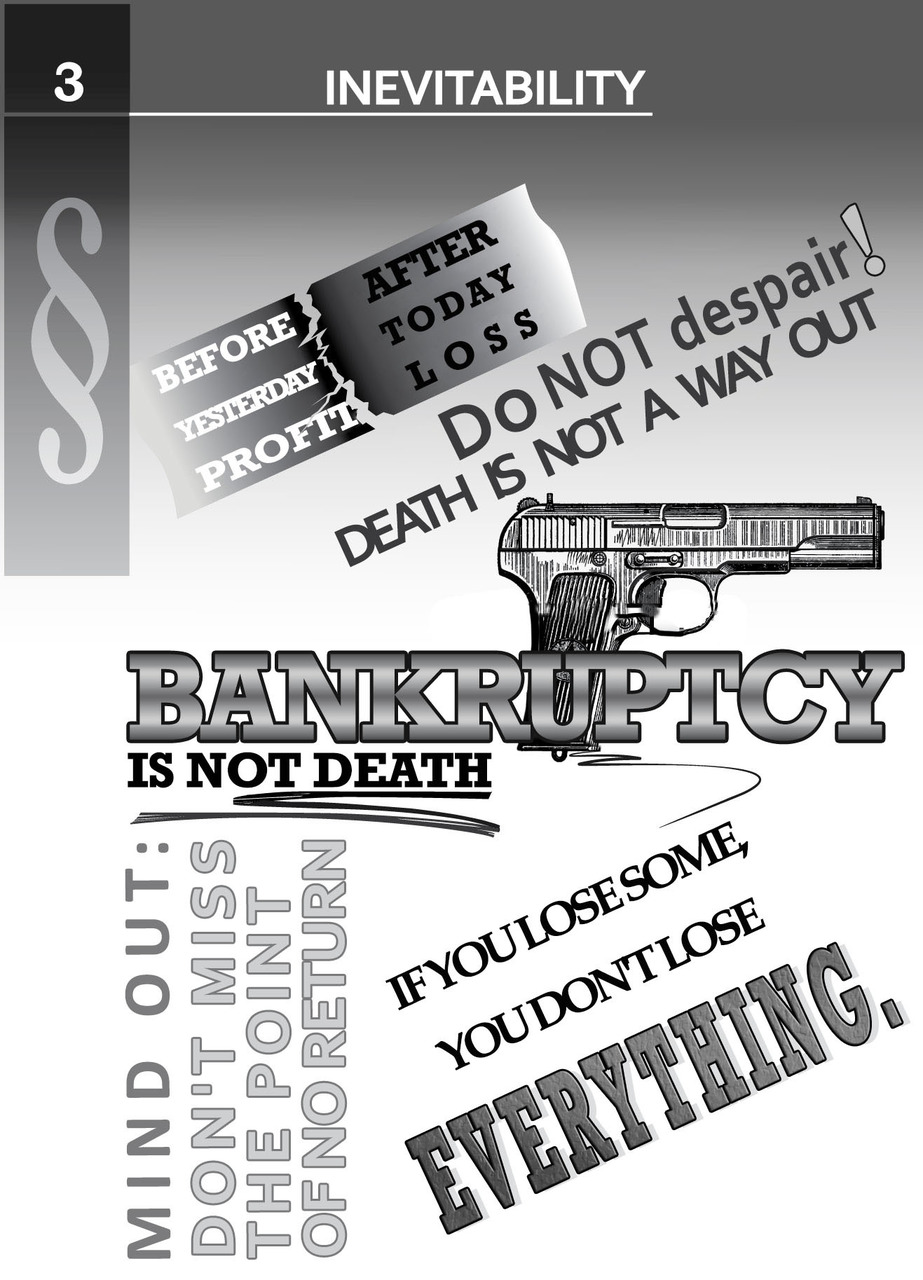

I believe that many businessmen and lawyers in Russia and abroad will corroborate my research. You can read a lot of books on bankruptcy and memorize almost all the legislative and judicial practice related to this tricky area, but you can never know where it may lead. Having studied a large number of related Russian and international cases, I venture to say that bankruptcy is neither death nor even an incurable disease. It is merely a vehicle for getting rid of liabilities that have suddenly put a deathly stranglehold on a business, whatever its size.

