Бесплатный фрагмент - Available about Forex trading in Russia

Introduction

In Russia, as in other countries, there is such a profession as a trader. Who is it?

A trader is a specialist armed with knowledge and skills, and trading, in accordance with the legislation of the Russian Federation, in the currency markets (Forex), stock, futures, commodity and other markets.

The goal of the trader is to profit from the inevitable change in the rate of a particular trading instrument.

We will also consider and learn how to trade in the currency trading market. The Forex market.

Many people ask the question: is it possible to earn money through the Internet? If possible, how much per month, per day? Where and how? There are many ways. One of the earnings on the Internet is currency trading on the Forex market. The forex market is the currency trading of different countries.

This activity is allowed in Russia and, moreover, it is regulated by the laws on the stock and foreign exchange markets. Many brokers are licensed by the Central bank of the Russian Federation. From the income from the Forex market with physical persons. a person is charged the usual tax on the income of an individual.

Read what the Forex market is. Unlike the stock market, where stocks are traded, investment portfolios are collected, futures and options are traded, currency is traded on the Forex market. However, recently brokers have expanded the list of instruments on which you can trade. They included trading in oil, metals (contracts for gold, silver), commodities, some indices, and cryptocurrency. Our favorite and popular ratio of the ruble to the dollar in the Forex market is called the currency pair or currency instrument USDRUB and has a chart of the exchange rate.

Forex trading is earning money with an investment. That is, you will need to make a certain capital, a certain amount, which you will then dispose of. Portions of which you will then use to earn money through the Internet on the Forex market.

Just a person from the street, meaning unprepared in any way, will not be able to trade on Forex. Rather, it can, but it will be clowning and at a loss. He will be able to trade, but without knowing the basics, studying some theory, without working out some practice, a person will not be able to successfully earn money, as experienced traders earn, almost at the click of their fingers. He needs to become a trader. That is, a person little prepared. But there is nothing to be afraid of. Many people learn to drive, but millions have long been well — versed in driving.

A Forex trader is different from a stock exchange trader.

That is, we can say with confidence that Forex trading is earning money on the Internet. Moreover, using the technique, their knowledge, listening to the advice of experienced traders, observing the trading system almost like a robot, a human trader can earn a lot of money. Incomparable with any earnings on the Internet.

Forex trading via the Internet has some advantages compared to trading, for example, on the stock exchange in stocks, futures, etc., for example, on the Moscow Stock Exchange or in general on the stock markets. What are the advantages?

There are a lot of qualified foreign exchange brokers who have been working in this market for a long time. About brokers-here. Forex is exactly currency trading. And many brokerage companies offer their services in this market.

If on the stock market and, in particular, with brokers on the Moscow Stock Exchange, the so-called” entry fee” or initial investment is a fairly large amount. Then forex brokers are very democratic. Free opening of a personal account, trading and demo account with a broker. And the beginning of trading with some brokers can start literally with$ 10 + bonuses that are offered by the brokers themselves. At the top of the site there is an advertisement of the broker Alpari, telling about the action of doubling the amount on your deposit, when replenishing the account. Click on the banner and use it.

There are brokers offering Forex trading training. I, personally, was trained by the Russian forex broker Forex Club in 2006 and I do not regret it at all. This broker has a bunch of branches all over the country, almost in every major Russian city.

After training, you will learn how to trade either manually or automatically, either according to the signals. Automatically — this is trading with Expert Advisors. There are paid or free Forex Expert Advisors that trade automatically. They are also called forex robots. You can get acquainted with my work here.

Learn how to use forex indicators. Like the standard indicators that are included with a particular trading platform, there are indicators written by third-party people for the platform.

Learn, open an account and trade.

So, what is the Forex market?

International Forex Market (Forex). What’s it? Its scope and actors

The Forex market, with a turnover of 4 trillion dollars a day, is a huge ocean. And everyone wants to take their stream away from this ocean.

Forex (Forex, sometimes FX, from the English Foreign Exchange — “foreign exchange”) — the market for interbank currency exchange at free prices (the quote is formed without restrictions or fixed values). The combination “forex market” (English: Forex market, FX-market) is often used.

In the English-speaking environment, the word “Forex” can mean not only mutual currency exchange, but also the whole set of currency transactions, as well as foreign currencies as such. In Russian, the term Forex is usually used in a narrower sense-it means exclusively speculative currency trading through commercial banks or dealing centers, which is conducted using leverage, that is, margin currency trading. At the same time, the terms “international forex ‘and’ international forex market ‘are a tautology, due to the fact that’ foreign exchange” initially implies operations with foreign currency.

Operations on the forex market for purposes can be trading, speculative.

I.e., part of the operations on the market is carried out purely for the purpose of purchasing significant amounts of a particular currency. These are purely trading operations. And hence, in particular, significant changes in the exchange rate of a currency instrument, a currency pair.

The Forex market (foreign exchange market) is an interbank market that was formed in 1971, when international trade moved from fixed to floating exchange rates. The main principle of Forex is to exchange one currency for another. At the same time, the exchange rate of one currency relative to another is determined by the supply and demand of market participants. The exchange is made according to the ratio to which both parties to the transaction agree.

Forex is not a “market” in the traditional sense of the word. It does not have a single center, it does not have a specific trading place, such as a currency futures market or a commodity exchange. Trading takes place over the phone and through computer terminals simultaneously in hundreds of banks around the world. Thanks to the emergence and development of the Internet, it became unnecessary for a private investor to resort to the services of large banks, and it became possible to conduct trading via WWW from their home or office computer.

Hundreds of millions of dollars are bought and sold every few seconds, which is the essence of so-called currency trading. The ability to generate income in the foreign exchange market is based on the simple fact that each national currency is the same commodity as wheat or sugar. And its cost is just as relative. Since the world is changing faster every year, the economic conditions of a particular country (labor productivity, inflation, unemployment, etc.) are increasingly dependent on the level of development of other countries. And this affects the value of its currency relative to other currencies and causes changes in exchange rates.

We will also consider the trade of a private trader and the speculative trading mode.

Deposit — the amount of funds on the trading account with the broker.

To successfully trade on the Forex market (Forex), you need to understand that…

Now I am likely to disappoint many beginners: 90% of traders in the Forex market, one way or another, drain their first deposit. This is because those who start trading have little idea what they are dealing with. When using a large, high leverage (you will learn later what it is), working in the Forex market can be compared to driving a Formula 1 car. As a rule, those who start, getting into a Formula 1 car, try to immediately press the gas pedal, not really understanding how to steer and what the instruments on the control panel show. Don’t feel the “dimensions”. Just like in real life.

So, let’s go. The trader works in the market through a broker.

Eg. You have chosen a broker. Registered on the broker’s website. Thus, you have created your personal account on the broker’s website. Now you need to create an invoice. (Register and create a Demo or Trading Account with a broker, for example, Alpari, RoboForex, Cerich, Forex Club.) A broker usually has the ability, in addition to several types of real trading accounts, to create and use a demo account. It is quite clear that first you need to open a demo account. This account has virtual money. But the terms of trade are as close to “combat” as possible. You can choose a large deposit. And feel, so to speak, the scale. The speed of both winning and losing. And volumes. On a demo account, you can experiment as you want. The money is virtual.

In the future, it will be clear to you that when choosing an account, you need to choose its characteristics very carefully. The account and currency pair have their own internal characteristics.

Now, of course, you need to download the trading platform from the broker’s website and install it on your computer. For example, MetaTrader 4. This is a very common and fairly simple and democratic trading platform. A brief description and basic skills of working with the platform are described in the chapter below.

When you open an account, the broker gives you the account number and password. After installing the platform and launching it, you need to connect to your chosen account in MetaTrader 4. (Enter its number and password in a special window). In our case, this is the number and password of our demo account.

Are we ready to trade? No. We still need to open the chart of the selected currency pair. In the open window of a currency pair or Forex instrument, we see a quote chart or quotes. Or, they say, the exchange rate of the currency pair. A little later, we will understand how to make deals and how to make money on it. And now a small excursion. To choose the right direction of the transaction, buy or sell, we need to analyze the movement of the exchange rate on the chart in the MetaTrader 4 platform. What should we be guided by?

You can list them. Indicators of movement. Technical and fundamental analysis of the chart. Other, similar currency pairs. To know what are the transaction, the market or pending. Know the characteristics of the transaction. What lot will the deal be opened with? You should know that the trade has two closing orders. One is for limiting losses, called a Stop Loss. And the other is for profit-taking, called Take Profit. What kind of deal to choose a stop loss. What to follow when choosing.

Transactions are also called orders in another way. There are market orders and pending orders. Market orders are executed immediately. They are executed at the current BID price-the sale price or ASK price-the purchase price, which is usually slightly higher. And sets them for you by your broker. In contrast, pending orders can be placed at any price and will be executed when the exchange rate reaches this price. Now let’s understand what we are buying or selling and what we are looking at on the trading platform.

Bid, bid — the selling price of the base currency for the quoted one. In the currency quote, it is indicated on the left.

Ask is the price at which the purchase of the base currency is made for the one quoted on Forex.

Spread — the difference between the best prices of sell and buy orders at the same time for an asset.

Let’s imagine this situation: you opened an account in rubles (RUB) with a broker, put an amount in rubles (RUB) there, and for some part of rubles (RUB) you want to buy euros (EUR) for dollars (USD) on the euro-dollar (EURUSD) pair. That is, you need to change rubles (RUB) at the USDRUB exchange rate to dollars (USD) and already buy the coveted euros (EUR) with the dollars (USD) you have earned. This is the essence of the deal. All this will be done for you by the broker on your command, that is, when you click the appropriate BUY/SELL button (BUY/SELL), indicating how much (LOT) USD.

The exchange rate is indicated on Forex by the symbol XXX/YYY, where XXX is the base currency and the quoted currency. For example, EUR / USD — euro-dollar, USD/RUB-dollar-ruble. In the first case, USD is the quoted currency, in the second case, USD is the base currency.

Let’s understand how the price of the currency exchange rate of the instrument is formed.

The Forex currency. The Bid and Ask prices

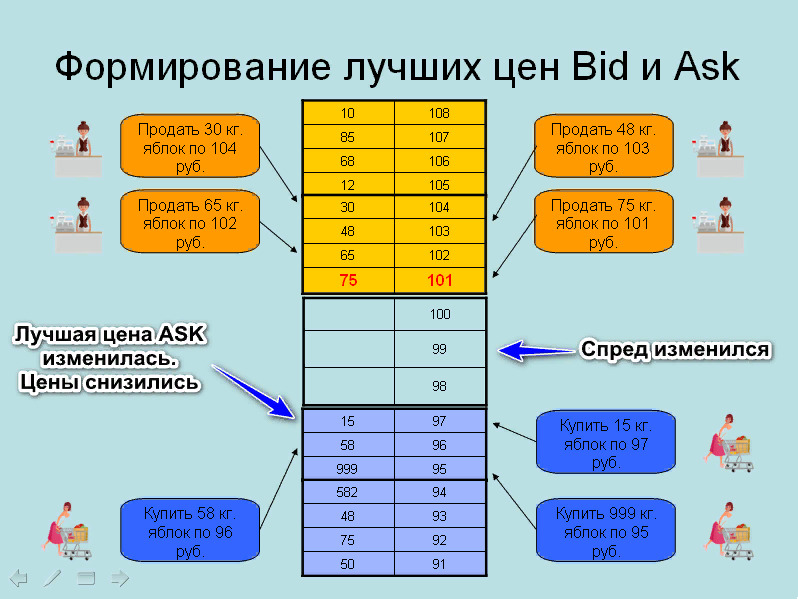

Those who trade in Forex are not alarmed by the difference in prices between the best Ask buy price and the best Bid sell price. It happens the other way around. The absence of a spread, the so-called zero spread, is alarming. Because it becomes unclear who forms this zero spread. The presence of a spread, the difference between the best buy price and the sell price — is a natural process rather than an artificial one.