That is why I would like to share my research results with you.

SECTION 1. MISTAKES

It’s axiomatic to learn from the mistakes of others.

PROBLEM 1

Given: no nuptial agreement. Businessmen share the ups and downs of both life and business with their families. No one would think of signing a nuptial agreement with their spouse.

Question: why is it important? Nearly everyone who one day decides to act as a guarantor by putting their signature under the text, hardly ever reads it before signing, nor will they re-read it after the hearing. However, everything given away as a present or sold during the three years, or 36 months to be precise, or 1,095 days to be exact before the court declares the company or the individual bankrupt, will be returned to the bankrupt’s estate to be sold to settle the defaulter’s debts.

Solution: make sure to sign a nuptial agreement to avoid a lot а trouble for your family in the event of an unexpected bankruptcy.

PROBLEM 2

Given: consolidation of assets in the hands of a single person. It would seem perfectly logical to consolidate the successful parts of the business, to build the logistics and management systems in such a way that the business is efficient. Training programs cost a lot of money, experience comes with age and working your fingers ‘to the bone’, and businesses cannot but benefit from this.

Question: why is it then, with all parts of the business legally consolidated, there is nothing a bankrupt-to-be can do once the torpedo of crisis suddenly cuts through the side of his business ship? All the bulkheads of the ocean liner that held just yesterday will get soaked and torn like paper under the forceful inflow of creditors and controllers.

Solution: de facto and de jure become very important at a time like this. The most important thing in business is that nothing that is de jure significant should sit within anything else.

PROBLEM 3

Given: underestimation of likely pitfalls. There is no business in the world (and there will never be one in the foreseeable future) that is absolutely and forever immune to external or internal crises.

Question: what can cause bankruptcy? There is always room for betrayal, profligacy, envy, incompetent things done by partners, owners or their families. Natural disasters and wars, man-made woes and bad luck… The list of causes goes on and on.

Solution: you must always be prepared for the possibility of bankruptcy.

PROBLEM 4

Given: no team around. If a business executive or entrepreneur is under enormous pressure in the face of looming bankruptcy and there is no team by his side, he is doomed.

Question: who can be in the team? It is not just your family in a literal sense but also your friends, acquaintances, subordinates — anyone who is prepared to help or to lose some of their material means or income, including bonuses, allowances, and other benefits, along with the business that is going bankrupt.

Solution: try to build your team well in advance.

PROBLEM 5

Given: reliance on stocks and reserves. Even when bankruptcy is imminent, you should never feel compelled to use your stocks and reserves.

Question: why won’t it help? Your stocks are always lower than the resources needed to avoid going bankrupt.

Solution: lock your stocks and reserves away until you need to start all over again.

SECTION 2. ALL OF A SUDDEN

It is not true that bankruptcy cannot be predicted.

So why does it usually strike all of a sudden?

PROBLEM 6

Given: businesses are always on the lookout for ways to survive bankruptcy, often finding themselves on the brink, with all other options exhausted. Banks won’t refinance, interest is accruing on the cost of past borrowings, debts for materials exceed future earnings while wages and taxes have not been paid for months.

Question: why are bankruptcy procedures for business turnaround in 21st century Russia applied so poorly? Why do companies avoid any procedures that can lead to a loss of assets and why do creditors try to seize those assets by hook or by crook in order to sell them for a song and get at least something back?

Solution: It is evident that legislative and legal practices must be improved. Many entrepreneurs I know have had to prove to banks time and time again that a payment break or debt restructuring can rejuvenate their business or even make it more successful. This has been reaffirmed in practice — you must fight to the last ditch to prove that you can turn things around, request payment holidays or refinancing, try to convince everyone that you can redress the situation, and never give up on your business; if it is still alive, look for a way out. Do not initiate your own bankruptcy, let the banks do it for you if they fail to be convinced. At least you can buy some time, which is invaluable in this fight. You will need it in the course of protecting your assets.