And yet, many call the spread the broker’s earnings. Yes. If not from the commission, then from the spread, the broker earns on us on each of our transactions. I think that the spread exists and it is constantly changing, it is not wise to blame brokers. Let’s try to disassemble this mechanism and see what’s inside :).

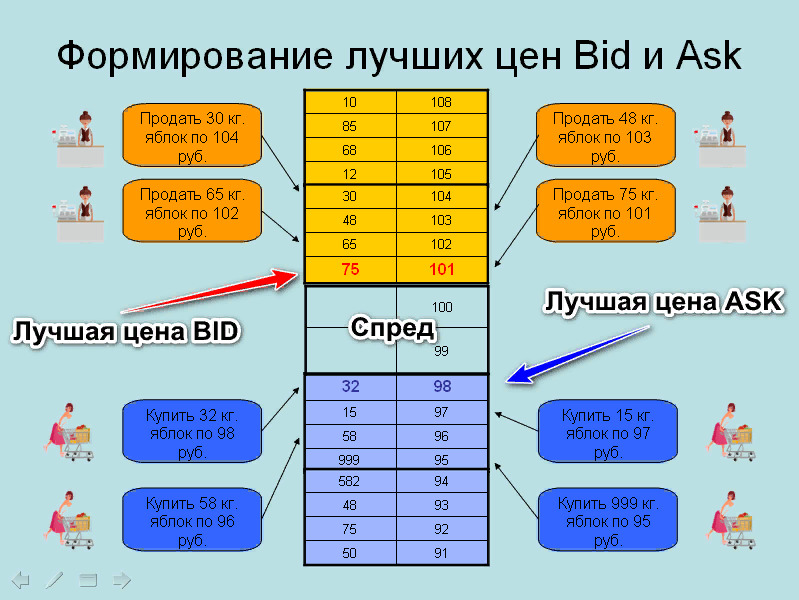

Let’s go to the market and go to the stalls where they sell apples. Behind the counter, sellers — in front of the counter, buyers. And if it’s a wholesale market, it’s even more interesting.

It is clear that sellers want to sell more expensive, and buyers want to buy cheaper. So much for the price difference. So much for the spread. And all are standing. Posted their prices. Nobody buys anything.

This state can be called a little differently: everyone posted their pending orders.

But now there is a buyer who urgently needs to buy some apples on the market, namely all that the seller has, but at any nearest cheap price, i.e. 75 kg at 101 rubles. No more expensive.

I bought. The market situation has changed. The seller left satisfied with 75 kilograms for 101 rubles.

The best selling price has changed and increased. Now it is 101 rubles per kilogram.

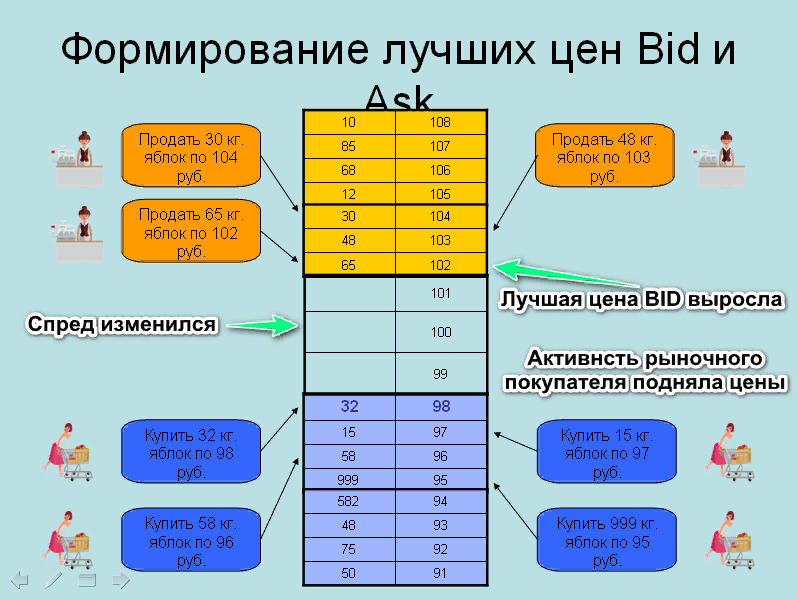

That is, the activity of a market buyer who wants to urgently buy a product, buy, as they say in Forex from the market, provoked an increase in prices and a change in the spread.

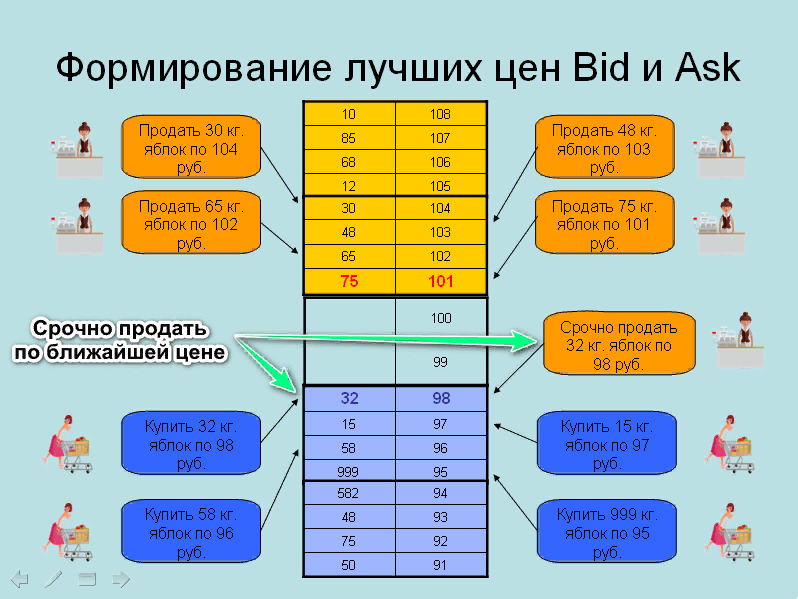

Now let’s assess the situation in which the seller urgently appeared ready to sell all his goods at any nearest price that the buyer will offer.

We are looking at how the market situation will change after this action.

The spread increased and the best price to buy Ask decreased and became 97 rubles.

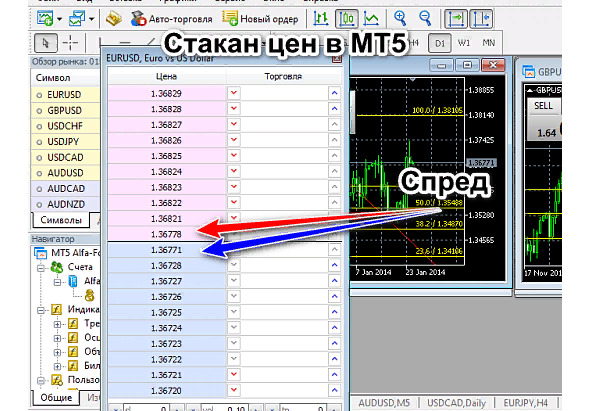

Indication of the spread in MT4.

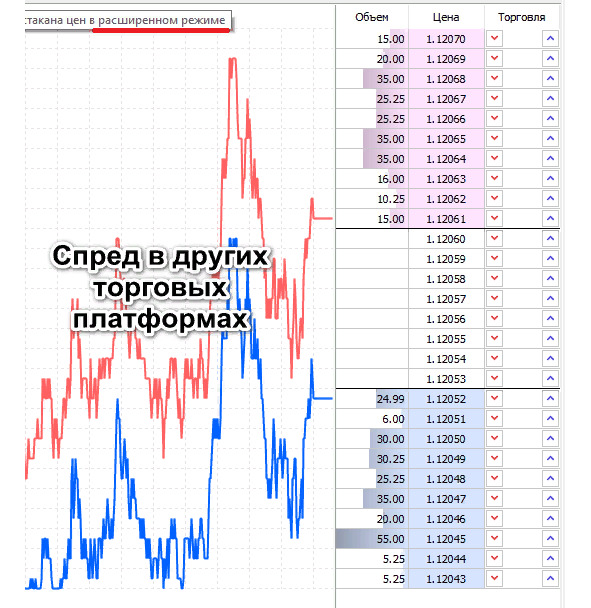

Here is how the price index is displayed with the help of the price glass in other platforms.

And in another platform.

It is clear, according to a slightly simplified mechanism, how the movement, the change in the exchange rate of the currency instrument occurs. How Bid, Ask and Spread prices are formed.

But let’s go back to the brokers and their demo account.

Broker — an intermediary that provides a meeting of buyers and sellers in the market. To be able to perform operations on the Forex market, you need to choose a broker that meets the necessary criteria and open a trading account with him.

Demo account — a training account with virtual money, where a novice trader can train, make transactions without the risk of losing capital.

Forex Broker

A good broker, Forex brokerage office (Forex) is 50% of success in trading on the market. Explains what to follow when choosing. Who are brokers and how to work with them?

For those in a hurry, you can take a look at –https://brokers.ru/brokers

Explanations on the regulators and types of broker work and account types are just below.

Work in the Forex market (Forex) is not directly possible, and it is useless and meaningless. You will have to work remotely via the Internet, and this is more convenient, through brokerage offices or brokers.

Forex brokers are firms that specialize in transactions in the foreign exchange market, sometimes stock, futures, etc., which, in theory, must have a Forex license for this activity, for example, from the Central Bank of the Russian Federation in Russia. The presence of a license, and this can be checked in the specialized sections on the website of the Central Bank of the Russian Federation, is like a “quality mark” for a brokerage office. Because in order to get a license in Russia, for example, a broker needs to fulfill a phantasmagoric number of requirements in accordance with Russian legislation. Not like over the Hill. Russian brokers licensed by the Central Bank of the Russian Federation are preferable. Finam Forex currently has such a license.

So why do we need them? But why? To work in the Forex market, first, we must have a working amount in the currency, or ruble equivalent. And this amount we will have to give to save and for our work to our chosen broker. This is, as it were, a banking structure. But its duty is to enter into a contract with us, to act on the open market, in accordance with the contract concluded with us and with our orders to open or close transactions. They do this not for free, but for a fee. Or it is income from the spread. We have already learned what this spread is. Or with a commission on each of our transactions.

As elsewhere, there are responsible brokerages whose goal is stable and leading work in the market and a stable legal income. There are also “sharashkin offices”, the so-called” kitchens”, the purpose of which is to” cut down your loot” and dissolve.

Normal brokers do not make noise, do not bother you, like gypsies sometimes. They simply exist, work, and advertise their activities in the usual way. “Kitchens”, as a rule, call on phones and brazenly impose themselves, hunting for your money.

Let’s see what a simple speculative trade looks like in the Forex market. Let’s say you opened an account with a broker, the parameters of which suit you, and deposited a certain amount to it. Now you can act with a fraction of this amount, called a Lot or lot share. For example, with Lot A, we ask the broker to open a deal to buy some currency at the price of X. Based on the subsequent price increase. And after some time, if the growth assumption was correct, you give the broker the opposite order to the previous one. About the sale of the same Lot A at price Y. Price Y is greater than price X. The sale of the Lot And you helped out a greater amount of original currency than you invested. The difference is yours.

Leverage is the ratio between the amount of collateral and the borrowed funds allocated for it by the broker. Leverage of 1: 100 means that you need to have an amount 100 times less than the amount of the transaction on your broker’s trading account in order to make a trade.