PROBLEM 7

Given: bank officials are indifferent and unwilling to even listen to reasonable proposals. Banks are never concessionary, so they must be the last point of contact.

Incidentally, banks are usually more alert than a soon-to-be bankrupt. Once they catch the wind of trouble in your financial affairs, they will act swiftly and professionally. They will already have got you to sign a personal surety and made all attempts to obligate each adult member of your family.

Nothing ever hurts an entrepreneur more than realizing that their business could cause their nearest and dearest to lose everything. Agents representing banks or other creditors often act ruthlessly, without compassion or intent to compromise.

Suddenly you realize that those with saccharine smiles who persuaded you to take out loans at extortionate interest rates of 15—25%, who invited you to free business breakfasts, discussion groups, and voluptuous parties with free buffets and champagne, where you were awarded prizes as the best business owner, have been, in fact, ‘fattening’ you up until the time your assets become more attractive to them than yourself.

Question: are you suddenly aware that this is the end? I’m sure you are. No one I know who has gone through or is going through bankruptcy could have imagined three years prior to bankruptcy that an apartment given as a birthday present to their darling daughter (if the deed of gift was executed less than 1,095 days ago) would be taken away, auctioned off, and sold.

Example one: my acquaintance once told me a story about a bank lawyer. She was certain she was entitled to slander the debtor in court and was cynical to the point where she didn’t hesitate to triple the debt amount just to prove in court that the debtor was a swindler. That the debtor had been borrowing from the very same bank for more than 20 years without a single day of payment delay, largely paying back the loans taken out for business development at an interest rate of 15—25%, she would not even want to talk or hear about.

Example two: a bank has been lending money to an entrepreneur for many years, using the property built with the loans as collateral. When the crisis collapsed sales, the bank foreclosed on the entire property for a quarter of its value, refusing to revalue it and leaving the businessman in debt to other creditors. This is how a successful property owner turned into an entrepreneur with a mountain of debts.

Solution: do not give up, study the intricacies of bankruptcy procedures thoroughly. This fairly uncomplicated subject does not require a university degree — just diligence and a competent hands-on lawyer.

SECTION 3. INEVITABILITY

For many people, the inevitability of bankruptcy is a personal catastrophe above all else. Successful yesterday, bankrupt today — how do you live with it?

PROBLEM 8

Given: the issue of payment arrears inevitably looms when the difference between income and expenditure on the corkboard in your office changes sharply from positive to negative compared with the results of the previous operating month or quarter. The banking community is abundant with ‘hotshots’ able to convince you that all you have to do is take out a loan and all your problems will be taken care of by the bank’s capital as long as you are making timely interest payments.

Yes, there are some very talented entrepreneurs out there who are able to grow exponentially with a loan at 15 to 25% interest…

Question: but if the average profit in developed economies is less than 10—20%, how can one pay 15—25% interest rates? Only when the economy or a particular economy sector is growing, or perhaps a particular company has struck it lucky or come up with something that its competitors haven’t got. But it is abundantly clear to the author that a business with a loan portfolio in excess of 50% of its annual turnover is inevitably heading for bankruptcy.

Solution: if a business executive or entrepreneur does not want to see a ‘black swan’ from the window one day, he should monitor the immediate future for the inevitable moment when it is no longer possible to increase cash flow. Only a growing business can cope with borrowing, otherwise you are on a down escalator. If your turnover has stopped growing or earnings have begun to fall, the loan with its draconian interest rate must be urgently reduced or disposed of altogether.

We often believe that we are the ones to be spared. If the entrepreneur in Problem 7 (Example two — the bank foreclosed on an undervalued property for next to nothing) had sold some of his property even at a discount in good time, he would have been able to pay off the loans or reduce them considerably, and then use the remainder to invigorate his business again. But it is hard to switch from a Mercedes to a more modest car, or to sell a country estate that is not needed at the moment! No stomach for it. And, inevitably, the entrepreneur loses the property in a court of law, with the creditors snapping it up for a mere song.