Well, if you are at least a ruble millionaire. You can invest a significant amount for the Forex market. Accordingly, you can get a significant profit on the difference. But, if you do not have a significant amount. In this case, the broker gives you the opportunity to use leverage. What is leverage? For example, a leverage of 1: 100 means that the broker increases your invested amount by 100 times. Thus, it gives you the opportunity to work on the open market for a much larger amount. For example, when buying a currency, it increased your amount 100 times. You have worked a large amount and your profit is calculated from the increased amounts. The danger is that if you choose the wrong direction of the transaction, your losses are also calculated from large amounts. Therefore, you need to be very careful in using the amount of leverage.

A demo account with a broker is a great opportunity to practice trading with virtual money. You need to start with it.

Previously, the broker was contacted by phone. Now all this happens through a trading platform (software package) on a computer, tablet, or smartphone.

The so-called brokerage “kitchens” are not set up for you to make a profit. Rather, you can say that they are determined to appropriate your deposit with various organizational and technical tricks.

For example, it is not timely to execute your order about the beginning or end of the transaction, or to execute your orders not at your ordered price. There may be input and temporary distortions of quotes.

Therefore, the conclusion suggests itself. When choosing a broker, it is necessary to check the license. In the case that no license has been to look carefully at the reviews about this broker. The essential question is how many years this broker has been working in the Forex market. Well-known, long-established brokerages are not interested in deceiving you. And they spend a lot of time maintaining their reputation.

A very important issue is the resolution of legal conflicts that may arise during trading. For example, if a broker has its head office outside the Russian Federation, the solution of many legal issues can be very complicated. On the contrary, if the broker is located within the Russian Federation, and even more so has an extensive network of offices in cities, then interaction with it in case of legal conflicts is much easier.

I can’t recommend a specific broker to you. Each has its own set of services and trading accounts. I can only speak for myself. I studied with a Forex Club broker. I work with the RoboForex broker. You have to choose a broker yourself, having found it through the search engines Google and Yandex, expending great efforts on the evaluation of the terms, read the reviews or search data on the license. I’m not going to point the finger at anyone here. Like a good one. This one’s bad. Everything changes all the time. In short, the broker who can safely pay you the money you earned, and choose. This is almost the most important thing in all trading on the Forex market. I.e., the contract-offer or whatever you need to read very carefully not only before the first transaction, but even before making money on your deposit.

On many sites, the name of the regulator for the broker is placed opposite the name of the broker.

Regulators for brokers:

IFSC — (International Financial Services Commission, International Financial Services Commission of Belize) is part of a group of organizations that fight money laundering in the Caribbean region, but the main activity of this formation is to provide licenses for the right to conduct financial, brokerage or investment activities in the offshore territory of Belize. The IFSC license can be seen from both reliable and dubious brokers.

NAFD — National Association of Forex Dealers. This organization acts as the legal successor of the CRFIN. The task of the organization is to protect the rights of all trading participants in the foreign exchange market. The regulator works closely with government agencies and lobbies for the interests of financial market participants.

FSA-FCA (Financial Conduct Authority) — The Financial Conduct Authority of the United Kingdom, which is a non-governmental independent body that regulates the activities of investment, banking and financial companies, acts in accordance with the"Financial Services and Rinks Act 2000”.

CySEC is the Cyprus Securities and Exchange Commission, which serves as the state regulator in Cyprus. The main mission of the Commission is to control the activities of financial and foreign exchange companies located in the Republic.

CBR — Central Bank of the Russian Federation;

ASIC — (Australian Securities and Investments Commission) — the state Securities and Investments Commission of Australia is the main and only financial regulator in the country.

SEBI-The Securities and Exchange Board of India (SEBI) is the regulator of the securities market in India.

BVI FSC — – Financial Services Commission of the British Virgin Islands. The financial regulator was established in 2001.

RAUFR-Russian Association of Financial Market Participants (RAUFR) is a non-profit organization that unites responsible participants of the financial markets of the Russian Federation on voluntary terms.

CNMV-The National Commission for the Spanish Stock Market (The Comision Nacional del Mercado de Valores, CNMV) is the state financial regulator of Spain.

FCMC-Finanšu un kapitāla tirgus komisijas (FKTK, in English Financial and Capital Market Commission, FCMC) The Financial and Capital Markets Commission of Latvia is the state financial regulator of Latvia.

FINMA — (Swiss Financial Markets Authority) is the Swiss financial market surveillance service, which is a public authority.

The Commission for Regulation of Relations between Financial Market Participants is a non-profit organization whose activities are aimed at developing services and regulating relations between Russian participants in international financial markets.

BNB-Bulgarian People’s Bank (bolg. Bilgarska Narodna Bank) is the central bank of Bulgaria.

SIBA-Seychelles International Business Administration.

VFSC-VFSC is the Vanuatu Financial Services Commission, established in 1993. The duties of the regulator include: issuing licenses for financial activities on the territory of Vanuatu, monitoring the work of licensees, consulting the population.

CFTC-The CFTC (Commodity Futures Trading Committee) is one of the most authoritative forex and futures brokers in the world — the Commodity Futures Trading Commission, established by the US Congress in 1974. It is an independent government agency that is granted the right to regulate the options and futures markets.

MFSA-The Maltese Financial Services Authority is the government body of the Republic of Malta that regulates and supervises the financial and credit sector.

IIROC — Investment Industry Regulatory Organization of Canada. Investment Regulatory Organization of Canada.

MAS-Monetary Authority of Singapore. The Monetary Authority of Singapore (MAS) is the central bank and state financial regulator of Singapore.

And also against the name can be the method of bringing your transaction to the open market, i.e. the types of accounts used by the broker.

Types of the broker and the account types

MM — Market Maker;

NDD — No Dealing Desk. Trading without the participation of a brokerage company. Withdrawal of clients ' orders to the open market automatically and execution on the side of the liquidity provider.

ECN — Electronic Communication Network. Electronic communication network for the implementation of transactions for the purchase/sale of a financial asset (currency pairs), which eliminates the role of intermediaries from the information exchange chain.

STP — Straight Through Processing. A system that allows a Forex broker to send client orders for execution directly to liquidity providers — banks that trade directly on the interbank market. The more liquidity providers there are, the better execution for customers. The fact that traders have access to the real market and the possibility of instant execution of orders without the participation of a dealer makes this system extremely attractive for most traders.

DMA — Direct Market Access. The technology of accessing the market directly, bypassing the broker.

We have dealt with brokers and their real trading accounts.

Now let’s look at the demo account and its advantages. Any Forex broker must have a demo account.

Demo account

Forex trading, mastering Forex trading, learning Forex trading is very similar to learning to drive a car. Who thinks that he will sit down immediately and go, if he does not know how to drive a car, then he is deeply mistaken.

Just like in real life. He can go, but not far and not for long.

If you do not know the car at all, and this is unlikely, of course, but you are going to master it and learn to drive without accidents, then you need to first pull the handles, push the buttons, turn the steering wheel, push the pedals, turn the key in the ignition, open the hood and close the doors, and so on.

Similarly, in Forex. Before you start trading, you need to go to the website of the selected broker. And it must choose another and open a demo account and characteristics of currency pairs instruments that will be attached to this demo account, they also may differ. Therefore, a demo account must be very similar to a real account. Otherwise, the skills acquired on a demo account may diverge, or even interfere with working on a real trading account.

The MetaTrader 4 trading platform is universal. It can be used, and many brokers do, and in the stock market. When trading stock, futures, metals, contracts. That is, the trading platform itself is quite versatile, but the parameters of both demo and real accounts and currency pairs provided by the broker (not the parameters advertised on the site, but the internal parameters of the account and currency pairs to them) can seriously differ from the parameters of real accounts and currency pairs to them.

How to choose the right demo account?

Forex demo account and the importance of knowing its internal characteristics.

Below is a chapter devoted to analyzing the characteristics of accounts and how to determine them.

Many brokers have demo accounts where you can practice, arrange a demo trade, that is, work out any strategy or just watch the movement of the chart, the movement of the indicator lines, the interaction of indicators, their fine-tuning. That is, a demo account is like a polygon where you can try everything on virtual money that you can’t try on a real trading account on real money.

I will immediately make a reservation that there are very important points. If you have already selected a future real account with real money according to any criteria, then your demo account should match the real account as closely as possible. According to the characteristics, internal parameters and parameters of the selected currency, currency pair” attached” to this demo account. You should know what the differences are between a demo account and currency pairs to it, from a real account and currency pairs to it in terms of characteristics and parameters.

For example, on a demo account and a currency pair, there is, for example, an parameter such as the value of the maximum approximation of order prices to the exchange rate at the moment, can be zero on the demo and currency pair. On a real account, this parameter is probably different and has some value other than zero. And this is very important in real trading. And, depending on which strategy you are going to use: either it is a pip or scalper strategy, or even a medium-term one, this parameter can be very important. That is, the distance closer to which an order can be placed on a demo account, but not on a real account.

Another such parameter is the freeze level. That is, these are the nuances you need to know.

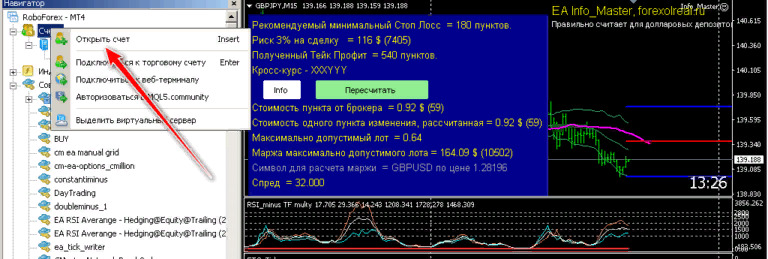

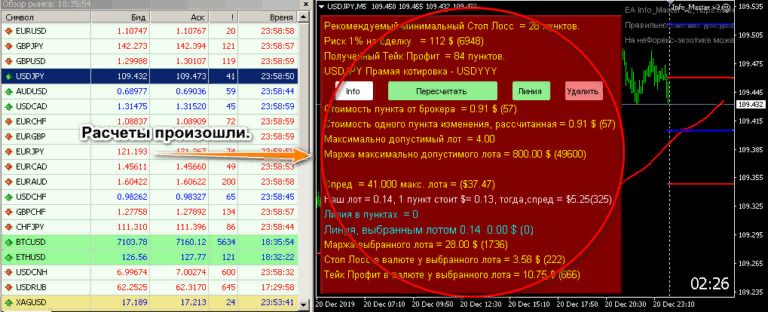

If you go to the page “characteristics of accounts” I have told, as if Info_master the EA run on a demo account or real account, you can by clicking on the “Info” button to see all the features of the selected account and the selected currency pair, and by switching between real account and demo account, it is possible to compare all characteristics. On the same page (https://forexolreal.ru) you can download the Expert Advisor.

In order to trade on the Forex market, you need to accurately and scrupulously know the characteristics of the account and the selected currency pair. Know what the broker forbids you, what sets big, what sets small. You need to know this so that these nuances in real trading do not come out in monetary losses.

Open an account with any broker through the MetaTrader 4 platform (MetaTrader 4)

Demo account can be opened directly in the platform.