Sometimes, instead of borrowing as a sole way to generate cash, you have to move your bad sellers even below cost.

Example: a friend of mine made profiles for dropped ceilings to attract customers rather than as a flagship product. He sold the profile cheaply in order to attract ‘anchor’ customers who would buy the core revenue-generating product in addition to the profile. In the end, he got so carried away with profile sales (the price was attractive and competitive!) that they far exceeded sales of the flagship product.

Sales kept growing, but the share of loss makers in the company’s turnover shot ahead of the profitable product share.

Inevitably, a disaster named bankruptcy started looming. Before he knew it and could pull the plug on production of the unprofitable product in time — there was no money for regular payments; materials, rent, electricity, and wages ate it all away, and taxes and interest were piling up. The only way to stop the process was to declare bankruptcy…

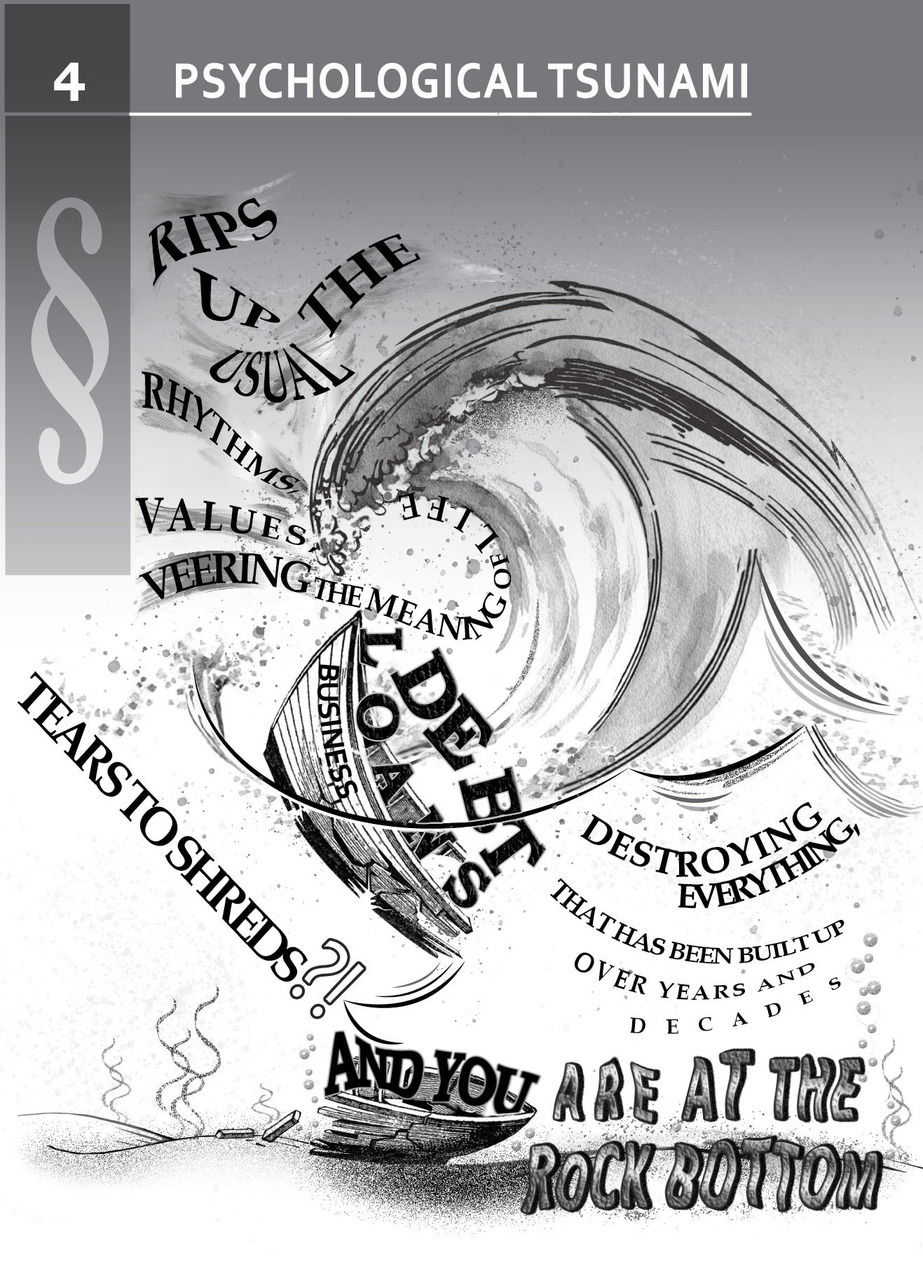

SECTION 4. PSYCHOLOGICAL TSUNAMI

The Damocles’ sword of bankruptcy is not the loss of wealth per se but, above all, the psychological state that comes over a man who was successful just yesterday, dividing his life into before and after.

PROBLEM 9

Given: an entrepreneur, who is usually well known in the place where he was born, where he grew up and where he has developed his business, cannot escape his recent popularity at the drop of a hat. Just yesterday, he and his company were on billboards, on magazine covers, on employees’ name tags, on the sides of cars, on business cards given to numerous officials, suppliers, and customers… In short, the company was a respected employer… Then suddenly, the soon-to-be bankrupt has to sever his connections with everyone. He locks himself in his luxurious country estate or drives off, wherever the road takes him, behind the wheel of an expensive car.

Question: what exactly is a psychological tsunami? It sweeps over everyone in equal measure, irrespective of the size of the business. When debts exceed the ability to pay them off, it is only the dishonest and criminally inclined who can remain indifferent. The rest of us realize that once all the resources we have feverishly sought to avert disaster are exhausted, the ‘great water’ will inevitably come to wash it all away.