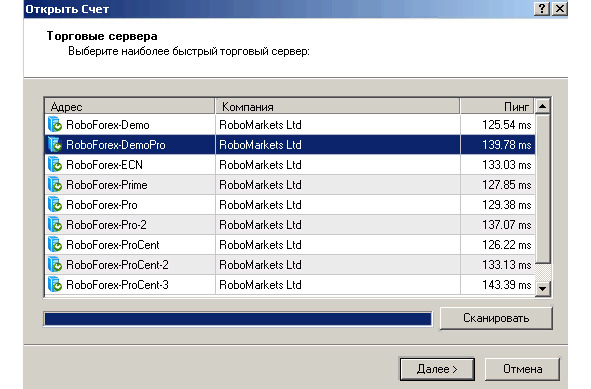

Open the Navigator panel in MT4.

Right-click on the “Accounts” folder.

How to choose the right demo account?

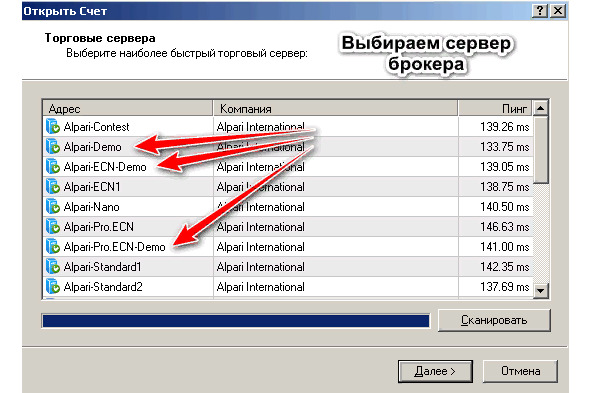

Select the broker’s server to open a demo account. If the real account will be ECN, for example, then the demo account should be selected of the same type, i.e. ECN.

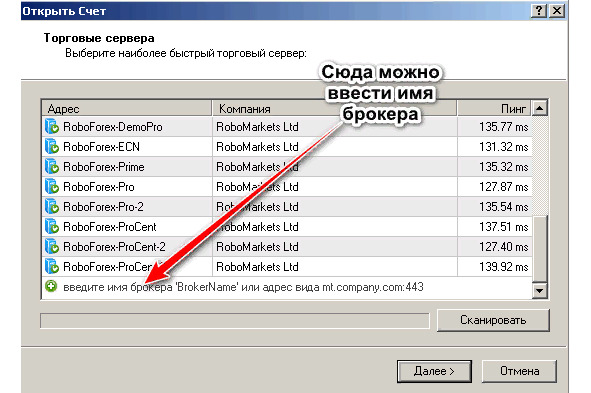

You can change the broker by entering its name in the lowest line.

Again, you can select the demo account server. From another broker.

Modified broker and its servers

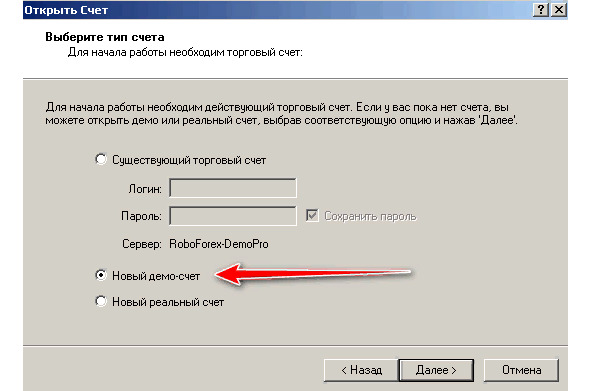

Next, open an account.

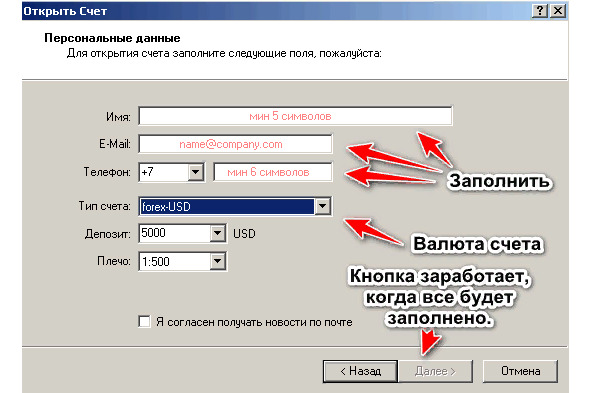

You need to fill in your personal data.

A demo account of the specified selected type will be opened with the selected broker.

But, a small feature will be in this (such opening) demo account.

A full demo account will be opened with a broker, for example, Alpari.

However, this account will not be included in the database of the Alpari site and your personal account on the site, although it will remain a demo account with the selected characteristics at the Alpari broker. The broker will be responsible for all parameters and characteristics.

Therefore, it is better to go in, and if not, create a personal account with the selected broker and open a demo account with the necessary parameters and characteristics. Just so that you can safely” top up” your account with virtual money in case of complete embezzlement.

There is another use of demo account besides training. If you are already sufficiently advanced in the study of the intricacies of Forex trading and are able to organize successful trading for a long period of time (20—100 weeks), then on the broker’s website you can declare yourself a signal provider. Open a paid or free subscription to your signals. You will earn extra money if paid.

Brokers also organize contests on demo accounts, demo contests. For a prize place in which a real and tangible amount is paid.

Go for it. As they say: in the beginning there was a demo account.

Forgive me, Lord! :)

And now it is very important to know the “pitfalls”, so to speak. Account characteristics and characteristics of the selected currency pair. And I repeat, it is very important to know them.

CHARACTERISTICS OF THE ACCOUNT OPENED WITH THE BROKER AND THE SELECTED CURRENCY PAIR

If you do not trade anyhow, but seriously and thoughtfully and neatly, you need to know many parameters and characteristics. For example, each broker has parameters on the account, some internal variables, and there are parameters on a specific instrument, that is, a currency pair. You need to know these parameters when choosing a broker and an account with it.