A ruthless tsunami tears down harbors, seaside villages, and coastal towns, flings ships of all sizes and displacements onto the shore, smashing everything into tiny pieces. Similarly, bankruptcy shreds the usual rhythms and values, veers the meaning of life, and destroys what was dear just yesterday. The psychological tsunami smashes and ruins the lives of all people, however famous they are: it pulverizes tangible and intangible assets of any value, nullifies everything that has been built over years or even decades and provided a living for tens and hundreds of families. Those who are not legally savvy or do not have their in-house legal service feel even worse as they realize that they will not just fail to pay their debts but will also be dragged into the maelstrom of criminal prosecution.

Solution: Unfortunately, as practice shows, no one usually prepares for a potential bankruptcy or even thinks about exploring a civilized mechanism of protection from creditors well in advance of it. Nobody wants to even conceive that this can be possible for a business that was successful just yesterday.

Why do we listen to preflight safety briefings for the umpteenth time: what to do in case of ditching, how to inflate a life jacket and blow the whistle? Why do we practice running to the lifeboats on a cruise so that we know in an emergency which lifeboat is ours, where to find it and how to put on our life vests? And why do we not prepare in advance for a potential bankruptcy? It may be just around the corner, especially after yet another economic crisis.

Every single soon-to-be bankrupt becomes panic stricken, desperately grasping at straws, as the vortex of impending bankruptcy begins to suck him in.

One should always prepare for bankruptcy by running ‘command-post exercises’ or ‘management games’, just as military officers run simulations on maps or in a giant sandbox, recreating the terrain of the eventual theatre of operation. It is crucial to keep drilling who will do what when unavoidable bankruptcy first starts gently knocking on the window and then bangs on all the doors. Check the lifeboats and life jackets, make sure the oxygen cylinders are full and the parachute is properly packed. If bankruptcy doesn’t take you by surprise, there will be no panic, and no psychological tsunami.