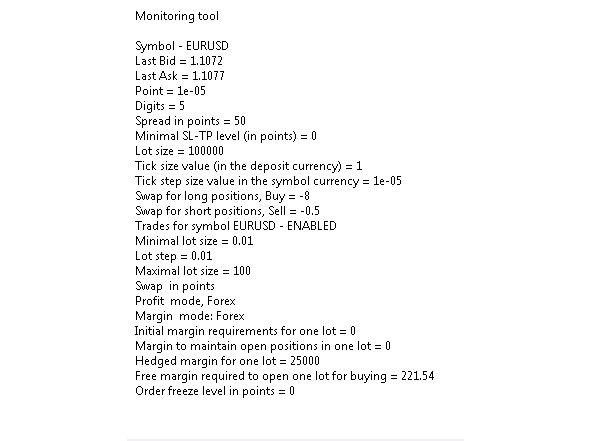

There is my free Expert Advisor Info_master M. 2.0 for MT4, by installing it on any selected account and currency pair and clicking the Info button on it, you can get comprehensive information about the account and pair.

So what are these parameters?

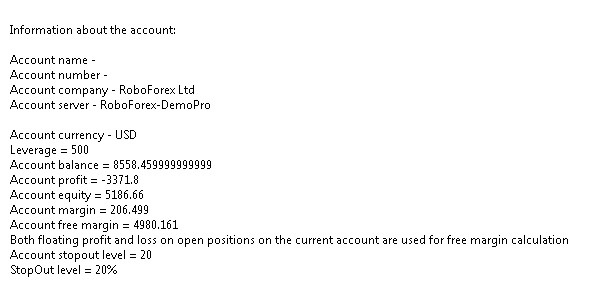

Features of the account:

Where,

Account name — Name of the account owner;

Account number — the ID or account number;

Account company — The brokerage company that provided the account;

Account server — The broker’s server where the account is located;

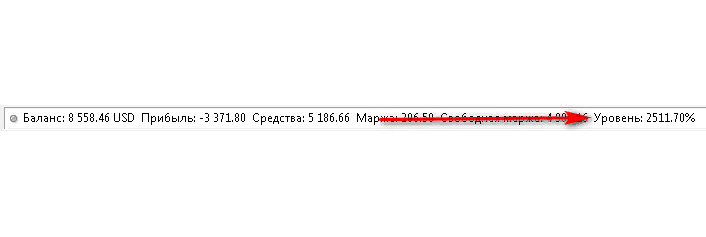

Account currency — The currency in which the account is opened;

Leverage — leverage;

Account balance — Current balance;

Account profit — Current profit loss;

Account equity — the Current available funds;

Account margin — Current deposit;

Account free margin — Current free funds from the transaction;

Account stop level — The level at which all positions are forcibly closed.;

Stop Out Level — The percentage level at which all positions are forcibly closed.

Characteristics of the instrument, currency pair:

Symbol-Instrument, selected currency pair;

Last Bid — the Last sale price;

Last Ask — the Last purchase price;

Point — the minimum possible change in the currency exchange rate of the pair (for example, 0.00001 or 0.001);

Digits — The number of digits after the decimal point in the price of the current instrument, currency pair;

Spread in points — the difference between the best buy (ask) and sell (bid) prices of any instrument or currency pair at the same time;

Minimum SL-TP level (in points) — The minimum distance in points from the current price, closer to which neither stop loss nor take profit can be placed.

Lot size — The value of the contract at which the lot will be equal to one. If there are, for example, 100,000 units of account currency (with or without leverage), then you can work with lot = 1. And so, only in shares: 0.01, 0.5, etc.);

Tick size value (in the deposit currency) — the value of the tick (offset of 1 point) in the deposit currency;

Tick step size value in the symbol currency — the cost of a single offset in the currency of the instrument, currency pair;

The Swap for long positions, Buy — Swap for each position the open top. Every day at 21:00 GMT, a swap (payment to the liquidity provider) is charged for open positions;

Swap for short positions, Sell-Swap for each position open down;

Trades for symbol — Whether trading is currently allowed on this instrument;

Minimum lot size — The minimum lot size to use;

Lot step — step of the Minimum lot;

Maximum lot size — The maximum possible used lot;

Swap in points-Mark what the lot is calculated in;

Profit mode, Forex-A method of calculating the profit on the account. In this case, the market;

Margin mode, Forex-A method of calculating the margin on the account. In this case, the market;

Initial margin requirements for one lot —

Margin to maintain open positions in one lot —

Specifically about the two points listed above, it is better to read here.

Hedget margin for one lot-The margin is calculated from this contract size, which is set for closed (locked) positions (simultaneously open opposite positions with the same lot, and only for them. For non-fixed positions, the margin is calculated from the main contract size);

Free margin required to open one lot for buying — The margin required to open a trade in the top 1 lot;

Order Freeze Level — The freezing range in which any orders are temporarily “frozen”, i.e. actions with them are temporarily prohibited.

These characteristics should be controlled, chosen if you want to trade with a profit, and not engage in endless draining of the deposit.

At the end of the book there is a dictionary of Forex terms, where each term is deciphered, what it means.

So, we did a preparatory educational work, in order to get acquainted with the trading platform, the most common in Forex and MQL4 huge, just a myriad of indicators, expert advisors-robots and scripts that help the trader to construct and operate a trading system based on any trading strategy.

Let me remind you: Successfully trades in plus on the Forex market, figuratively speaking, not the trader himself, but the trader who strictly observes the signals and rules of a verified trading system.

But before we move on to trading techniques, let’s study or at least get acquainted with the MT4 trading platform and how to analyze the situation on the selected instrument, currency pair.

METATRADER 4 TRADING PLATFORM, OVERVIEW

Information and trading platform developed by MetaQuotes Software Corp., designed for the organization of dealing services in the Forex, CFD and Futures markets. This is a full-cycle complex, that is, no additional software is required for the organization of dealing services in the presence of MetaTrader 4. The server part works only on the Windows family platform. The client part is available in versions for Windows, Android and iOS.

Бесплатный фрагмент закончился.

Купите книгу, чтобы продолжить чтение.