SECTION 5. CENTRIFUGAL FORCE

To fear is human:

some are afraid of water, others are afraid of confined spaces, yet others are afraid of heights, and some are afraid of a little bit of everything.

PROBLEM 10

Given: there is no one who is not afraid of going bankrupt. But people treat bankruptcy in different ways. Some know how to deal with it in a civilized way, and how to manage their assets competently in times of trouble. Others begin panicking, rushing around, blaming everyone else, and feeling sorry for themselves.

As a general rule, the soon-to-be or recent bankrupt can lose several days of sleep. Then depression sets in, sometimes extremely severe and unknown to someone who was so strong and unyielding in any business fight, who used to know no fear in the face of guns and knuckledusters of a gang of robbers or the wrath of creditors and controllers, who has always been ready to go through hell and high water for his business, no matter the weather and the time of day.

Question: what happens when he suddenly finds himself facing bankruptcy?

First, an entrepreneur doesn’t want to be known as ‘bankrupt’; he fears it like the plague, actively fending off the very word — publicly and privately.

Second, when businessmen start to sense looming bankruptcy, they begin to spin the centrifuge of problems, seeking advice from everyone and spilling the beans to those who are not supposed to be aware of the impending plight.

Solution: do not be confrontational, let alone threatening. Always remember that energy is already being drained, and the next step in business and relationships is total panic. Suppliers stop delivering, banks stop lending, partners refuse to fund joint projects — as a result cash flow is ruptured; your best employees quit, top managers leave, and sometimes even your nearest and dearest shun you.

PROBLEM 11

Given: the maelstrom of problems accelerates as bailiffs arrive and litigation begins. Court orders and restrictions, including temporary confiscation or banning property from sale or registration, can quickly follow. Foreign travel may be restricted. The centrifugal force of bankruptcy proceedings squeezes out the entrepreneur and deprives him of the right to manage his property and business.

Question: what happens next? A group of toxic creditors appear with a financial manager and then a crisis manager. Negotiations are out of the question; all they want is to seize and sell all the debtor’s assets. They do not care that in most cases they can get all their money back much faster, and in full, if they allow the company to be kept afloat. Practice shows that bankruptcy takes at least three years (unless it is the bankruptcy of an asset-free guarantor — such proceedings are quick and take about 12 months).

Refusing to relinquish ownership and business management rights, not recognizing the substance and legitimacy of creditors’ claims, all while being on the brink of bankruptcy, and sometimes the heat is turned up by the threat of criminal prosecution for actions that can be qualified as contrived and deliberate bankruptcy.

Solution: it is crucial to contact experienced lawyers as soon as you realize bankruptcy is imminent. The larger and more complex the business, the more important it is to have a team of lawyers with different skills. One of them might be an excellent negotiator, capable of finding common ground with creditors in all disputes; another is a brilliant theoretician with a keen eye for the attacking party’s Achilles heel; one who is also able to expose the defending party’s weaknesses competently. There is no such thing as an all-in-one lawyer.

The businessman must get thoroughly immersed in the subject at hand to avoid being thrown out of the process thanks to his own inactivity and stupidity, which only accelerates the centrifugal forces stripping him of his assets. Apart from the bankruptcy law, this immersion must include court practice, and, better yet, the experience of those who have gone through bankruptcy. But you will have to learn as you go, because time will be extremely short. It is critical not to miss the moment when the ‘invaders’, skillful at taking away others’ property and neutralizing the current asset owner’s resistance, cross the border.

If you do not want to trigger the centrifugal force of imminent bankruptcy and associated procedures, do not shout at every corner about your business troubles. Nor try to call to account those you consider culpable for your predicament, as it will only facilitate the centrifugal process that will deprive you of your asset rights and empty your pockets faster than you can sensibly do anything about. It’s not just money, it is also lack thereof that loves silence.

The centrifuge of events should be as far away as possible from the source of power that will initiate the bankruptcy process. Do not be the one to plug it in.

Бесплатный фрагмент закончился.

Купите книгу, чтобы продолжить чтение.